Thematic Investing Whitepaper: Connectivity (Internet of Things & Digital Infrastructure)

PreviewThis piece is part of a larger whitepaper, Investing In Thematics From a PM Perspective.

Connectivity creates opportunities, and we expect the Connectivity theme to grow as the internet of things (IoT) connects more devices across sectors. Sparked by the continued miniaturization of microchips and receiving a powerful tailwind from the speed and capacity of 5G networks, IoT sensors and connected devices are set to harness the power of collected data. While these technologies appear to occur effortlessly, they rely on an extensive network of towers and data centers. Core to the Connectivity mega theme’s growth potential is the significant investment being made to enhance this digital infrastructure.

Key Takeaways

- Industrial IoT (IIoT) will be a key component of the Fourth Industrial Revolution (Industry 4.0), which we expect to transform manufacturing and supply chains. IIoT is expected to account for over 70% of all IoT connections by 2024.1

- Increased connectivity increases the need for investment in digital infrastructure. Between 2016 and 2020, the U.S. wireless industry invested $140 billion in infrastructure enhancements, building over 417,000 new cell sites in 2020 alone.2

- The Connectivity theme lives up to its name by connecting numerous themes, both innovation-based and physical infrastructure-based. We believe this attribute makes Connectivity particularly dynamic from a portfolio perspective.

Why the Internet of Things and Digital Infrastructure are Such Powerful Forces

Connected devices are everywhere and growing more powerful.

Connected devices produce an almost unimaginable amount of data. Technology conglomerate Cisco estimates that IoT devices produced 500 zettabytes (1ZB = 1 trillion gigabytes) of data in 2019, and it expects that number to grow exponentially each year as more devices come online.3

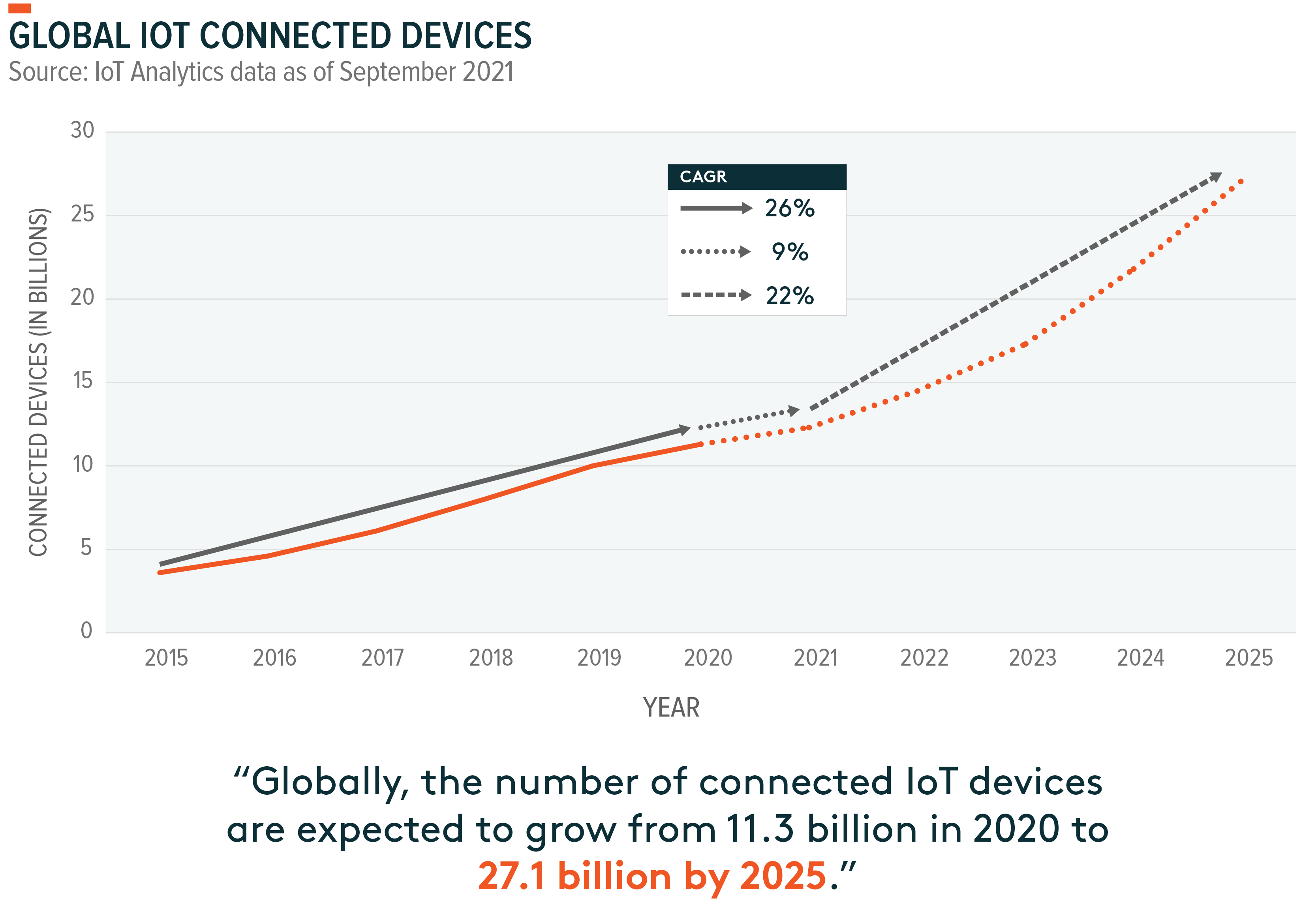

In 2021, the average American household had 25 connected devices, up substantially from 11 at the end of 2020.4,5 In total, the U.S. had 468.9 million connected devices online by the end of 2021, including 190.4 million data-only devices such as smartwatches or medical sensors. Data only IoT-focused connections have increased 272% in the U.S. since 2013.6 Globally, the number of connected IoT devices is expected to grow from 11.3 billion in 2020 to 27.1 billion by 2025 as the chipsets and wireless communication services that enable connectivity become more available.7

Cheap and readily accessible sensor and communications chips enhance the capabilities of everyday devices. Microsoft data shows that the average price of an IoT sensor declined from $1.30 in 2004 to $0.44 in 2018.8 This trend combined with computing power increasing by a factor of 10 roughly every four years has resulted in even basic products such as toasters receiving a digital upgrade.9

In the short term, the semiconductor shortage has increased the prices of chips and other electronic components, demonstrated by the semiconductor producer price index rising from 54.1 to 55.3 in 2021.10 The long-term trend of declining costs per unit compute is expected to resume once manufacturing catches up with demand, further aiding IoT adoption.

Industrial IoT creates dynamic growth opportunities in the manufacturing sector.

Recent kinks in supply chains indicate that the current production paradigm isn’t sufficiently equipped to handle system-wide stress. The solution is to transform traditional and linear manufacturing supply chains into dynamic, interconnected systems. Bringing Industrial Internet of Things (IIoT) technologies into manufacturing facilities will change how products are made and delivered. Adding sensor technology and adaptive control systems to production lines will transform real-time data into actionable insights that can be used to increase manufacturing efficiency.

A key advantage of Industry 4.0 compared to just-in-time manufacturing is a reduction in downtime due to predictive repairs. Production downtime, even for necessary maintenance, can have large costs. By monitoring the current condition of machinery, reacting to warning signs, and cross-checking input and finished good levels, IIoT-enhanced factories can optimally schedule repairs, thereby reducing downtime and increasing facility throughput.

Further efficiency gains can be derived by utilizing IoT for inventory and asset tracking. With GPS technology, complicated logistics can be monitored and simplified. For example, a manufacturer can know in real time when a shipment of raw materials will arrive at a facility or when finished products arrive at a distribution center. This information can help companies maximize profitability by giving them insight on when to replenish inventory or help them locate and recover lost or stolen equipment and goods. McKinsey data shows that firms who implemented Industry 4.0 technologies were able to respond to the COVID-19-induced supply chain crisis in 96% of cases, while those firms without these technologies were able to respond just 19% of the time.11

Towers and data centers combine innovation and real estate.

Communications networks are essential digital infrastructure because they facilitate connections between the massive processing power of data centers and end users. Significantly, towers and data centers marry elements of growth-oriented technology investing and income-oriented real estate. Data centers provide physical space for customized server infrastructure while addressing cooling, power management, and security responsibilities, in exchange for regular fee payments. Data centers also serve a diverse set of clientele, including big tech companies, government agencies, financial services firms, and health care providers.

In 2020, the U.S. accounted for over 80% of new data center construction and expansion projects globally. Investment in this infrastructure totaled more than $700 million.12 But more is needed, as demands on digital infrastructure will only increase. The vastly improved bandwidth, latency, and speed that 5G networking technologies offer will be required for widespread adoption of advanced IoT-enabled devices like autonomous vehicles. However, current infrastructure is likely to crack under the additional load, making the need for cell towers greater than ever.

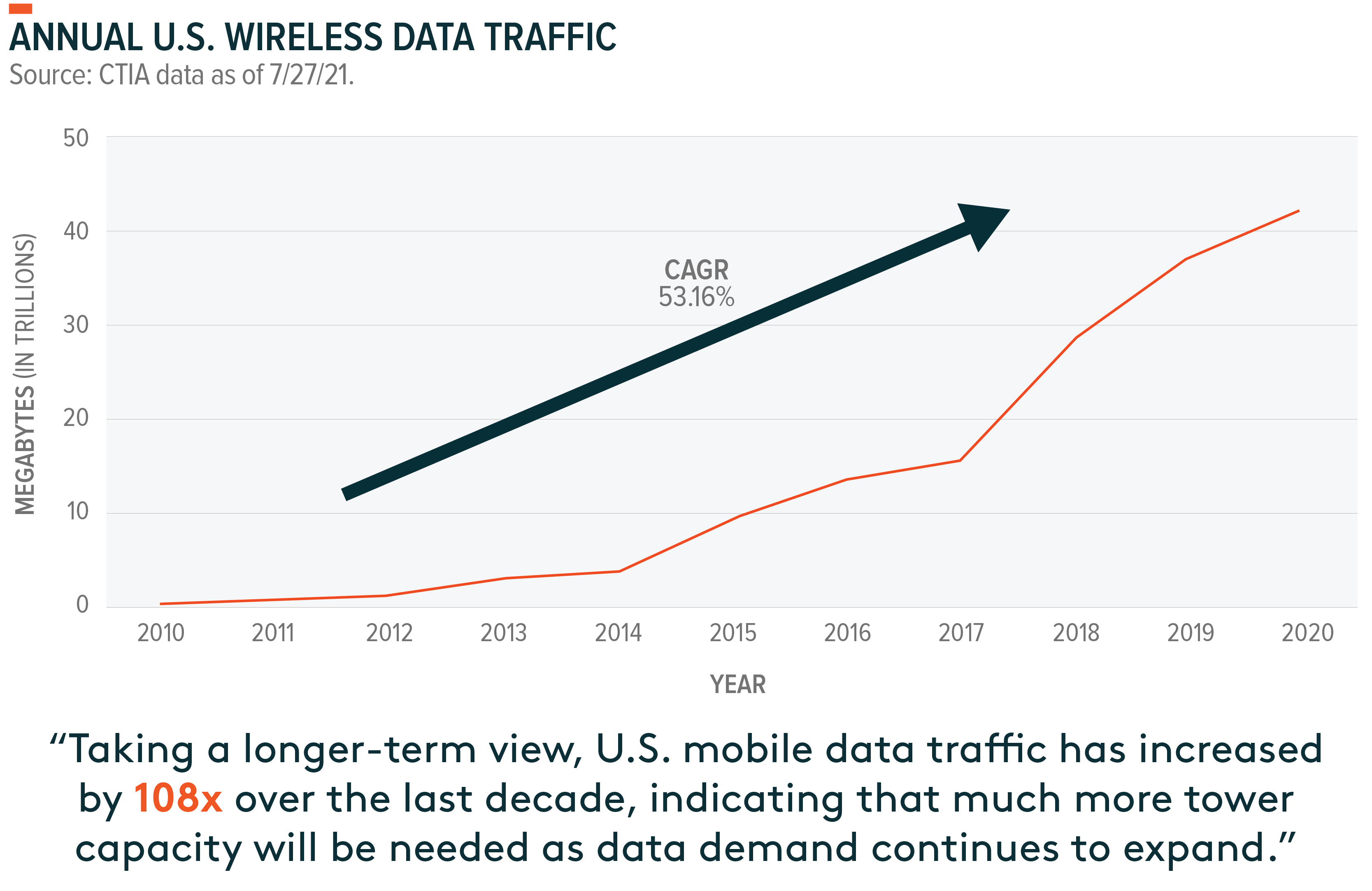

Currently, there are approximately 128,000 macro cell towers in the U.S., but each tower only has so much range and capacity. A typical cellphone only has enough power to reach a tower up to 5–7 miles away, and a single Long Term Evolution (LTE) cell can only manage about 200 active device connections per 5 megahertz (MHz) of spectrum before speeds begin to slow.13,14 The expansion of IoT means a higher demand for towers and wireless spectrum to ensure adequate coverage. Tower demand is expected to remain robust with 6.37 billion active smartphone users globally.15 But construction and permitting hurdles often limit expansion, making existing towers increasingly valuable. In the U.S., suppliers of macro cell towers increased tower capacity by about 8% from 2019 to 2020.16 But over the same period, mobile data per smartphone increased 29%.17 Taking a longer-term view, U.S. mobile data traffic has increased by 108x over the last decade, which indicates that much more tower capacity will be needed to meet data demand.18

Solutions for capacity constraints coming with 5G, continued investment.

With more data being collected by sensor-enabled devices than ever, transferring information in a timely manner can be a challenge. 5G networks offer a potential solution. Next-generation wireless networks offer more spectrum over more channels, increasing the number of devices able to actively connect to a tower at once, and allocating additional bandwidth to each device. 5G also uses small cell antennas, which have much shorter ranges than their macro counterparts.

The overlapping coverage areas that small cell antennas create raise wireless coverage density, which improves connections while alleviating pressure on any one tower. Coverage remains spotty compared to the more established 4G networks, but 20% of new smartphone sales in the U.S. were expected to contain 5G chips by the end of 2021, so improvement is inevitable.19

Wireless network providers are increasing investment in digital infrastructure. Data from wireless communications trade association CTIA shows that the wireless industry invested $30 billion into infrastructure projects in 2020, the third consecutive year capital expenditures increased, and the largest year of investment in the last five. Between 2016 and 2020, the industry’s investment in infrastructure totaled $140 billion. Over 417,000 new cell sites were built in 2020, a 35% increase from 2016. Over the last two years, a lighter regulatory touch facilitated more cell site construction than in the previous seven years combined.

This investment is in addition to the almost $200 billion spent on wireless spectrum auctions over the same period.20 Spectrum refers to the radio wave frequencies used to transfer wireless signals and is a core component of wireless communications. Auction winners are licensed to transmit on a larger swath of the electromagnetic spectrum, furthering the rollout of 5G technology and increasing the quality of end-user connectivity.

Risk to the Connectivity Theme

The semiconductor shortage is a headwind for IoT. Surging demand, including demand from 5G expansion plans, forced foundries to focus on high-margin production, typically the newest and most advanced chips. As a result, the production of lower-tier chips took a backseat. These commodity-type chips are typically used in consumer-focused IoT devices because they generally don’t require the fastest networking or processing speeds. An estimated 20 million cellular chipsets will go undelivered due to shortages in 2021, influencing 80% of global manufacturers to report challenges producing digital products and services.21,22 The result is increased prices and decreased availability of some connected devices, likely negatively affecting sales of consumer goods in the short term.

The chip shortage also affects the 5G rollout because routers, switches, and base stations face longer delivery times. Smaller network providers indicate that equipment delays stalled deployments by 18–24 months.23 These delays look to be more acute outside of the U.S., given the robust purchasing relationships and financial heft of the large U.S. networks.

IoT devices create more network vulnerabilities.

IoT devices can be easy targets for cybercriminals due to the network integration of many endpoint devices. With more points of failure, network maintenance becomes a larger task, increasing the chances of a missed software update or incorrect device setup. Comcast estimates that U.S. households can be exposed to as many as 104 cybersecurity threats per month, with the most vulnerable devices being smart home gadgets.24 The general market immaturity of connected devices is the main reason, as cybersecurity issues are often addressed after product creation and through firmware updates. Connected ecosystems such as Google’s Nest and Apple’s HomeKit could provide solutions, but the risk remains.

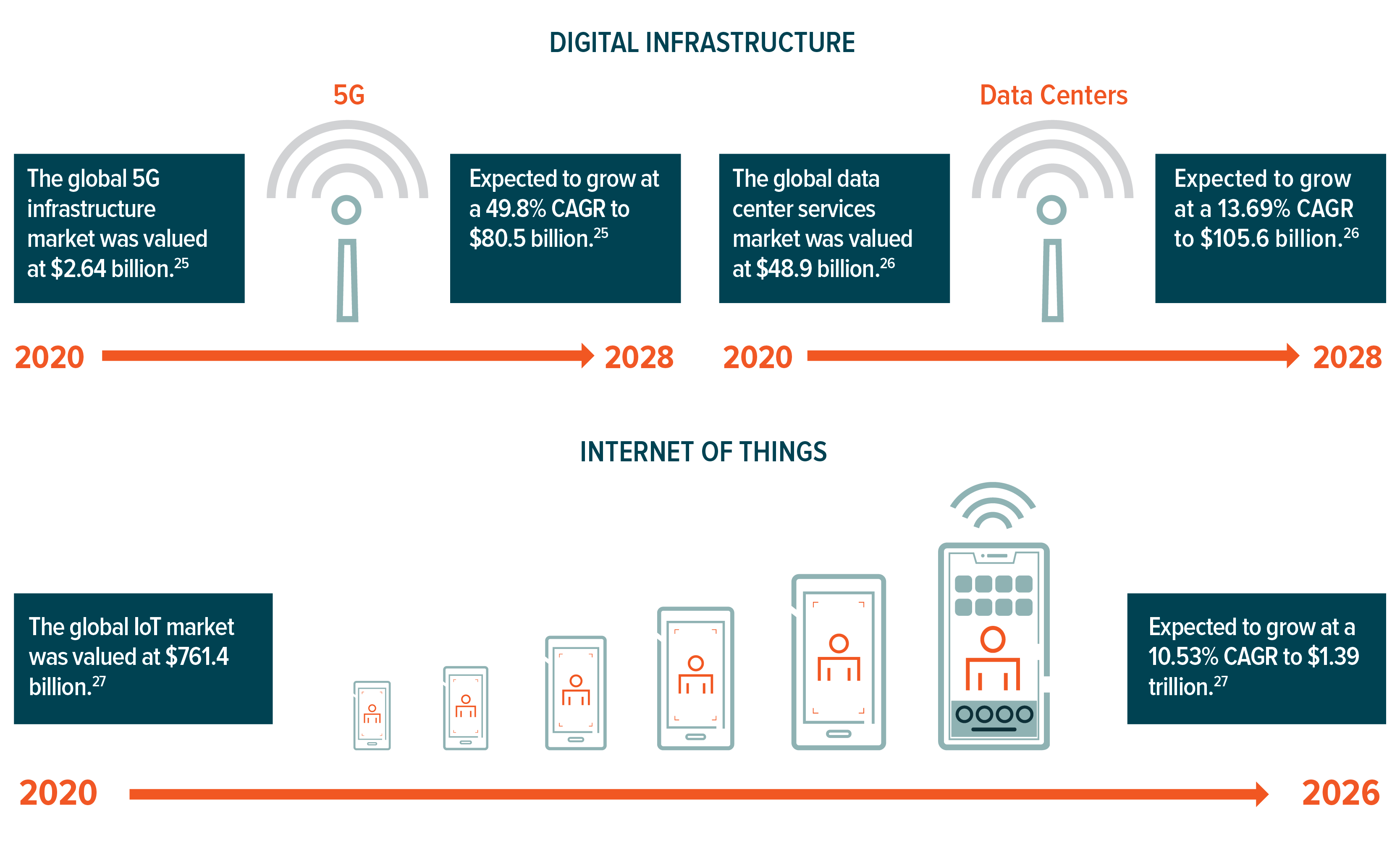

Visualizing the Market Opportunity

Thematic Intersection with Connectivity

Robotics & AI and Cloud Computing

The Robotics & AI and Cloud Computing themes intersect with IoT, particularly from an industrial perspective. Industrial IoT can take many forms, but it mainly focuses on increasing operational efficiency via sensor-based monitoring. Future growth in the industrial space will stem from the integration of robotics, cloud computing and connected IoT devices to build smart, automated factories. Artificial intelligence (AI) utilities will rely on data gathered by IoT systems and sensors to present real-time insights about the world around them.

If AI is a system’s brain, IoT acts as the digital nervous system. Connectivity will be essential, with private 5G and low power wide area (LPWA) networks playing a critical role in manufacturing automation that enables real-time and remote monitoring of autonomous systems. Juniper Research predicts that the industrial sector will account for over 70% of all IoT connections by 2024.28

Health & Wellness

Connected fitness trackers record some of the most intimate data an individual can produce. The health and wellness economy is growing, especially after the pandemic inspired many to be more active and conscious about their wellbeing. The global fitness tracker market grew 19.5% year-over-year in 2020, expanding at a faster rate than the overall IoT space.29 Fifty-eight percent of U.S. consumers now use smartwatches or fitness trackers to quantify their daily steps, workouts, and sleep.30

Additional upside stems from clinical settings, where medical grade sensors can provide lifesaving information. For example, blood sugar tracking and advanced heart monitoring are two key growth areas, as they can take readings in real-time and then share and store patient data with their care team.

Connectivity in a Portfolio Context

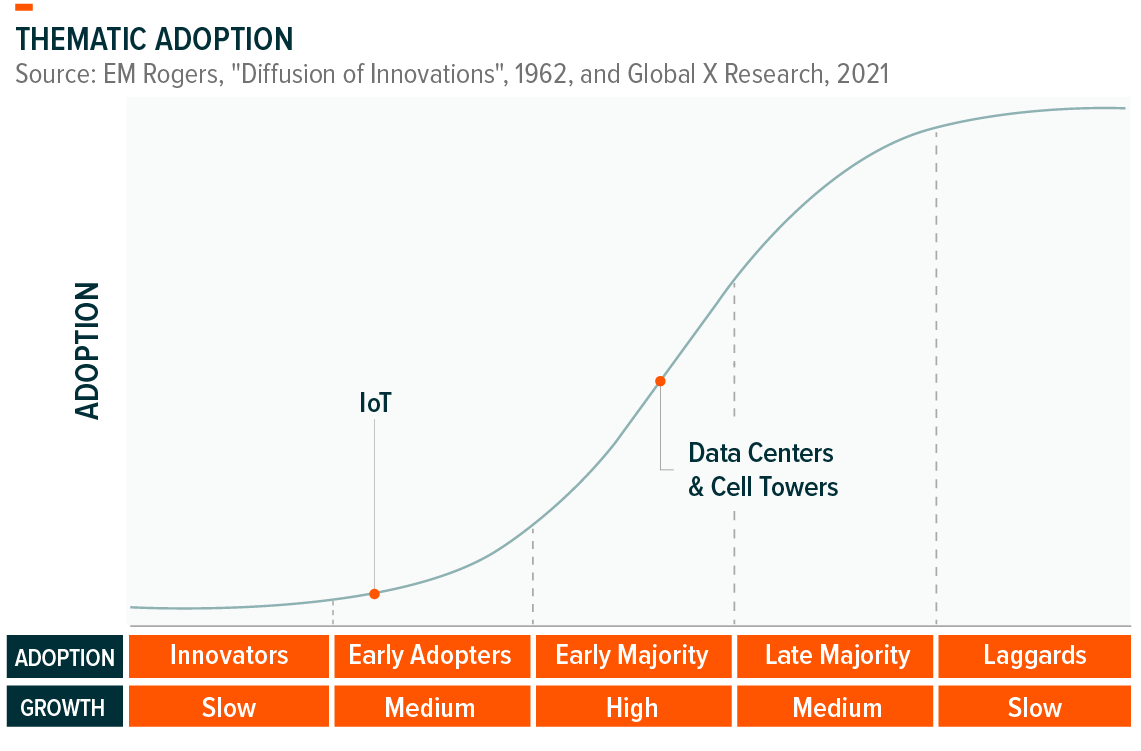

The Connectivity theme lives up to its name by connecting innovative technology and physical infrastructure. We believe this attribute makes the space particularly attractive from a portfolio perspective. Digital infrastructure is further along the adoption curve, falling into the core of the Early Majority phase, and indicating that adoption levels are high and rising. IoT is growing in interest, moving further into the Early Adopters phase, but remaining at a low absolute level.

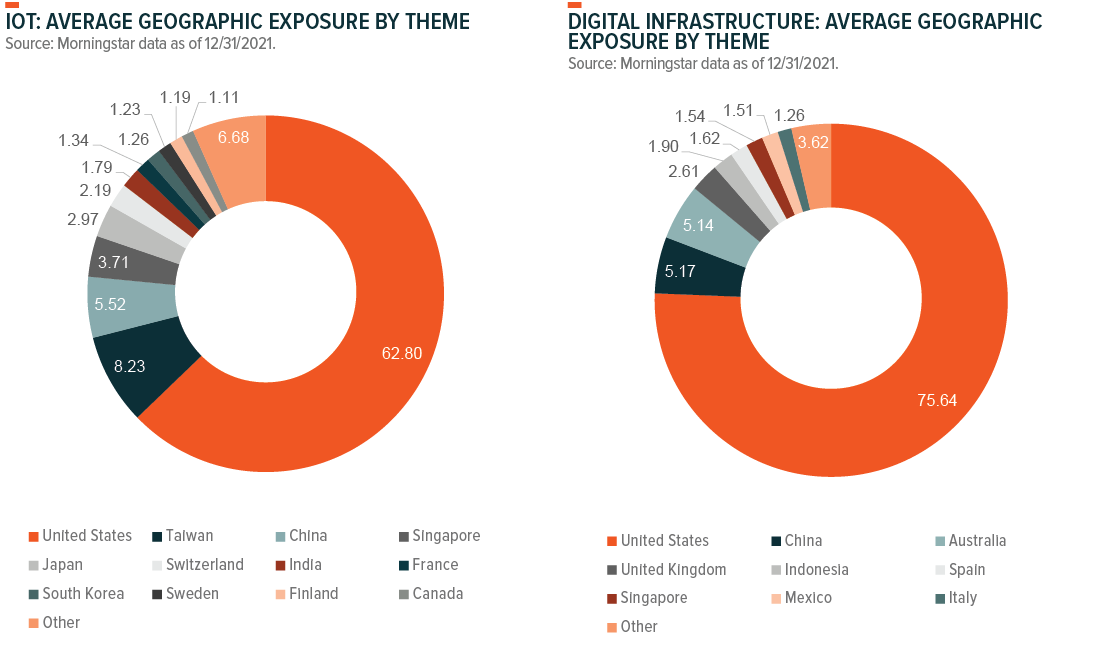

The companies implementing Connectivity technologies are global and stand to benefit as thematic adoption rises across the world. The pie charts on the next page break down the geographic exposure of the largest Connectivity thematic ETF products. We believe there is ample innovation occurring outside of the states, and that limiting exposure to the U.S. will exclude key players to the detriment of investors over the long term.

Note: Pie charts include the largest four internet of things and all three digital infrastructure ETFs according to our thematic classification. All Thematic ETFs weighted the same.

In our view, thematic equity should be targeted, using screens to ensure the underlying companies provide the desired exposure. This pure play focus minimizes overlap between themes while also differentiating the exposure provided by the theme relative to broad beta products. We conducted an overlap analysis between Connectivity thematic ETFs, the S&P 500, MSCI ACWI and the most applicable S&P 500 sector ETF for each exposure, XLK (Technology Select Sector SPDR Fund) for internet of things, and XLRE (Real Estate Select Sector SPDR Fund) for digital infrastructure. We found that average overlap by weight for internet of things was 8.9% when compared to the S&P 500, 7.2% vs. the MSCI ACWI, and 11.7% vs. XLK. Digital Infrastructure scored lower on broad indexes, 2.1% when compared to the S&P 500 and 1.3% vs. the MSCI ACWI, but scored much higher compared to XLRE at 28.0%.31 These low levels of overlap with broad indexes reflect the benefits of thematic exposure.

The Connectivity theme continues to mature, creating attractive opportunities for long-term investors. The internet of things is now a core technology with connected consumer devices growing in capability and commonality while industrial applications catalyze the Fourth Industrial Revolution. Simultaneously, the digital infrastructure that this connectivity requires continues to advance, including 5G networking technology that provides users with wireless speeds that dwarf those of previous generations.

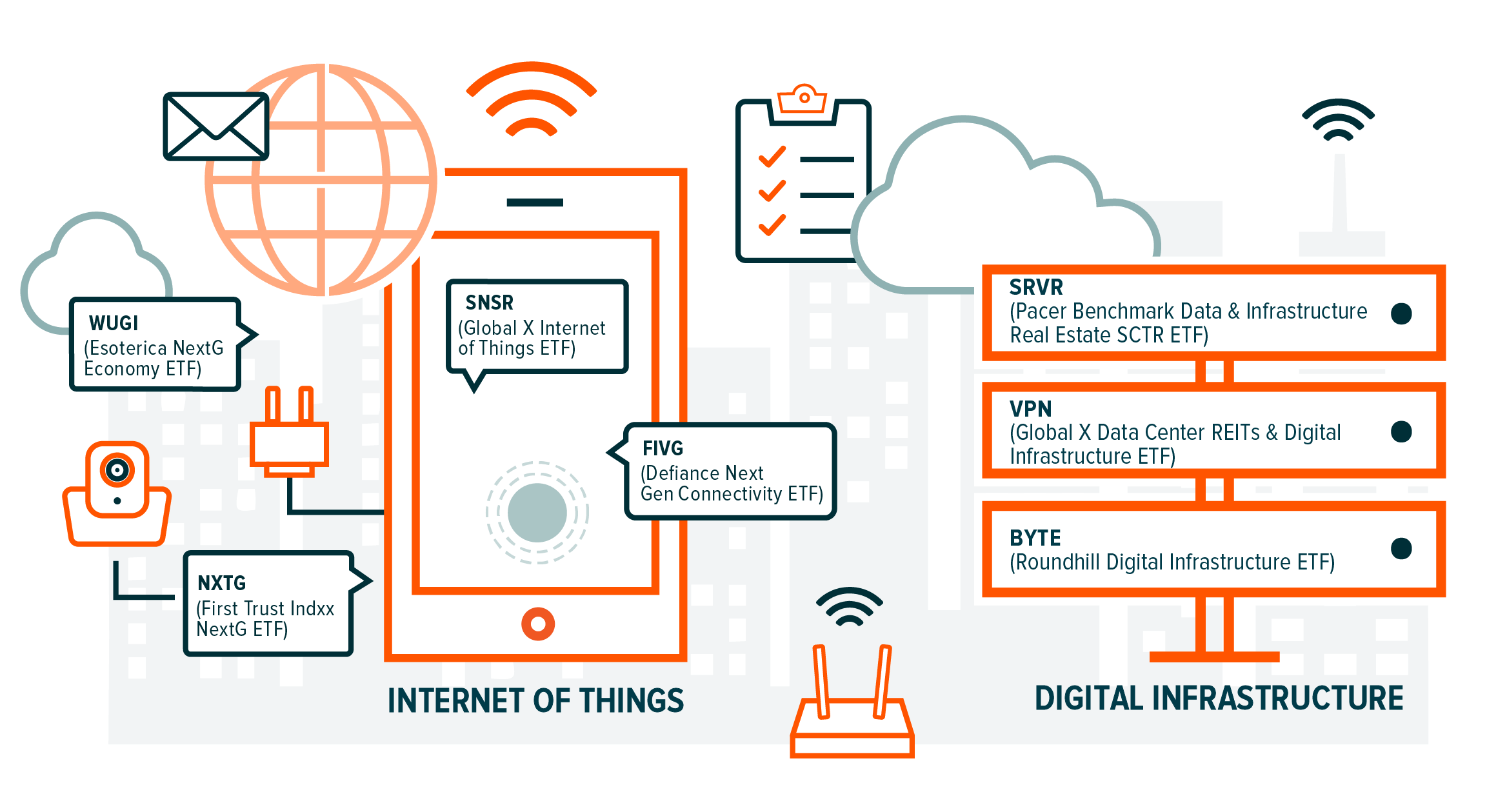

How to Access Connectivity

The graphic below identifies some U.S. listed ETFs that provide direct exposure to the Digital Infrastructure and Internet of Things themes.

Read the next section of the Thematic Investing Whitepaper on the Robotics & Artificial Intelligence theme.