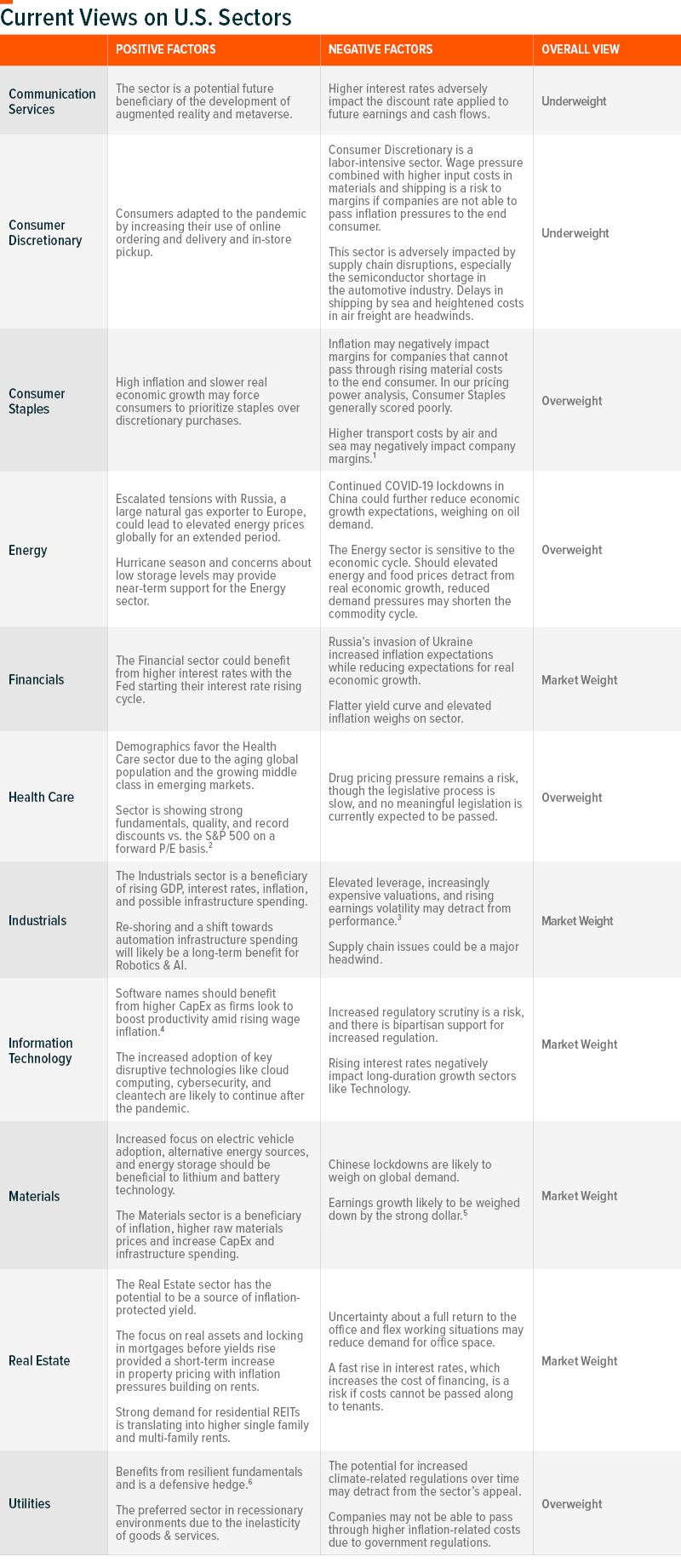

Earnings Roundup and Sector Views

This has been a tough earnings season for certain sectors of the S&P 500 Index. This earnings season provided investors insight on how impactful supply chain issues and inflation were on corporate profits. Positive earnings surprises were not rewarded to the same extent versus the recent past. In Q1 2022, companies that reported positive earnings surprises saw an average price decrease of -0.3% two days before and after their report. At the same time, negative surprises were punished with average price decreases of -5.1% two days before and after earnings release. With 488 companies, making up 97% of the S&P 500 index, having reported their Q1 2022 earnings, we can dissect what happened and how expectations provide insight into the future.

Key Takeaways

- 77% of companies have reported positive bottom line, EPS, surprises.

- 73% of companies have reported positive top line, Revenue, surprises.

- 67 companies reported negative earnings per share (EPS) guidance for Q2, while only 29 companies gave positive EPS guidance.

- The forward 12-month P/E is about 17x, below the 5-year average of 18.6x and in line with the 10-year average.

The number of companies that have cited “inflation” on their earnings calls has shot up this quarter. Over 400 companies mention that inflation had some level of impact on their performance, up from 350 in Q4 2021, and 300 in Q3 2021. At the same time, the number of companies citing “supply chain” challenges have decreased a bit. About 350 companies have spoken to some degree of how the supply chain challenges are impacting performance, down from 360 in Q4 2021, and down from 365 in Q3 2021.

Revenues

The Industrials, Consumer Staples, and Information Technology sectors had the highest percentage of companies reporting revenues above estimates. Concurrently, the Communication Services and Financials sectors have the lowest percentage of companies reporting revenues above estimates.

Currently, the blended revenue growth rate of the S&P 500 is around 13.6% and is above both the five and ten-year averages of 7.1% and 4.0%, respectively. The sectors that had the largest growth in revenue were the Energy, Materials, and Real Estate sectors. These are the same sectors that are beneficiaries of higher inflation. For the Energy sector, oil prices were the dominant factor as the average price of oil in Q1 2022 was 63% higher than in Q1 2021. The Materials sector experienced revenue strength from rising commodity prices due to dislocations in global trade owing to a fractured supply chain. The Real Estate sector experienced strength from rising rents and property values. The adverse impacts of rising yields and mortgage rates have yet to make their way into the earnings reports for this sector, we will likely see an impact in Q2.

Margins

The blended net profit margin for the S&P500 index in Q1 was around 12.3%, above the five year average, but below the ten year averages of 11.2% and 12.8%, respectively. Seven sectors have reported an increase to their profit margins in Q1 2022 compared to Q1 2021. Energy is the standout, with a 10.5% margin, compared to 4.6% last year.

Real Estate and Information Technology had the widest margins out of all sectors at 36.4% and 24.8%, respectively. Consumer Discretionary and Consumer Staples had the smallest margins at 4.7% and 6.4%, respectively. The Consumer sectors are labor heavy and are prone to wage pressure and higher input costs, which includes elevated transport costs.

Profit margins declined in four sectors: Financials (from 22.6% to 17.6%), Consumer Discretionary (from 7.6% to 4.7%), Communication Services (from 13.8% to 12.6%), and Consumer Staples (from 6.7% to 6.4%).

Earnings

The percent of companies beating estimates is about in line with the five-year average and above the ten-year average. On a sector level, Industrials, Consumer Staples, and Information Technology had the highest percent of companies reporting earnings above estimates. While the Consumer Discretionary sector has the lowest percent of companies reporting earnings above estimates.

Nine out of eleven sectors had positive earnings growth – led by Energy, Materials, and Industrials. The two sectors that are reporting negative earnings growth are Consumer Discretionary and Financials.

The earnings outlook for equities remains hazy as many uncertainties remain. Lockdowns in China will likely continue to stall the transport of goods across the Pacific Ocean. The war in Ukraine will likely cause commodity prices to remain elevated and in some cases scarce. A slowing economy will likely weigh on consumer spending and demand. Thus far for Q2 2022, 96 companies have issued EPS projections with about 70% giving negative guidance. This is above both the five and ten-year averages. Much of the negative guidance has come from the Information Technology sector, followed by Industrials, and then Consumer Discretionary.

Improving inflation data in the recent PPI and PCE reports provided markets a glimmer of hope that inflation may have peaked. Combined with more dovish statements from the Federal Reserve helped alleviate equity market selling pressure at the end of May.

Our sector views table, on the next page, provides more detail on sector positioning and the current tailwinds and headwinds for each sector.