Four Companies Leading the Rise of Artificial Intelligence & Big Data

Recent technological advancements in artificial intelligence (AI) have companies diversifying their revenue streams across the value chain. Firms continue to expand their AI solutions, with global private investment in AI more than doubling in 2021 to $93.5 billion as compared to 2020.1 Critically, the advancements are practical in nature, which helps to further democratize AI by making it accessible to an increasing number of small and medium businesses (SMBs), developers, and end users.

In our view, these and other similar developments discussed in this blog post justify recent healthy growth forecasts for the AI market, which is broadly categorized into AI software, hardware, and services. Among them, revenue from AI software, the largest AI category, is forecast to increase by 21% year-over-year (YoY) to $62.5 billion in 2022. 2 However, over the next five years, the AI services category is expected to grow the fastest with a compound annual growth rate (CAGR) of 22%, followed by AI hardware with a 21% CAGR.3 In this piece, we highlight four companies in the Global X Artificial Intelligence & Technology ETF (AIQ) that are shaping the growth path of technologies along the AI value chain.

- Microsoft: Bringing accessible Artificial Intelligence as a Service (AIaaS) solutions to the broader market.

- IBM: Making quantum computing a reality with the world’s s first 127-qubit processor.

- Nvidia: Increasing factory and warehouse productivity with Smart Transport Robots.

- Alibaba: Deploying smart supply chain solutions to boost efficiency, productivity, and revenue.

Microsoft Extends Its Reach in the AIaaS market

Microsoft introduced new capabilities for its AIaaS product suite, along with other updates to existing products during Microsoft Build 2022, the company’s annual innovation conference for developers and software engineers. AIaaS allows customers to reap the benefits of AI technology such as high-quality vision, speech, language, and decision-making AI models without the large initial investment associated with building internal capabilities. In our view, these offerings have the potential to boost productivity significantly across various industries and sectors, such as e-commerce, healthcare, retail, and telecommunications, among others.

At the event, Microsoft announced updates to Azure Cognitive Services and Azure Applied AI services, a family of AI models that can be applied as application program interfaces (APIs).4 With these offerings, Microsoft can help expedite the democratization of AI by enabling conversation summarization, video analysis, and image generation, among other services that customers can build upon and embed within their applications.5 These services use AI to make apps smarter, which can improve existing scenarios and introduce new ones. As an example, in healthcare, Nuance’s Dax Solution uses AI to document patient encounters at the point of care, reducing the burden on physicians. Similar capabilities exist for other industries. Microsoft’s customer relationship management (CRM) platform, Dynamics 365, automatically summarizes customer conversations into valuable insights that can be passed on to relevant subject matter experts.6,7

Microsoft’s offering doesn’t stop there. The Microsoft Intelligent Data Platform integrates data analytics, operational databases, and data governance. Such integration is important in a world where every application will be intelligent and adapt in real-time and analytics won’t just be a backend process. In e-commerce, the Microsoft Intelligent Data Platform can be used to create personalized experiences, including product recommendations, by capturing new interests from current sessions and instantly matching historical data to online session data. Customers can build their applications on Cosmos DB (Cosmos Database) or SQL (Structured Query Language) Hyperscale. With Azure Machine Learning, they can retrain models based on real-time learning. And with Power BI (Business Intelligence), they can share insights across the company.8

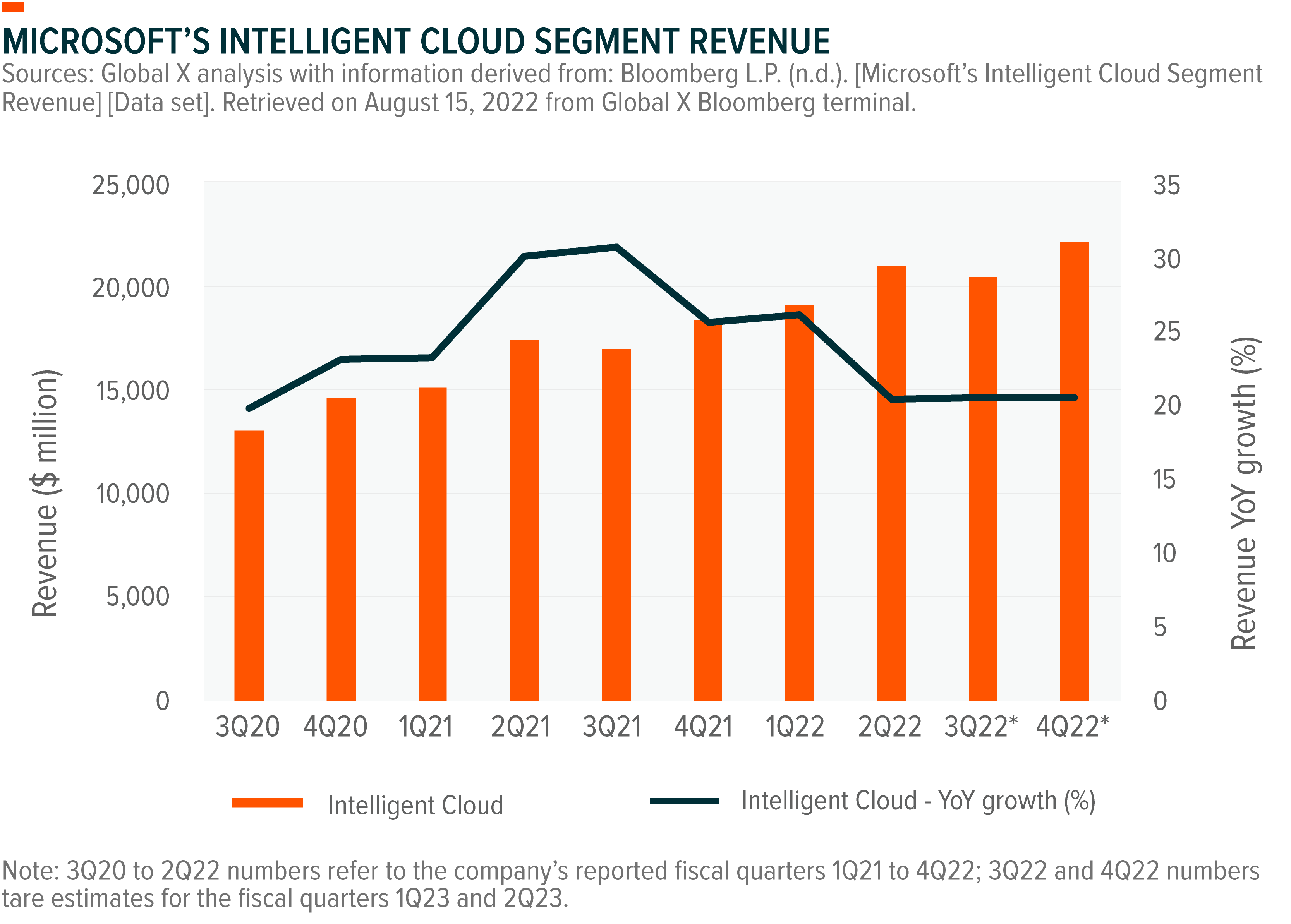

At the same time, cloud services continue to grow at Microsoft. The Intelligent Cloud segment reported the highest revenue growth of the company’s segments in 2Q 2022, up 20% YoY in the quarter to $20.9 billion.9 Drivers were Azure and other cloud services posting 40% YoY growth.10 The average revenue growth for the segment over the past eight reported quarters is 25%.11

IBM Brings Advancements to Practical Quantum Computing

Over the past four years, advancements in quantum computing are getting it close to a massive technological breakthrough. Processing information using qubits is what makes quantum computers so powerful. Classical computers process information using bits, where each bit can have a value of “0” or “1”. Quantum computers use qubits, which can represent “0” and “1” simultaneously. This so-called “superposition of states” means that quantum computers can process, in parallel, multiple computations.12 Another difference between the two computers is that a classical computer increases its power linearly with the addition of each transistor. A quantum computer’s power increases exponentially with the addition of each new reliable qubit.13

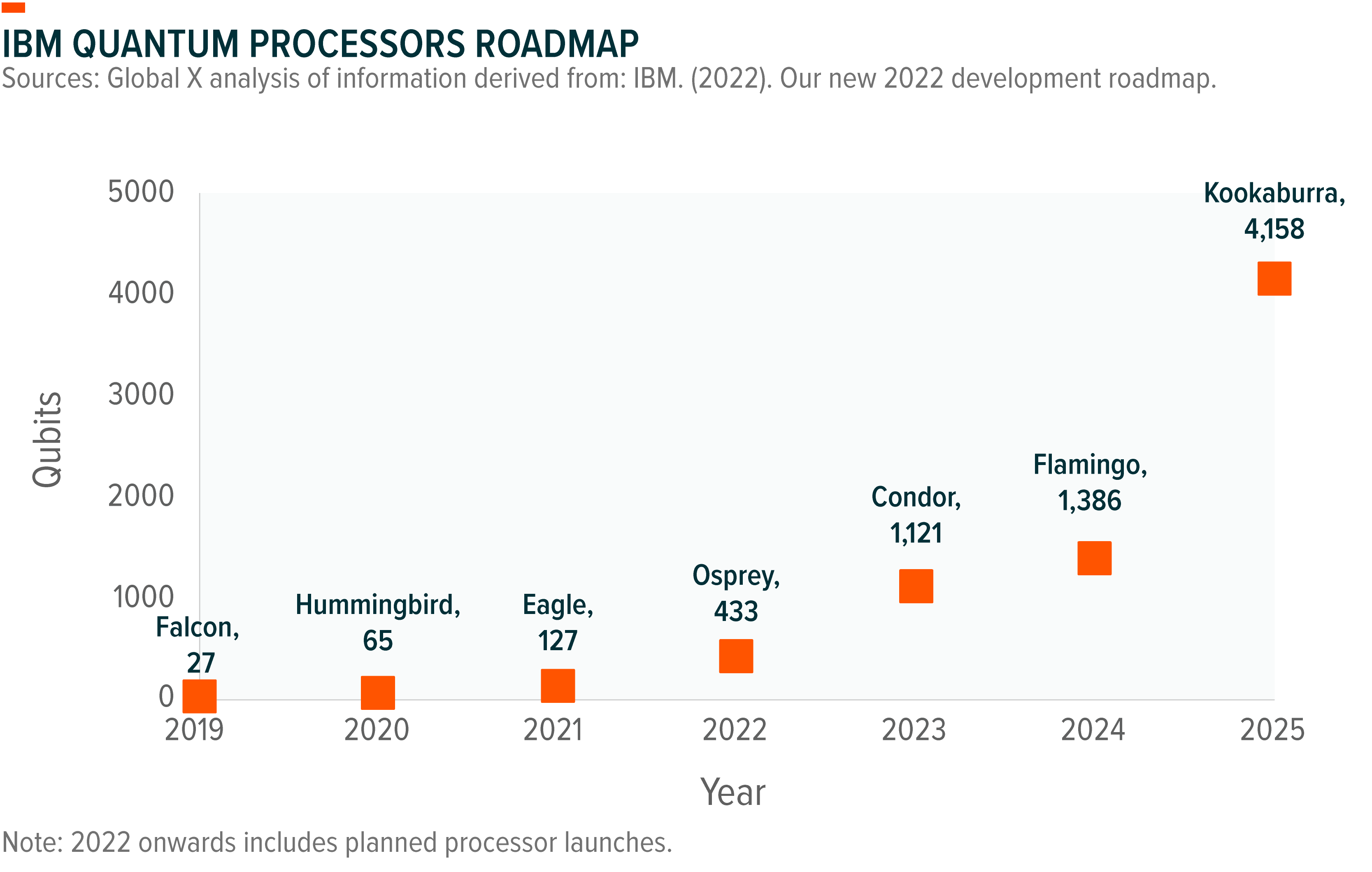

Central to the quantum story is IBM, which recently introduced foundational products that could accelerate quantum computing’s practical adoption. Notably, in 2021, IBM introduced the world’s first 127-qubit processor, known as IBM Eagle. The 127-qubit broke the previous 100-qubit barrier.14 Each additional qubit doubles the amount of memory space required to execute algorithms. IBM reaffirmed its commitment to quantum computing by increasing investments in research and development as well as areas like AI and hybrid cloud. The company recently unveiled its new roadmap to practical quantum computing, announcing its plans to produce the 433-qubit Osprey processor in 2022, deliver the 1000+ qubit Condor in 2023, and launch more than 4000 qubit processors by 2025.15 Also, to give developers advanced simplicity and flexibility across quantum and classical systems, IBM plans to introduce a serverless approach with Qiskit Runtime in 2023.16

The goal is for quantum computing to eventually be used alongside classical computers to solve complex problems, such as helping banks manage systemic risks. An example is the quantum algorithm that Spanish bank BBVA and Zapata Computing, a Massachusetts-based quantum software company, are developing to target credit valuation adjustment (CVA). Introduced following the 2008 Global Financial Crisis, CVA measures the market value of counterparty credit risk. According to Zapata’s CTO, the algorithm will carry out the necessary calculations with a “hundred to thousandfold reduction in the amount quantum resources required.”17 For context, quantum computers are about 158 million times faster than the most sophisticated supercomputer currently available.18 In other words, it takes four minutes for the quantum computer to complete a specific task, compared to 10,000 years for a traditional supercomputer.19

Quantum computing vendors and governments have started implementing strategic approaches to reaching quantum advantage over classical computers, “the point at which a system employs the technology to bring a step change in solving a practical computing task”.20 Vendors are publishing quantum computing roadmaps emphasizing methods for improving qubit scaling and error correction.21 And governments are ramping up support for quantum technology’s development. Multiple countries have committed billions of dollars towards quantum computing, with the EU already investing more than $7 billion thus far.22 Investments like these set the stage for the quantum computing market to grow significantly in coming years. According to one estimate, it could reach $8.6 billion in 2027, up from $412 million in 2020.23

Nvidia to Lead the Way in AV Technology for Factories and Warehouses

Nvidia’s CEO recently said that 2022 will be a big year for the company’s autonomous vehicle (AV) technology as it brings more short-distance deliveries to factories and warehouses. The Nvidia Jetson AGX Systems for robotics deploy machine learning (ML), computer vision, navigation, and more to enable robots to learn, adapt, and evolve.24 One use case for Nvidia Jetson AGX is Smart Transport Robots (STRs), which use autonomous delivery navigation.

One notable adopter of STRs is BMW Group. The carmaker is working with Nvidia to build its new state-of-the-art automotive factories based on advanced AI computing and visualization for logistics robots, data analytics, and high-resolution simulation for robotics training and factory planning.25 BMW will use STRs at its warehouses to pick and organize over 30 million car parts into custom trays from different suppliers.26 STRs can also pitch in on BMW’s assembly lines, which output a new car every 56 seconds, sometimes with up to 10 different models on the same line at once. STRs must pick, organize, and deliver the right parts to the correct car in real-time. Many of the roughly 10,000 car orders per day BMW processes are custom orders.27

To ensure that the STRs have streamlined communication and can handle larger and complex environments, they are trained using Nvidia’s Isaac simulator network to run real-time simulations with an almost infinite number of possibilities.28 With these technology and economies of scale in place, and by securing market share and future revenue streams, we believe Nvidia is well-positioned to take advantage of the growing AV trend in smart manufacturing and automation.

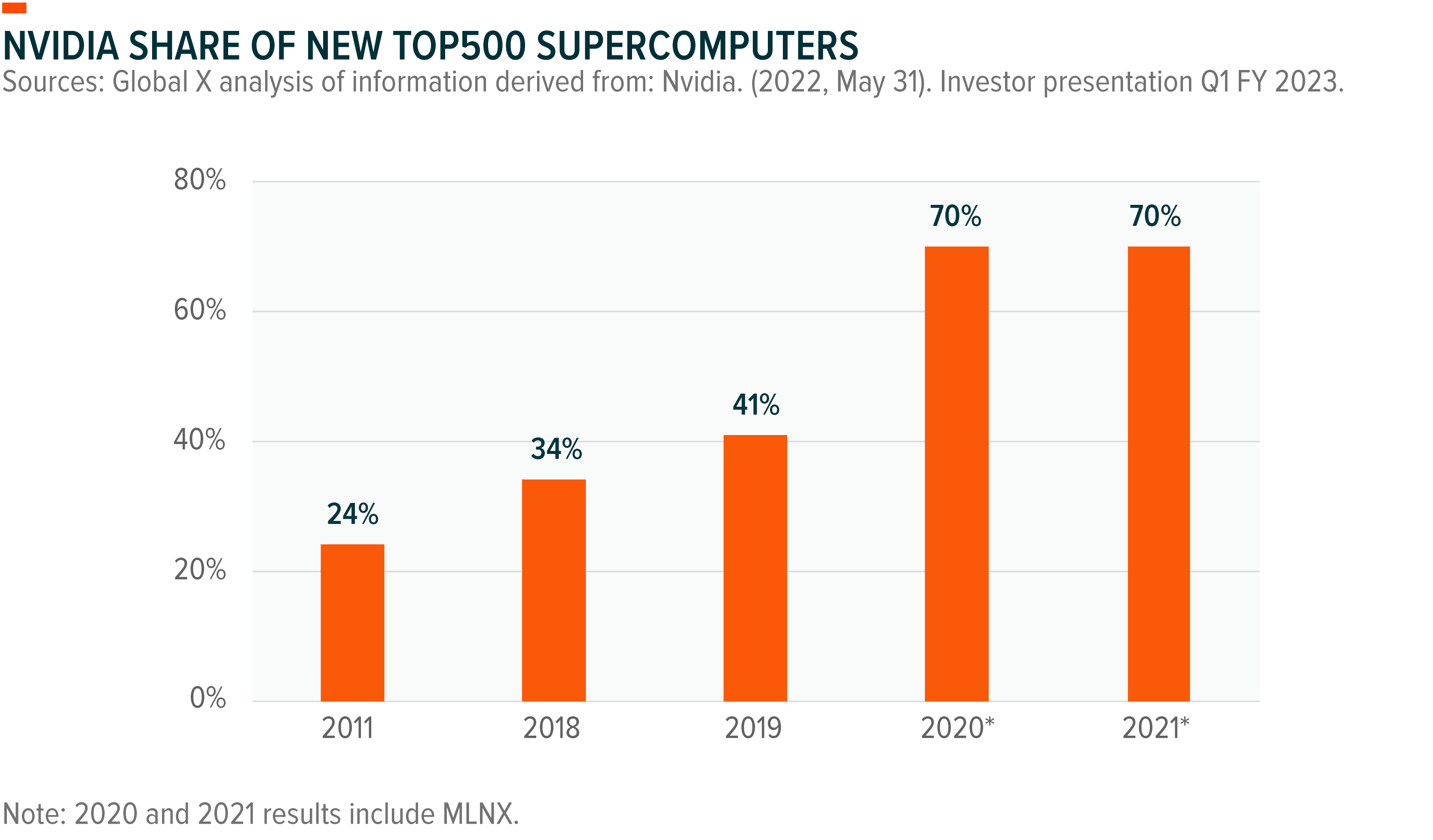

At the same time, Nvidia’s Data Center and Gaming segments reported record revenue in Q1 2022, with Data Center becoming its largest platform.29 Growth drivers for the segment include the rising adoption of AI and graphics across major industries and rising compute needs, which cannot be met by x86 CPUs, for example. Data-center scale computing is another major driver for the segment. According to Nvidia, its share of accelerators in supercomputing is over 90%, including a 70% share of the TOP500 supercomputers. 30

Alibaba’s Smart Supply Chain Solutions Contribute to Revenue Growth

Alibaba, the world’s largest ecommerce platform, uses AI in its daily operations, such as predicting what consumers want to buy. Parcel volume in China grew 30% year-on-year (YoY) in 2021, with most of the growth coming from e-commerce. 31 Alibaba’s Cainiao, the logistics arm of Alibaba Group, positions the company to take advantage of this growth. The segment reported 88% YoY average daily package volume growth and had an average daily package volume of 64 million for the six months ended September 30, 2021. 32

Cainiao uses Alibaba Cloud’s Internet-as-a-Service (IaaS) platform to track packages at every stage of the supply chain.33 Cainiao’s public cloud portal, Link, provides real-time logistics data sharing as packages move from one stage to the next. To improve the service’s efficiency and effectiveness, Cainiao uses machine learning models and algorithms for tasks such as volume forecasting. 34

Cainiao is working to enhance its offerings by deploying more advanced Internet of Things (IoT) solutions, and exploring how it can use them to communicate temperature and location, two important factors when transporting perishable goods.35 Adopting edge computing to increase supply chain efficiency and deploying IoT and edge computing in delivery bots are two other areas that Cainiao and Alibaba Cloud are researching.36

In Q2 2022, Alibaba’s most recently reported financial quarter, revenue from Cainiao before inter-segment elimination grew 7% YoY, driven by its value-added services provided to its China commerce retail business, as well as the growth of fulfillment solutions.37 Previously, the company also announced that Cainiao is helping to increase adoption of the L4 self-driving vehicle Xiaomanlv for unmanned parcel deliveries, having delivered over 10 million parcels since inception in September 17, 2020 through to March 31, 2022.38

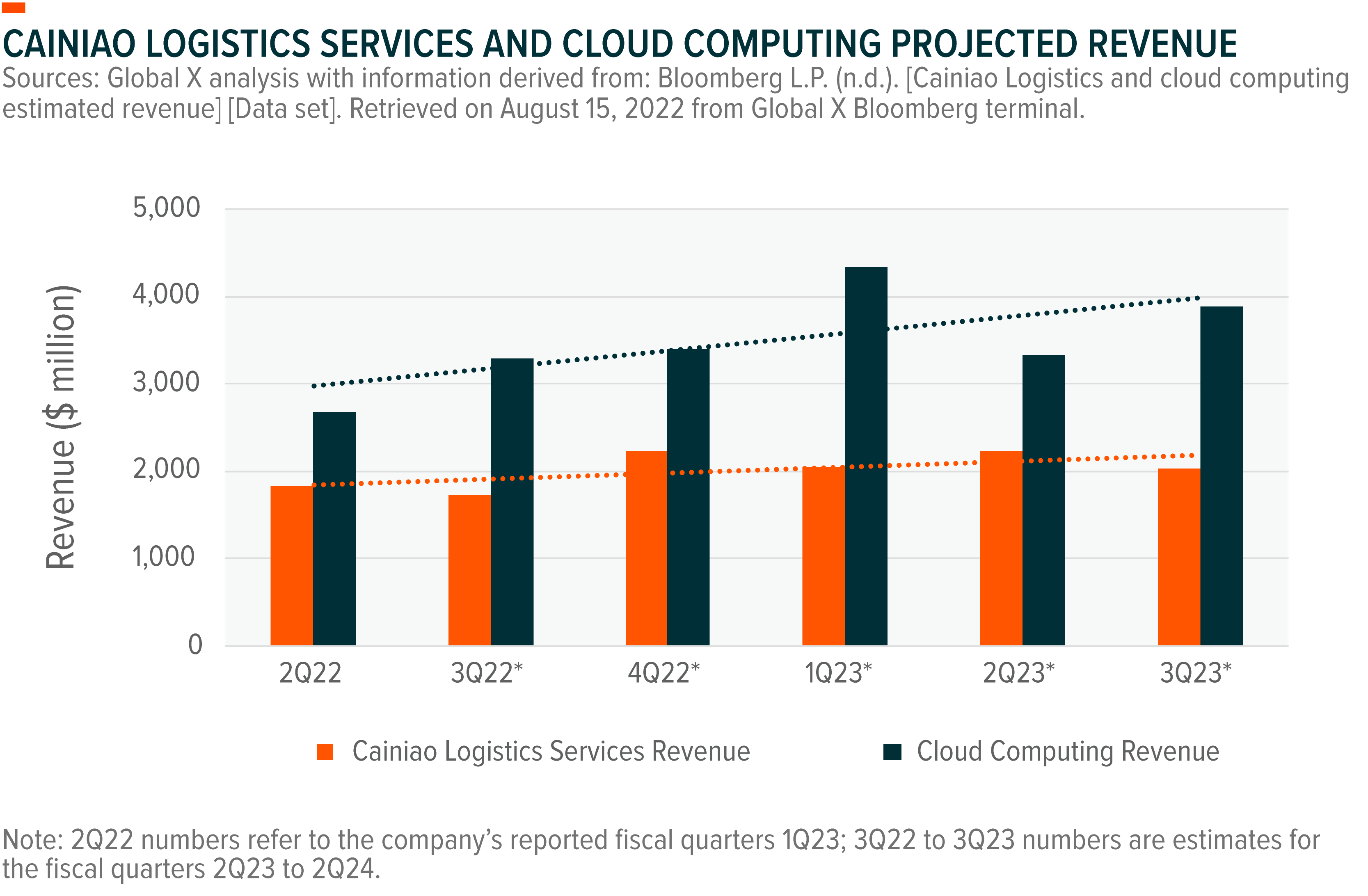

Average projected revenue growth over the next four quarters for Alibaba’s Cainiao Logistics Services segment is 9%, tracking closely its Cloud Computing segment at 11%.39

Conclusion

Recent earnings reports from major AI companies indicate that the current challenging macroeconomic environment has not dampened their commitment to advancing their existing AI offerings and developing new ones. Companies continue to invest heavily in AI, with year-over-year global private investment more than doubling in 2021. Similarly, AI patent filings nearly doubled to 141,000 in 2021 from a year earlier.40 We believe that these four companies, and their recent advancements across the AI value chain, can continue to lead the way in AI. With compelling revenue streams, we expect these companies to be major contributors to the industry’s growth in the coming years.