Checking in on Cannabis (Part 2): An Update on Existing Markets

ListenThe following is part 2 in 3-part blog series on the global cannabis industry. This part takes the pulse of existing cannabis markets. Part 1 highlighted and evaluated progress toward legalization in U.S. states. Part 3 will discuss the possibility of federal legalization in the U.S. and abroad.

Global cannabis markets are thriving despite the backdrop of COVID-19. 2020’s lockdowns translated to devastating losses for some industries, but Cannabis fared better. Many state and federal governments around the world deemed cannabis businesses as essential, keeping their doors open and catalyzing what ended up being a watershed year for the industry. Global legal cannabis sales reached a record $21.3B in 2020, up an impressive 48% year-over-year (YoY).1 2021 is also proving to be a boon with most legal markets showing similar or greater strength thus far.

In the following, we examine legal cannabis markets around the globe, providing updates and outlooks on cannabis sales, as well as delving into the implications of recent market developments.

Key Takeaways:

- U.S. states that recently legalized recreational cannabis sales are experiencing robust growth, propelled by the pandemic and a streamlining of licensing and regulations

- More established markets in the U.S. like California and Colorado are continuing to enjoy growth years after legalization as consumers embrace new cannabis products

- Canada’s nation-wide legalization efforts initially started off slow, but growing retail distribution and expanding derivative product offerings are helping businesses capture market share from illicit sales

LEGAL CANNABIS MARKETS IN THE U.S.

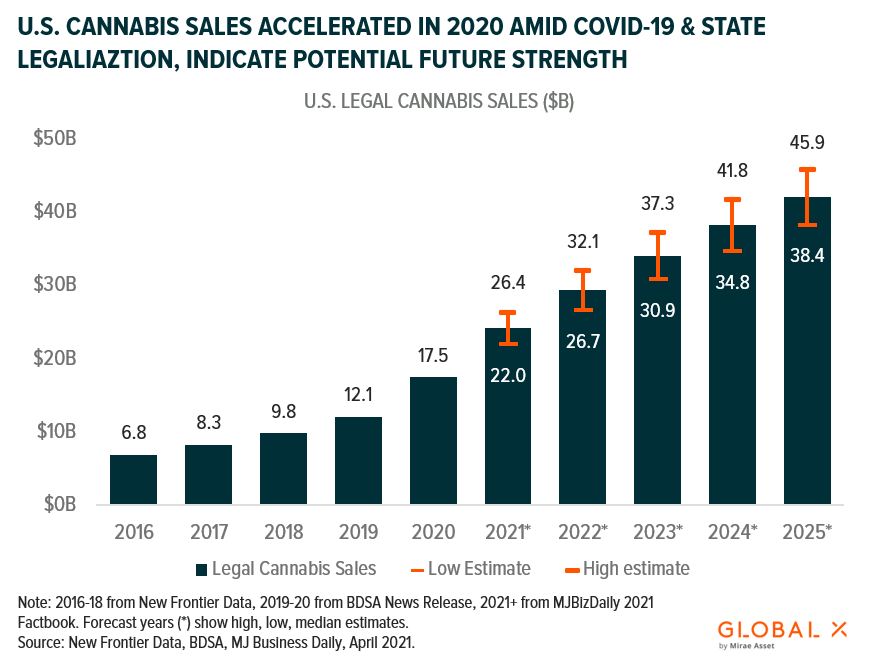

Legal state markets in the U.S. contributed to over 80% of global sales in 2020, growing to $17.5B on the back of greater acceptance and supportive stay-at-home trends.2

States with Recent Legalization Legislation Make Their Mark

Illinois

Market Update: Illinois legalized recreational cannabis in June 2019. Legislators were swift to establish retail regulations and in-store sales commenced at the start of 2020. Despite the prompt rollout, the state’s licensing process limited the number of retailers, inhibiting supply and immediate scale. 2020 sales still reached the milestone $1B mark but were potentially held back as licensing delays stalled retail growth throughout the year.3 These dynamics are still in effect. As of April 2021, only about 110 licensees serve Illinois’ population of approximately 13 million – that’s around 1 licensee to every 120,000 people.4 For comparison, there is 1 for every 10,000 people in Colorado.5

Outlook: Promising legislation that would help improve supply dynamics in Illinois is currently in the works. House Bill 1443 would provide for more than 110 retail dispensary licenses and will initiate the distribution process for an additional 75 dispensary licenses that were previously earmarked for social equity programs.6,7 Governor JB Pritzker expressed support for HB 1443 and could sign the bill into law in the near future. Illinois is one of the most undersaturated legal cannabis markets, and we believe that an expansion of licenses in 2021 will go a long way in addressing this. Cannabis sales could total reach $1.7B in 2021 and $3B by 2024, assuming the market develops as expected.8

Michigan

Market Update: Michigan legalized recreational cannabis in November 2018 and the market has scaled quickly in the three years since. 260 recreational cannabis stores currently serve the state’s population, amounting to about 1 store for every 35,000 people. But despite having more stores than other newly legal states, sales weakened toward the end of 2020. Between Q3 and Q4 2020, sales of dry flower fell 16% while total recreational sales declined 9%. Dry flower products became less popular during the pandemic, due in part to Michigan’s generous at home cultivation policy. Instead of going to the store, many consumers opted to grow their own plants. In Michigan, unlicensed adults are allowed to grow up to 12 mature plants within their residences.9 In an encouraging sign for the industry, highly profitable derivative products led the way for a sales recovery in early 2021. Cannabis sales surged in Q1 2021, up 163.6% YoY and up 21.4% sequentially from Q4 2020.10

Outlook: Michigan’s recreational cannabis market stands to benefit from stable supply dynamics and high sales volumes of cannabis derivatives. In April 2021, 43% of total cannabis sales in Michigan were derivatives, the highest share in the nation.11 We expect high-margin derivatives such as edibles, concentrates, and THC-infused beverages to continue to make up a large percentage of Michigan’s product mix, much to the benefit of retailers and distributors. Recreational sales are expected to grow from $990M in 2020 to between $1.9Band $3B by 2024.12,13,14

Massachusetts

Market Update: Massachusetts legalized adult use of cannabis in November of 2016, but recreational sales took another two years to begin. The Massachusetts market is known for its high prices which are often twice the national average.15 The state’s seasonal climate is unfavorable for cultivation, forcing producers to rely on expensive climate-controlled facilities.16 Cultivating cannabis in this setting costs 82% more per square foot than outdoors.17 Additionally, high excise tax rates and licensing fees associated with a robust regulatory process further add to the cost.18 Despite these headwinds, Massachusetts’ cannabis businesses continue to chip market share away from illicit markets. Recreational sales in the state totaled $700Min 2020, up 56% YoY.19 Notably, the state achieved this despite cannabis retailers closing statewide for 60 days in 2020.20

Outlook: Massachusetts must find ways to incrementally cut costs if it wants to propel the growth of legal cannabis sales. In January 2021, the Massachusetts Cannabis Control Commission approved new regulations that are more accommodative for the industry. The new regulations reduce annual costs for social equity approved cannabis businesses, permit delivery services for recreational and medicinal cannabis, approve specific branded sponsorships, and increase flexibility for caregivers who utilize medical marijuana.21 Upstream cultivators performed admirably in a difficult environment, and we believe such measures will provide relief to the entire value chain. Total annual sales of cannabis could clear $1Bin 2022 and reach $2.6B in 2025..22

Pandemic Year Invigorates Established State Markets

California

Market Update: California just celebrated 4 years of legal recreational cannabis. Over that time, its legal retail market blossomed into the world’s largest, growing from $1.4B in 2018 when sales began to $4.4B in 2020.23 Though a complex and strict regulatory framework governs the market, a characteristic that typically hampers supply, licensing is progressing without issue. California’s three licensing authorities have granted more than 10,000 licenses to commercial businesses throughout the state.24

The pandemic proved to be a tailwind for the state’s industry with sales surging in the spring and summer.25 California was the first state to mandate non-essential business closures and it set the tone for the rest of the country when it designated cannabis businesses as essential. Cannabis businesses reaped the rewards of this action, gaining further credibility and generating outsized revenues during the stay-at-home economy portion of the pandemic.

Outlook: We expect momentum from 2020 to continue through 2021 – some estimate that legal sales could reach as much as $5.5B by the end of the year, a 25% YoY increase.26 The state is more than on track to achieve this total. Monthly sales exceeded those of 2020 in each of 2021’s five full months, and by 34% on average.27 Growth prospects beyond 2021 also look promising. According to Marijuana Business Daily’s 2021 Factbook, adult-use sales could total $6.7B by yearend 2025, representing an 8.8% compound annual growth rate (CAGR). In our view, high-growth derivative products like edibles and infused beverages, streamlined regulatory processes, and greater acceptance of legal cannabis will play key roles in achieving this.

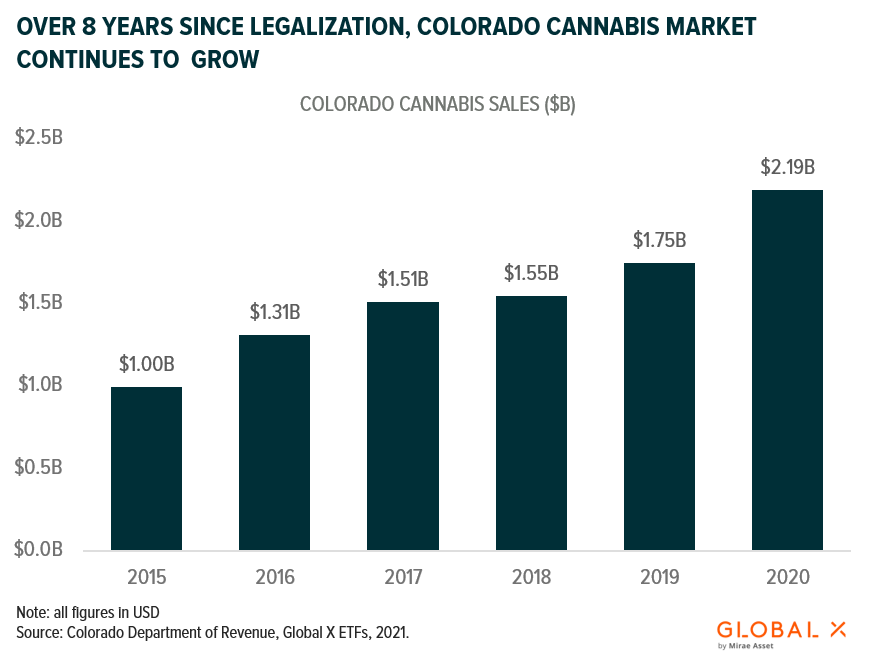

Colorado

Market Update: Colorado became the first U.S. state to legalize recreational cannabis with the passage of Amendment 64 in 2012. Fast forward to today and the state ranks number one nationwide in legal cannabis sales per-capita, while its legal cannabis market is the second largest in the world after California.28 And while Colorado’s legal market is oldest in the country, it is still growing quickly. Legal retailers sold $2.2B worth of cannabis in 2020, a 25% YoY increase.29 Speaking to this success, business owners across the state noted cannabis consumption became a recreational activity for consumers during lockdowns and that cannabis derivatives provided a sales boost amid COVID-19 concerns.30

Outlook: Adult-use sales are expected to total just under $3B in 2025, growing at a CAGR of 4.9% with 2020 as the base year.31 Colorado may lose some of its first-to-scale advantage in the coming years as other state legalization efforts succeed. Tourism has long bolstered the state’s sales, especially when few alternatives existed where one could purchase legal cannabis. However, we do not feel as though this trend represents an existential threat. Total sales attributed to tourism increased leading up to the pandemic, even as an increasing number of states legalized recreational cannabis.32 Revived tourism following the pandemic should also provide a short-term boost. Additionally, we view Colorado’s highly accommodative regulatory environment as a value driver that will give cannabis operators flexibility as the industry matures.

Our Take

While cannabis is still federally illegal in the U.S., the combined size of legal state markets and the widespread designation of cannabis businesses as essential are bringing new credibility to the industry. Incumbent states like Colorado and California are demonstrating that properly scaled markets can generate significant revenues, providing a glimpse of what a bona fide legal cannabis industry might look like. For these markets, it is still just the beginning. There is still more illicit market share left to gain, and companies are continuing to find new ways to capture more of existing customers’ wallets.

New state markets are still facing some of the same problems that incumbents did in the past, but now have playbooks to turn to. While sales may start off slow, strong consumer demand and the ability to learn from past legalization rollouts mean that places like Illinois, Michigan, and Massachusetts could enjoy stronger sales in the coming years. Beyond that, legal cannabis states that have yet to commence retail sales are well-positioned to capitalize on the lessons learned in 2020 and the decade leading up to it.

CANADA BEGINS TO CRACK THE CODE

Canada’s federally legal market is hitting its stride after an underwhelming inaugural full year in 2019. The retail adult-use market doubled in 2020, serving as a testbed for scaling a successful country-wide market and rolling out cannabis products outside of flower.33

Market Update: Cannabis became legal in Canada in late 2018 after the passage of bill C-45, better known as the Cannabis Act. An initially lumbering licensing process capped the market’s short-term potential as only a limited the number of retailers were permitted to sell. Ontario, Canada’s most populated province, only had 24 licensed retailers 1 year into legalization.34 Fewer stores meant less supply, which led to higher prices and less consumption by volume – all of which benefitted the existing illicit market.35

Things are different today, though, and processes around licensing have markedly improved. Ontario boasts almost 600 stores and an additional 800 stores are scattered throughout Canada’s 12 other provinces and territories.36 Greater supply resulted in lower prices and more consumption, driving recreational cannabis sales to a record $2.2B USD in 2020.37 Encouragingly, for the first time ever, household expenditures on legal cannabis exceeded those of illicit product in Q3 2020.38 A part of this success came from the maturation of Cannabis 2.0, a term used to describe sales attributed to derivative cannabis products like edibles, extracts, and cannabis infused food and beverages. 2.0 products became legal in 2019 and saw some success in 2020 after a poor initial rollout. At the end of the year, derivatives accounted for 36% of legal cannabis sales, with 20% attributed to edibles and 16% to extracts.39

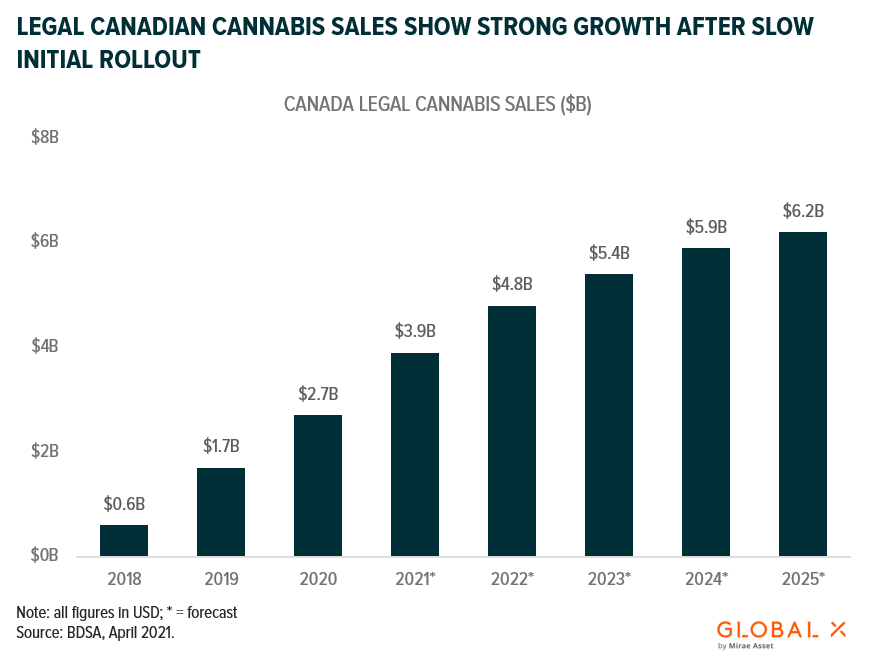

Outlook: The future bodes well for Canada’s legal market as it seeks to capture further illicit market share. Some project that the total legal market could grow an additional 44% to $3.9B in 2021 and reach as high as $6.2B in 2025.40 We expect Cannabis 2.0 to meaningfully drive a portion of this growth. Some forecast that derivative products could account for as much as 54% of Canada’s recreational cannabis consumption by 2025.41 The continued growth of such products will likely prove essential in further capturing illicit sales. In Q1 2021, 55% of recreational cannabis spending occurred in the legal market, representing a 34% YoY increase and the third straight quarter where the legal sales outstripped illicit ones.42,43 We also expect an expanding total addressable market to drive growth. In a 2020 survey, 24% of Canadians aged 25 and over reported using recreational cannabis in the 12 months prior compared to 21% in the year before.44

Our Take

The slow start of Canada’s legal market underscores the importance of streamlined licensing processes and initial product diversity. Future or soon-to-be legal markets can learn from Canada and implement licensing protocols that optimize initial supply and pricing so as to capture illicit sales from the get-go. Regulators should also design policy which recognizes the importance of derivative cannabis products in maximizing sales. The later and faltering rollout of Cannabis 2.0 slowed the legal market’s initial traction and gave operators unsteady footing at launch. We understand that regulators must be thoughtful of initial policy, but we also believe that legal markets which find a happy medium between restrictive regulation and supportive policy will be the most successful moving forward. That said, Canada overcame many of its initial difficulties and we expect continued growth in the coming years.

CONCLUSION

Legal cannabis markets thrived during the pandemic. While lockdowns and stay-at-home orders had devastating impacts for most brick and mortar retailers, many cannabis businesses capitalized on their essential business status. Consumers across the country embraced recreational cannabis, purchasing more product than ever and enjoying it in their newfound leisure time. Expanded product lines that included cannabis-infused beverages, a wider range edibles, tinctures, and other derivatives brought optionality to existing consumers and captured more of their wallets. They also represented an entry point for new consumers, expanding the total addressable market. Flush with new capital, a large consumer base, and positive momentum toward widespread legalization, global cannabis markets are well positioned to see growth in the years to come.

Related ETF

POTX: The Global X Cannabis ETF seeks to invest in companies across the cannabis industry. This includes companies involved in the legal production, growth and distribution of cannabis and industrial hemp, as well as those involved in providing financial services to the cannabis industry, pharmaceutical applications of cannabis, cannabidiol (i.e., CBD), or other related uses including but not limited to extracts, derivatives or synthetic versions.

Click the fund name for fund holdings and important performance information. Holdings subject to change. Current and future holdings subject to risk.