Investment Strategy Monthly Insights: Secular Trends in Commodities and Infrastructure

Market sentiment remains cautious amid ongoing concerns about elevated inflation, recession risk, and the lingering impact of the recent banking liquidity crisis. As we navigate through earnings season with caution, there are clear thematic bright spots in the market for discerning investors. We see potential in structural long-term themes including Physical Environment and Commodities. By focusing on long-term themes that are underpinned by strong secular growth trends, investors can position themselves to navigate this period with a degree of protection and potential for growth.

Investment strategies highlighted this month:

- Copper – Electric vehicles and China’s construction boom are fueling demand for copper.

- US Infrastructure Investments – Billions are set to be invested in bridges, grids, and clean energy as the nation works to rebuild for a sustainable future.

- Uranium – Nuclear power’s renaissance has been increasing global uranium demand as countries pursue net zero emissions targets.

Copper Miners – How Electric Vehicles and China’s Construction Boom are Fueling the Copper Market

On April 12th, the US Environmental Protection Agency announced its most stringent standards for tailpipe pollution for road vehicles to date, with the goal of promoting the adoption of electric vehicles (EVs) and aiding decarbonization efforts.1 This will likely further accelerate the vast buildout of electric charging infrastructure and manufacturing of EV batteries, increasing the demand for copper. The US government has provided $2.8 billion towards the manufacturing of EV batteries and aims for 50% of new car sales to be electric by 2030.2 Further, the demand for commodities is expected to persist as part of a long-term structural trend by global clean energy industrial policies, such as the Inflation Reduction Act (IRA), which are crucial to the development of renewable infrastructure and decarbonization initiatives.

China’s building and construction sector is a major driver of copper demand, responsible for 30% of demand globally.3 In April, China’s Q1 2023 GDP data showed a growth rate of 4.5%, surpassing the 4% forecast by economists polled by Reuters and roughly aligning with the government’s 5% target for the year.4 This growth was driven by a strong export market, infrastructure investment, and a rebound in retail consumption and property prices. In March, China’s new home prices increased by 0.5% month-over-month, marking the third consecutive monthly rise and the fastest pace of growth in 21 months, largely driven by government support policies.5 We believe that the significant government package directed towwards housing developers announced in November 2022 is fueling this robust rebound in China’s building and construction sector. The property sector received new loans totaling $162 billion from leading Chinese banks, which has injected significant liquidity into the Chinese real estate market.6

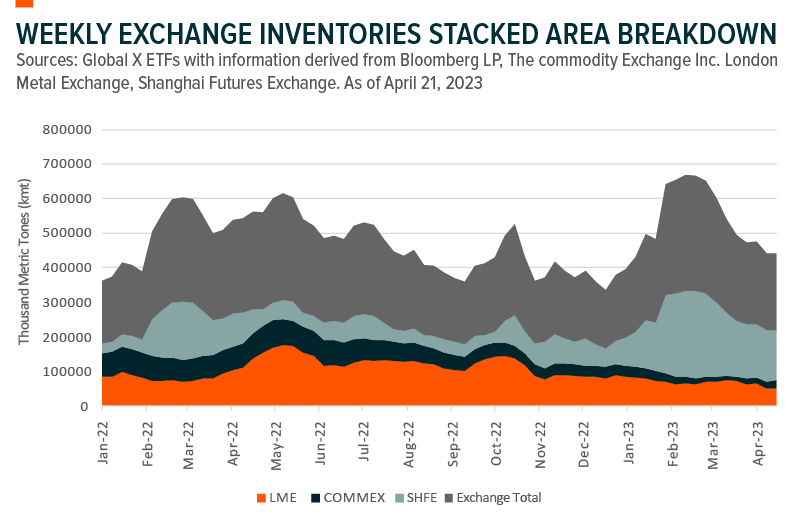

Disruptions in mining regions, such as Chile and Peru, which account for almost 40% of the world’s copper supply, have caused delays in the delivery of raw copper, leading to production disruptions.7 These challenges are compounded by low copper inventories in the United States and Europe, raising concerns that the copper market may soon face a deficit.8 The depletion of inventories increases the risk of a price surge, as traders may rush to replenish their stocks.

The combined Copper inventories on the London Metal Exchange (LME) and Commodity New York Mercantile Exchange (COMEX) remain critically low, which should further support elevated copper prices. A continued weakness in the Dollar Index (DXY), as witnessed recently, could also further support copper prices.

US Infrastructure – Federal Investment in Infrastructure and Clean Energy Creates Opportunities for Growth and Innovation in US Economy

On April 13th, the White House announced a new round of funding for bridge projects as part of the Bridge Investment Program (BIP), which will invest $12.5 billion towards rebuilding, repairing, and replacing bridges over the next five years.9 The BIP is a grant program as part of the Infrastructure Investment and Jobs Act (IIJA), which passed in August 2021 for an amount of $1.2 trillion. It provides funding for a wide range of infrastructure projects, including transportation and energy. In January 2022, President Biden announced an additional $2 trillion infrastructure package, known as the Build Back Better Act. Investments in infrastructure are expected to have a significant impact on the US economy, creating jobs, onshoring more private investment, and adding trillions to the US economy by 2039. Currently, more than 10,000 projects have the potential to receive investments from IIJA funding, which totals over $185 billion at the state level, with California, Texas, and Florida receiving the greatest share.10 The rental equipment sector has experienced a robust recovery in the past two years, and with unprecedented federal spending and large private investments, above-trend revenue growth is expected to continue.

A further $370 billion from the Inflation Reduction Act (IRA) program was enacted in August 2022 to encourage investments in key energy infrastructure markets, including modernizing power grids, encouraging the generation of renewable power, and spurring electric-vehicle manufacturing and development of cleantech. It includes an additional $10 billion investment tax credit for clean energy manufacturing, with nearly $6 billion allocated to help existing heavy manufacturing, such as steel and cement.11 The IRA will allocate $12.5 billion to the sustainable energy transition, while the IIJA dedicates $80 billion to the energy transition, with $16.5 billion for grids, specifically for projects that boost grid resilience and efficiency and integrate EVs. As part of the IIIJA, the National Electric Vehicle Infrastructure (NEVI) Formula Program is directing $5 billion of funding over five years to build out the electric charging network as part of the goal of reaching 500,000 charging stations by 2030.12

The IIJA and IRA are both long-term investment plans that should have a meaningful impact in 2023 and are providing production visibility for US infrastructure companies for several years.

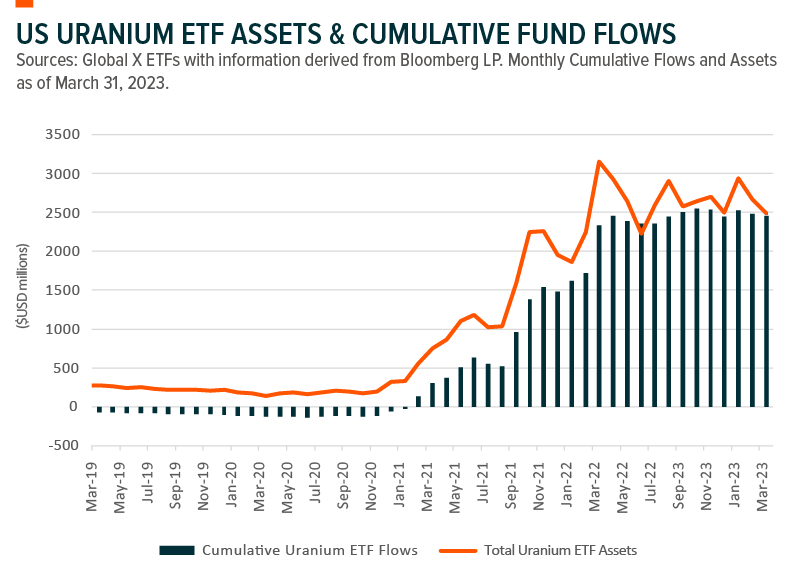

Uranium – Nuclear Power’s Renaissance Spurs Global Uranium Demand as Countries Pursue Net-Zero Emissions Targets

As countries around the world strive to decarbonize their energy systems, nuclear power may play an important role, given it is a reliable source of baseload power. This is likely to continue to increase the demand for uranium. Several countries have recently announced plans to expand their nuclear power capacity, including the US, UK, China, and India. The International Energy Association (IEA) predicts that under its Net Zero Emission 2050 target, nuclear power capacity worldwide will need to more than double from 413GW in 2021 to 871GW in 2050.13 In a report issued by Clifford and Chance LLP in February 2023, the World Energy Organization (WEO) projects that 60% of new build plants will be constructed in China.14 That means China’s nuclear fleet could overtake the US as the largest in the world over the next 10 years.

China increased its nuclear approvals in recent years and in 2022 alone agreed on 10 new reactors that are typically larger than one gigawatt.15 China General Nuclear Power Group Co. Chairman Yang Changli stated in an interview that China’s nuclear fleet will grow to 400GW, which is seven-fold today’s capacity, by 2050 and will account for 18% of the country’s power generation.16 China is leading the nuclear renaissance and has seen nations including the UK turn to the technology in a bid to reach climate goals while meeting power needs. Yang’s forecast would require a clear step up in the country’s already ambitious building program, with more than nine gigawatts of additional nuclear capacity needed every year through 2060.

Small modular reactors (SMRs) are gaining popularity, due to their flexibility and potential use in hard-to-reach areas. With a power capacity of up to 300 MW(e), SMRs can fluctuate their outputs according to demand and can be built in a fraction of the time it takes to construct a traditional reactor. Mostly prefabricated in factories, SMRs can be fully constructed and operable within 2-3 years, a fraction of the 7-9 years required for a traditional reactor.17

Investing in uranium ETFs provides an efficient and cost-effective method for accessing a diverse basket of companies involved in uranium mining activities around the world and can help mitigate some of the risks associated with individual uranium miners.