Investment Strategy Monthly Insights, March 2023

In addition to persistent elevated inflation and ongoing geopolitical tensions, investors now also face uncertainty and volatility owing to the current banking liquidity crisis. During March, financial markets witnessed some of the largest moves in treasury assets and interest rates since the global financial crisis. The MOVE index, which tracks the implied interest rate volatility on US Treasury yields, soared to 198 on 15th March, a level not seen since 2008. This uncertainty further translated into strong demand for short term 2-year US Treasuries in a flight to safety in the wake of the banking liquidity crisis. The 2-year note experienced its biggest one-day fall since 1987 around the Black Monday crash.1 The recent turmoil is weighing heavily on investor sentiment and presents an additional challenge for major central banks globally which are still trying to fight persistent inflation.

However, bright spots in the market are emerging for discerning investors. Attractive valuations in secular long-term growth themes may offer investors lower risk entries. While investors are actively seeking defensive positioning to protect further possible downside, structural tailwinds remain intact, which may provide investors with opportunities to position for the long-term, particularly in themes such as cybersecurity.

Investment strategies highlighted this month:

- Defensive Themes During an Uncertain Geopolitical Environment – Cybersecurity may be positioned to benefit from macro risks and provide a hedge against geopolitical risk.

- Buffers and Precious Metals – Defined outcome strategies to buffer downside market risk and exposure to precious metals via silver miners may act as a diversification strategy that exhibits low correlation of returns and can reduce overall portfolio risk.

- A Global Battle to Own Disruptive Materials – Disruptive materials and copper continue to benefit from global policy tailwinds in the race for resources and remain secular long-term trends.

Cybersecurity as a Hedge Against Geopolitical Risks

Cybersecurity remains in a secular growth trend and may be poised to outshine in the near term, owing to recent geopolitical tensions that highlight the need for strong cybersecurity measures. With concerns about cyber threats linked to ongoing tensions between the US, China and Russia, companies that specialize in cybersecurity are likely to see increased demand. In April 2021, the US sanctioned companies that support Russian intelligence efforts to carry out malicious cyberattacks against the US. Today, it is clear that these sanctions are ineffective and that Russian cyber companies are growing.2

Recent government actions, including President Biden’s Executive Order and National Cybersecurity Strategy announced on 2nd March, further support the industry’s growth prospects. The order enhances the federal government’s systems by upgrading to zero-trust network access (ZTNA) and pushes for software makers and industries to assume greater responsibility for their systems’ security.3 The White House has also announced a $70 billion IT budget and a $12.7 billion cybersecurity budget for federal civilian agencies, a 13% increase from the FY2023 budget, which will also integrate security into software development and require IT providers to report cyber incidents.4

The industry’s growth potential is further highlighted by the increasing prevalence of cyberattacks originating from mobile devices, with 45% of enterprises experiencing a breach, intrusion, or data theft in the past year, according to a report by Verizon.5 According to a report by Microsoft, companies are increasingly adopting zero-trust network access to increase speed and security, with 96% of security decision makers believing zero trust is critical to their enterprises’ success.6

We view the cybersecurity theme as an effective hedge against ongoing geopolitical risks. Companies within this theme have shown strong pricing power and have good cross-selling opportunities, making their products fairly demand inelastic to pricing inflation. Cybersecurity also benefits strongly from longer-term tailwinds, such as increasing company spend. Cybersecurity as a basket is showing persistent sales growth of 24% and is trading at a 0.22x price to sales growth ratio. The enterprise value to sales growth ratio is currently at 0.36x, in line with its longer-term average of 0.34x.7

Defined Outcome Strategies to Buffer Further Market Downside and Precious Metals Exposure Via Miners as a Diversifier

The recent volatility driven by the banking liquidity crisis saw the VIX rise north of 30 for a brief period. Risk-averse investors who seek protection against a sharp downturn or are unsure about the direction of US equity markets may find buffer strategies compelling. Buffers are a risk management options strategy designed to provide a level of downside mitigation with the potential to provide lower volatility and protection against any sharp downturns. Used tactically, these strategies can differentiate an investor’s risk/return profile by gaining an explicit amount of downside protection and lowering equity betas while staying invested in a broad stock index.

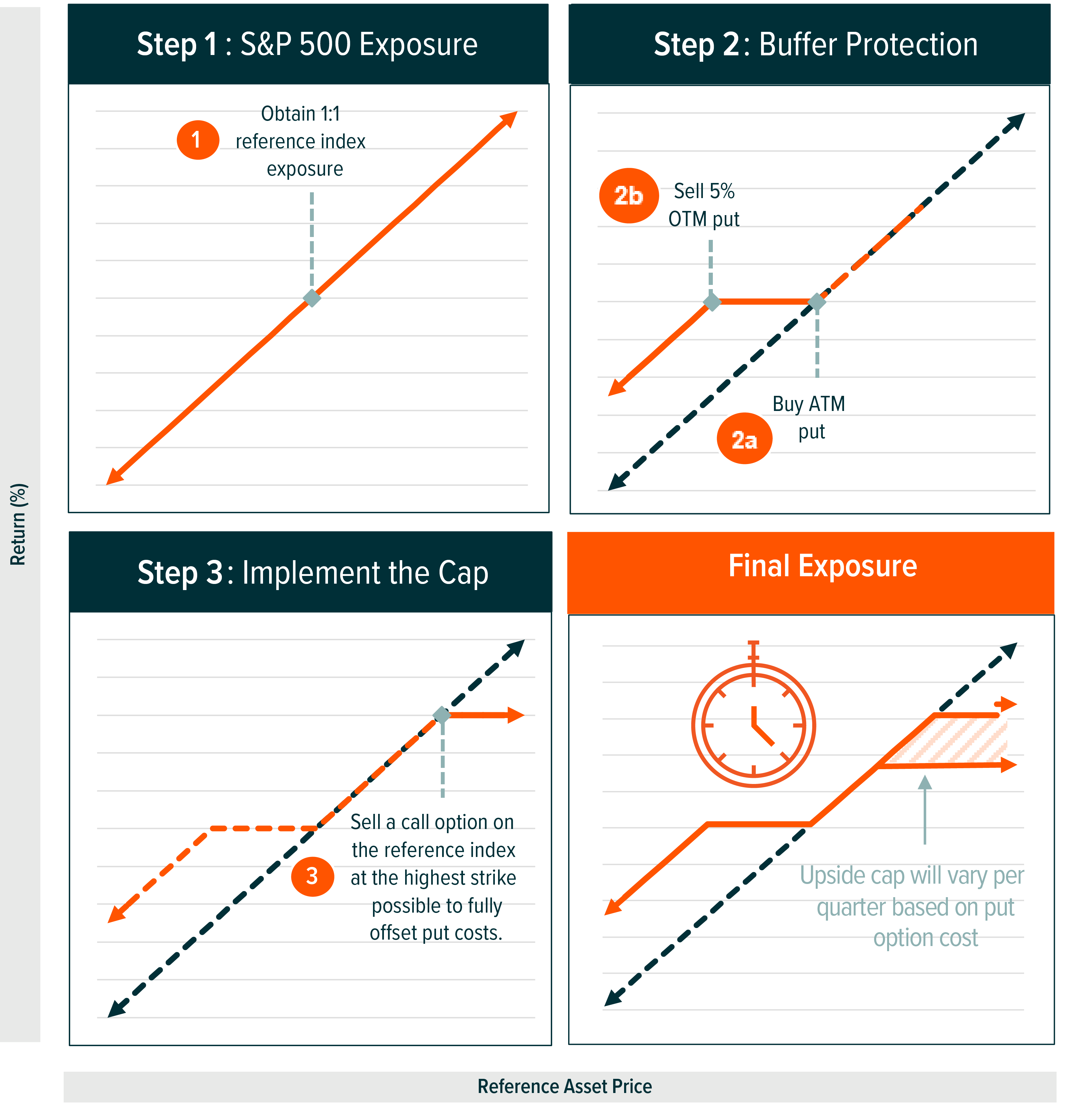

A combination of options is used to obtain a buffer. For example, a defined outcome strategy with 5% buffer protection protects against the first 5% of losses in the reference asset, such as the S&P 500 Index (SPX), over the course of the outcome period. The strategy typically includes a long exposure to the S&P 500 Index, a long-put spread where the strike prices on the long and short put option positions determine the level of downside protection being offered (e.g., 5%), and a short SPX call. The upside cap is used to offset the premium costs of the put spread. The result is an exposure that achieves the full upside potential of the reference asset, up to a cap, with the ability to provide a specified amount of downside mitigation over the life of the contracts. In bear markets, these strategies only expose investors to losses that exceed the buffer.

Alternatively, investors seeking safe-haven exposure and currency risk hedging for their portfolios may look to invest in precious metals—and particularly silver given current valuations. The uncertain macroeconomic backdrop, a banking liquidity crisis and a weakening dollar index make precious metals an attractive investment option. The recent short-term decline in real interest rates from their highs also supports the bullish case for precious metals in the near term. On 17th March, the gold to silver ratio was 87, down from its interim high of 92 on 10th March. Despite being above its long-term average of 68, the ratio could tighten significantly if precious metals enter an enduring bull market, causing silver to outperform gold.8

Silver has higher industrial uses than gold, with essential applications in photovoltaic (PV) cells. With solar energy becoming more prevalent in Europe’s clean energy transition and the in the US via incentives for solar manufacturers from the Inflation Reduction Act, silver could benefit from structural tailwinds. These factors could potentially offset a possible forthcoming industrial production slowdown. However, both precious metals serve as a currency hedging strategy in a portfolio. Silver has a negative correlation of 0.51x with the US dollar over the past five years and a negative correlation of 0.65 over the past 12 months. Additionally, silver has a 1.6 beta to gold (five year) and a 0.72 correlation to silver (one year). Furthermore, silver miners exhibit similar characteristics, with a 0.82 correlation to silver and a negative 0.64 correlation with the US Dollar Index (DXY).9 Silver miners offer a leveraged play via equities on the underlying metal.

A Global Battle to Own Disruptive Materials Provides a Secular Trend

The growing demand for raw materials fuelling a wide range of disruptive technologies, is attracting further policy tailwinds directed towards the clean energy transition. On 16th March, the European Commission introduced the Net-Zero Industry Act and Critical Raw Materials Act in response to the US Inflation Reduction Act and to reduce its dependence on sourcing materials from China.10 The EU aims to mine at least 10% of its annual consumption of critical raw materials and process at least 40% of that consumption by 2030, with 16 strategic raw materials prioritized for sourcing, processing and recycling.11 The list of strategic raw materials include copper, lithium, nickel and rare earth elements and will be updated every four years. Additionally, the EU’s proposal for quick permitting of strategic projects, including mining, processing and recycling facilities acts as an additional tailwind for related companies.

The Net-Zero Industry Act seeks to increase the manufacturing capacity of green technologies such as solar, wind, batteries, storage and grid technologies while also further accelerating the streamlining of project approvals and providing additional funding to selected projects that align with its targets.12 The clean technology industry is set to grow to USD630bn by 2030, and the EU aims to increase its share of green technology production to at least 40% by 2030. This points toward increasing demand for copper and disruptive materials, as these are required in the manufacturing of wind turbines and solar cells, as well as the electrification of infrastructure, robotics, and electric vehicles, among other products.

A continued global commitment to cleaner energy transitions and incentives to accelerate the manufacturing capacity of green technologies make disruptive materials and copper miners a compelling investment theme. Investors may find long-term value in companies involved in the exploration, mining, production and refining of these materials. Currently, a basket of disruptive materials companies is trading at a price to sales ratio of 1.40x and EV/sales of 2.23x. A basket of copper mining companies is currently trading at a 0.79 P/S multiple with an EV/Sales ratio of 1.21.13

Regardless of how current geopolitical instabilities and challenges in the banking sector evolve, the structural decades-long trends fuelling demand for disruptive materials and copper are likely to continue accelerating. From vehicle electrification to the green energy transformation, both public and private sectors are looking upstream and considering how these key inputs could shape the economic future.