The Metaverse and Immersive Technologies Show Promise in Industrial Applications

ListenPreview

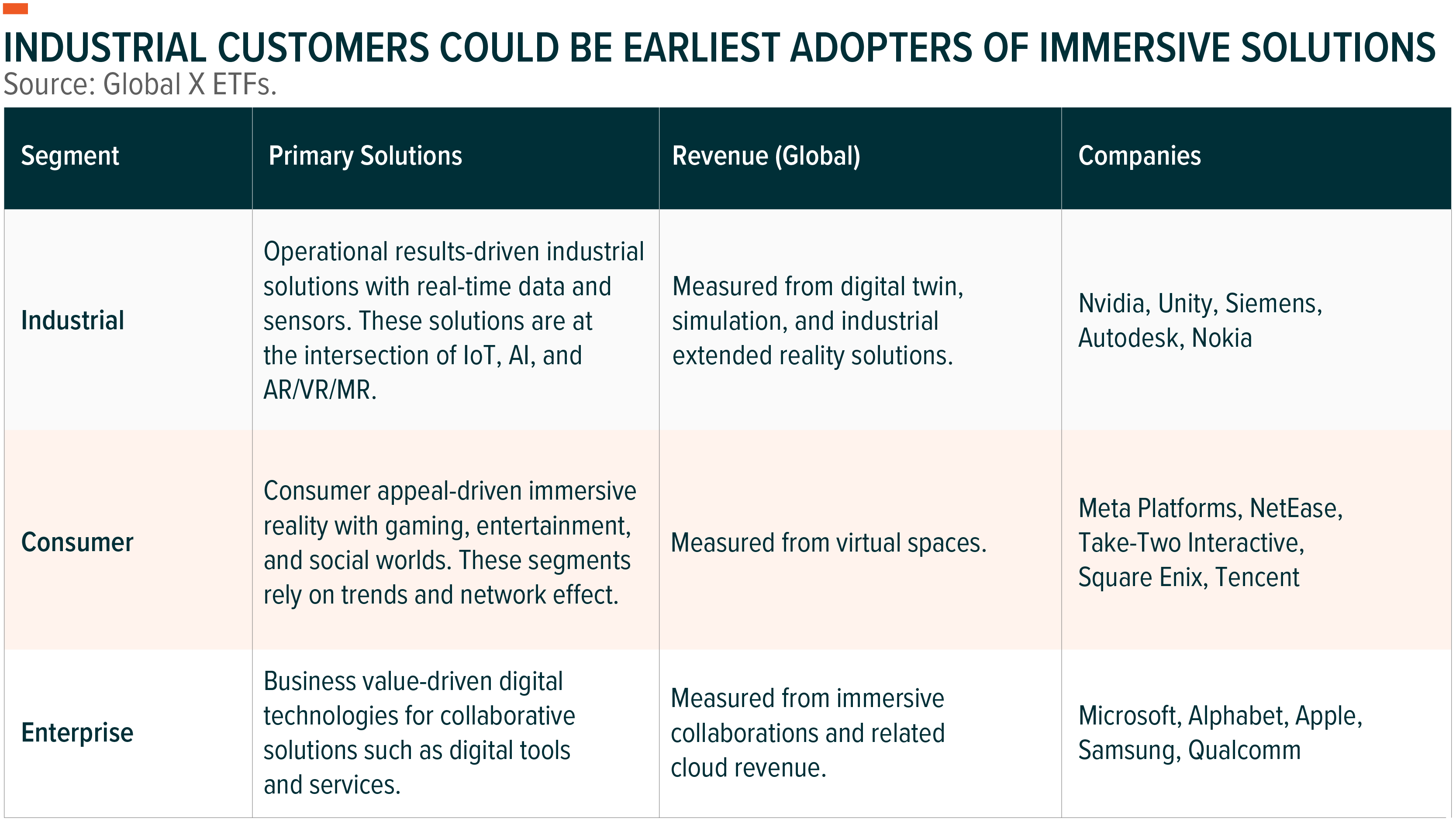

Some of the greatest potential for early adoption of the Metaverse and immersive technologies lies within the core industries that underpin our economies, including manufacturing, engineering services, construction, and transportation design. Collectively grouped as the Industrial Metaverse, we believe these technologies can transform how manufacturing systems are designed and tested, products are sourced, global teams collaborate, and more. Helping this transformation are persistent improvements in form factors and capabilities of XR headsets, which can, for example, give companies contextualized spatial views of projects without needing to dispatch employees onsite.

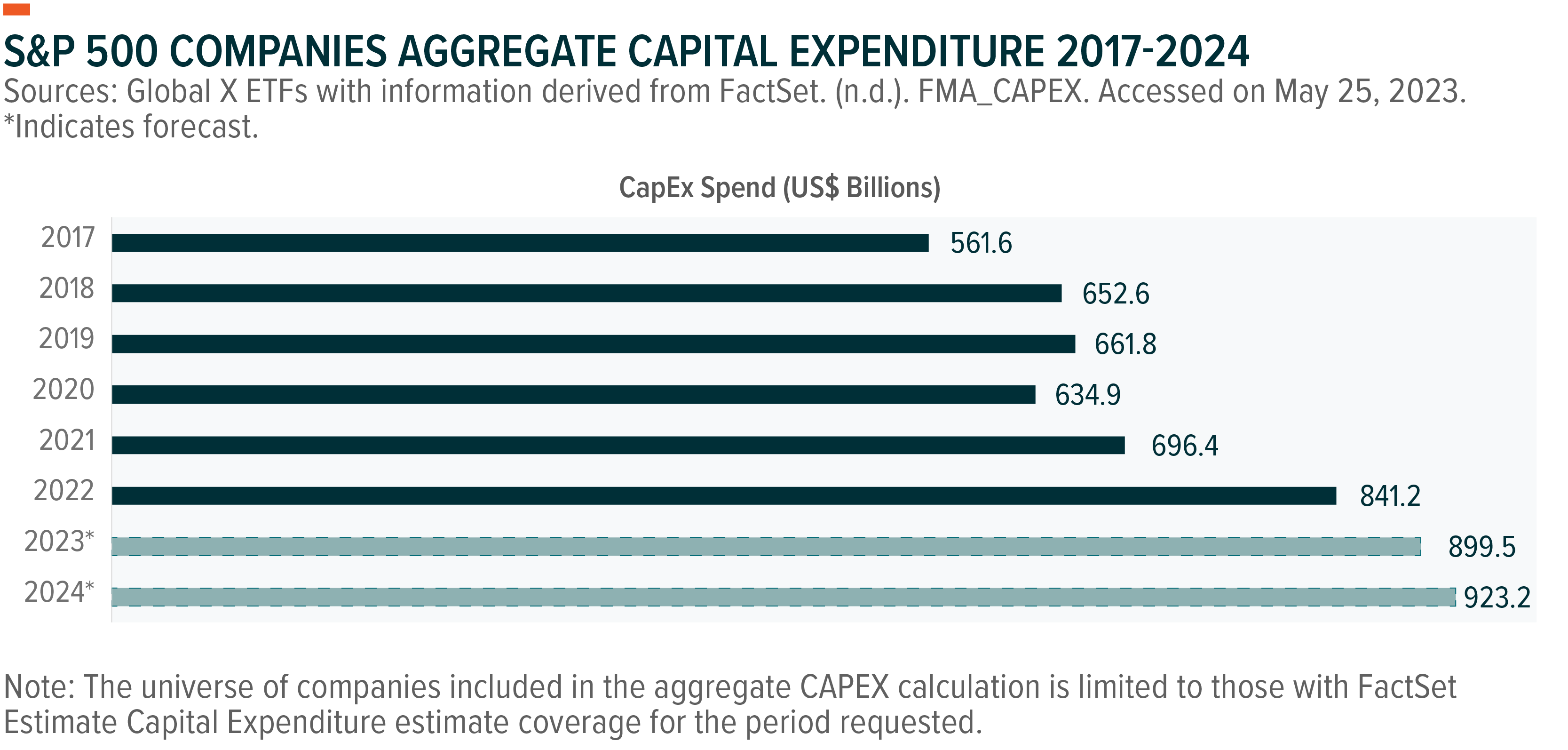

With broad post-pandemic capital expenditure (CapEx) expansion in the United States, China, and other major economies, we expect the development and adoption of immersive technology that caters to industrial functions to accelerate alongside automation. And in the process, we expect investors to have opportunities to capture this growth.

Key Takeaways

- We expect immersive technologies to play a key role in reshoring of supply chains and manufacturing, which requires investment in automation and intelligent software.

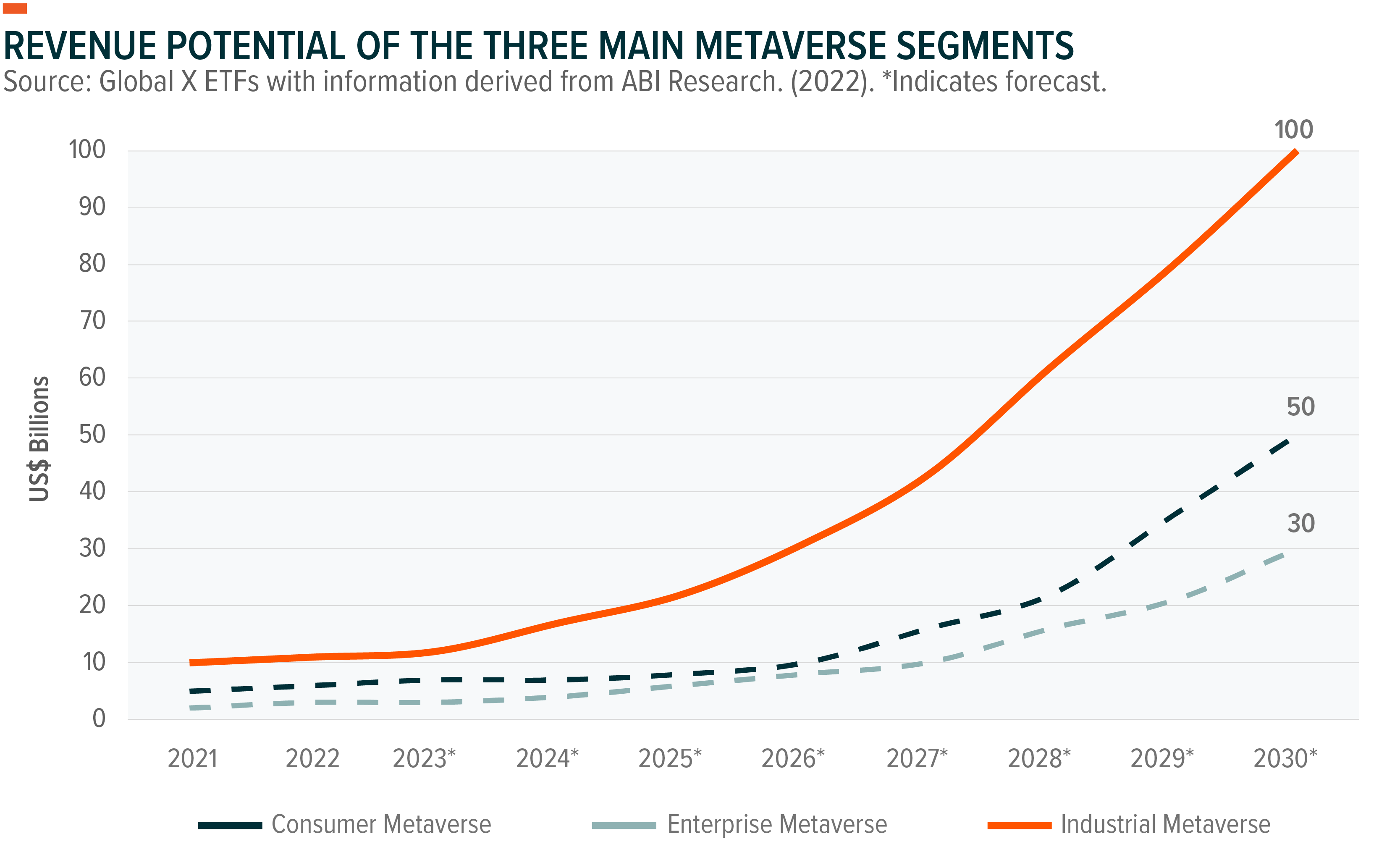

- The Industrial Metaverse currently represents a greater near-term revenue opportunity than the Consumer and Enterprise Metaverses due to its capacity to enhance operational efficiency.

- Early success of digital twin technology illustrates the Industrial Metaverse’s growth potential and the segments in line to benefit, including digital twin software, data management, and graphic processing hardware.

Reshoring Can Catalyze Automation, Connectivity, and the Metaverse

COVID-19 displacing global supply chains coupled with mounting geopolitical tensions has major economies and businesses around the world reconsidering their global manufacturing strategies and investing in domestic solutions. U.S. CapEx spending grew a substantial 19.8% year-over-year (YoY) in 2022.1 China’s spending on fixed assets grew by nearly 4.7% YoY in the first four months of 2023.2 An AVEVA survey found 85% of industrial businesses spanning manufacturing, large-scale agribusiness, food and beverage, infrastructure, energy, power and chemical processing plan to increase their digital investment.3 These capital projects set the stage for a Fourth Industrial Revolution, or Industry 4.0, the next step in the digitalization of manufacturing.

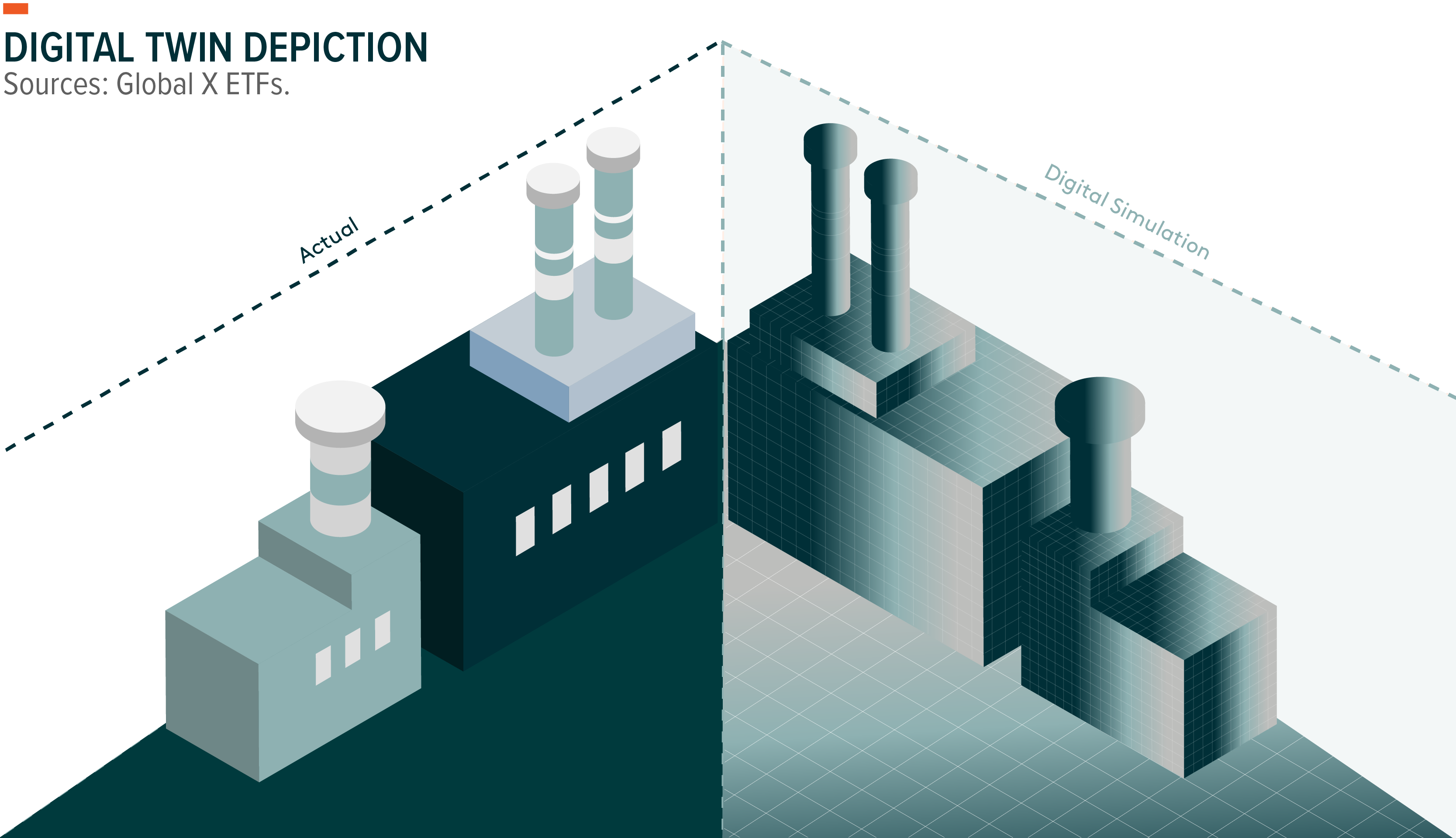

We expect increased investment in automation, connectivity, and virtual modeling to catalyze the growth of the Industrial Metaverse through technologies like digital twins, blockchain, and edge computing. In particular, digital twins, positioned at the convergence of artificial intelligence and virtual reality, serve as a conduit between the physical and digital realms. Also, enhancements to and expansions of networking infrastructure, such as the implementation of low latency 5G networks, can help proliferate applications.

Whether by way of 3D simulations or digital twins, the market for the Industrial Metaverse and its adjacent immersive technologies are more advanced than the Consumer and Enterprise Metaverses. Specific industrial use cases can explain the gap, as they seek to address real-world challenges and essential business needs.

Digital Twin Technology Is Critical to Industrial Automation

Digital twin technology facilitates the precise modeling of physical objects and environments in a digital space, capturing the full spectrum of variables that impact the object in its environment. This visibility allows companies to test assets, designs, and processes in real time without the risk of expensive mistakes made in the physical world. For example, the technology can streamline the planning of factories, buildings, even entire cities.

Valued at $12.6 billion in 2022, the global digital twin market is expected to reach $140.8 billion by 2032, a compound annual growth rate (CAGR) of 27.3%.4 The seeds of this growth potential are evident already, with many major industrial corporations and suppliers of automation solutions running successful experiments using this technology.

- Siemens & Nvidia: The Digital Native Factory in Nanjing, China is Siemens’ first factory with a digital twin, which helped increase the factory’s manufacturing capacity by 200% and its productivity by 20%.5 Also, Siemens collaborated with Nvidia to connect the Siemens Xcelerator and Nvidia Omniverse platforms to create photo-realistic, physics-related, and real-time digital twins. An initial result of this partnership is a digital model of a next-generation factory for battery manufacturer FREYR Battery. The demo features 3D representations of not only FREYR’s plant and machinery but also human ergonomics, safety protocols, and robotic inclusions at the factory.

- Unity: Designed to cater to trades such as automotive, manufacturing, architecture, and energy, the Unity Industry product suite provides live 3D augmented reality (AR), mixed reality (MR), and virtual reality (VR) support. The Unity Mars tool allows users to build mock-ups of AR and MR experiences equipped with special recognition. Unity Pixyz is for computer-aided design software professionals to turn Point Clouds into Mesh. Unity also has Timi, a fictional brand that depicts how real-time 3D marketing on a heavy equipment product line can work.

- General Motors (GM) and General Electric (GE): General Motors created a connected ecosystem by deploying approximately 6,000 operational technology (OT) devices at each of its plants and by integrating over 50 manufacturing execution systems (MES) applications. GM’s plants have 100,000 connections between the OT and Informational Technologies (IT) layers.6 To reduce the manual effort required to manage these systems, GM collaborated with GE Digital to develop MES 4.0. Together, they established GM’s Virtual Factory Testbed, which uses digital twins to simulate plant-floor behavior.

- IBM: The IBM Digital Twin Exchange is an e-commerce platform designed to facilitate the exchange of digital assets. The platform can be a valuable resource for asset-intensive industries because it offers a wide range of enterprise-wide digital assets. Also, IBM collaborated with infrastructure consultancy Sund & Baelt to develop a digital twin-powered system that optimizes inspections and predictive maintenance strategies for aging infrastructure. With the help of the IBM Maximo Application Suite, this system can extend the lifespan of critical infrastructure.

- Microsoft: Azure Digital Twins is a platform-as-a-service (PaaS) through which users can construct comprehensive twin graphs by leveraging digital models of buildings, factories, farms, energy networks, railways, stadiums, even entire cities. Also, Azure Digital Twins makes it feasible to design a digital twin that accurately portrays real-world Internet-of-Things (IoT) devices within a broader cloud solution.

Eventually, we expect digital twin technologies to spread to smaller instances, enabling virtually every asset and process within companies to be digitally replicated.

Broad Industrial Digitization Creates Robust Opportunity Set

The impact of industrial customers adopting sophisticated immersive tech and modeling solutions will be far-reaching. In line to benefit are platforms that provide digital twin software and vendors of connectivity solutions that make it easy to record real-time data, hardware providers that support graphic processing, and data management companies that facilitate data storage and access. We believe that cost savings, increased speed to market, and data abilities, among other benefits, will force buyers to invest in more technology.

As increased spending flows through the component and solution-provider value chain, we highlight these subcategories of technology solution providers as potential beneficiaries.

- Graphic Processing Hardware: Companies like Nvidia, which specializes in graphic processing units (GPUs) and AI-driven technology, and General Electric, which builds physical assets essential to critical infrastructure, are at the forefront of hardware development for industrial metaverse technology.

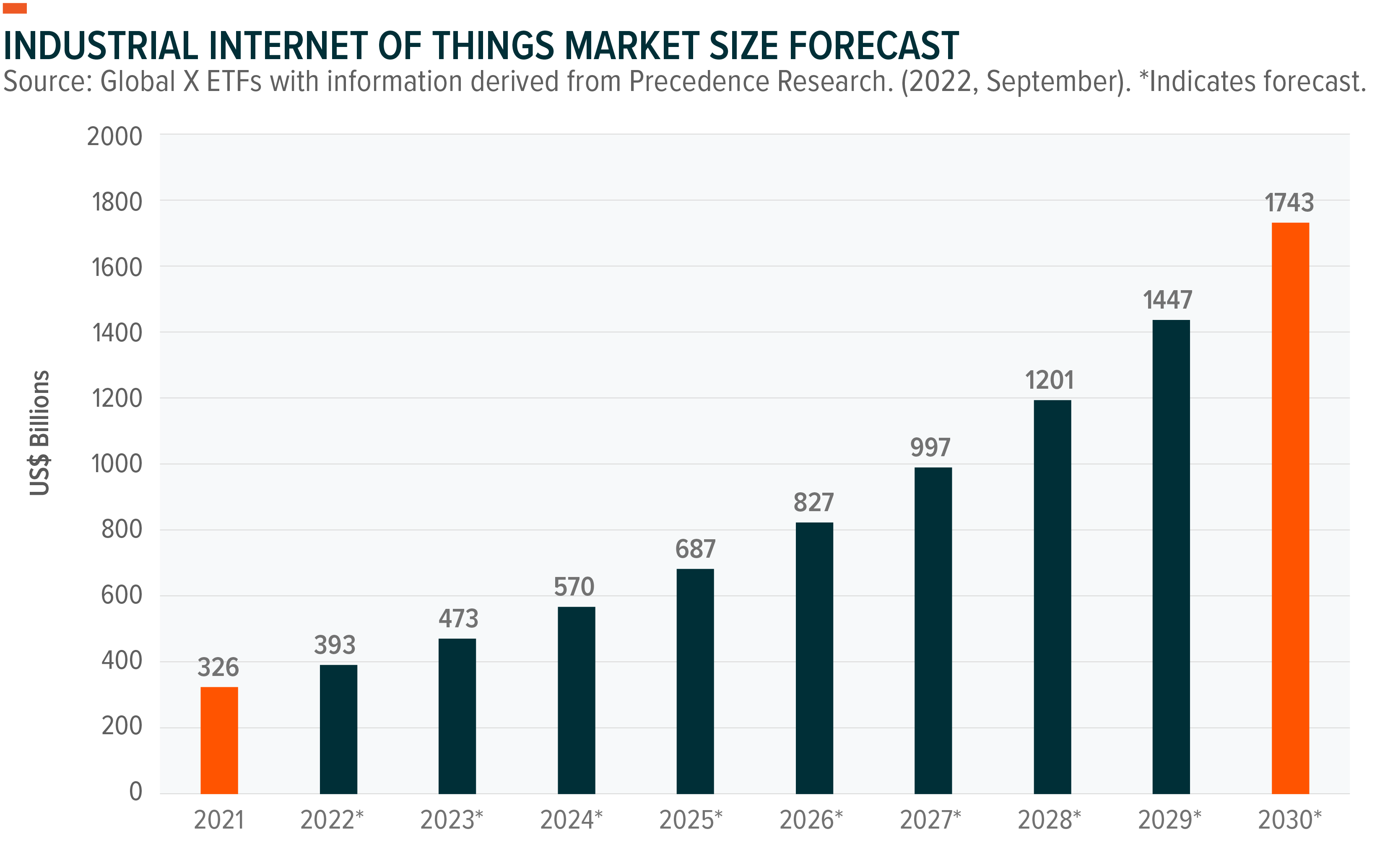

- Internet of Things & Connectivity: Increasing demand for comprehensive data acquisition presents a favorable outlook for the growth of IoT systems. Industrial IoT is expected to grow at a 20.5% CAGR through 2030.7 Significant opportunities are in optics, encompassing a diverse range of sensors, and radio frequency (RF) and wireless components essential for network infrastructure development.

- Creative Platforms: One of the segments with the most direct engagement with consumers, creative platforms focuses on advanced design and customization options. Companies in this segment, such as Unity with its comprehensive MR toolset and Microsoft with Azure Digital Twins, enable software professionals and aspiring designers to harness modeling technology. Also, likely to benefit in this segment are companies providing 3D modeling solutions, computer-aided design (CAD) systems, and turnkey graphic engines to build digital twins.

- Data Analysis & Management: Commonly used purpose-built solutions and increased data capture and record keeping translate into spending on databases and similar tools. Real-time data streaming platforms, data lakes, warehousing solutions, and modular databases can benefit, as can data analytics solutions. Positioned to benefit are companies such as Microsoft, Alphabet, and Amazon, which run vast cloud franchises, as well as platform providers such as Splunk, Dynatrace, Twilio, ServiceNow. As an example, AWS IoT Core is a crucial service for IIoT because it helps manufacturers to process and visualize data efficiently.

Conclusion: Industrial Applications Are Commercializing the Metaverse

Given strong signs of early adoption and experimentation, we believe spending on immersive solutions by industrial customers could scale up quickly. Shifting global dynamics post-COVID, geopolitical tensions, and government initiatives like the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and the CHIPS and Science Act create a unique investment cycle where automation and connectivity are not only a priority but also often a necessity. By the end of this decade, the Metaverse is potentially expected to be a multitrillion-dollar market, and we expect a substantial share of that market to be dedicated to industrial applications that grow rapidly with these tailwinds.8

Related ETFs

BOTZ – Global X Robotics & Artificial Intelligence ETF

AIQ – Global X Artificial Intelligence & Technology ETF

SNSR – Global X Internet of Things ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.