Four Companies Leading the Rise of Lithium & Battery Technology

ListenElectric vehicles (EVs) are upending the status quo of internal combustion vehicles (ICE), just like ICE vehicles once displaced the horse-drawn carriage. Fueling this shift to electric power requires next-generation battery technology and an ample supply of lithium, the key raw material for lithium-ion batteries.

While many people may be familiar with EV pioneer Tesla, there is an entire ecosystem of battery producers and lithium mining firms that are playing critical roles in this transformation. At a high level, the industry’s ecosystem starts upstream with lithium miners that extract the metal from the earth. These raw materials then move into the chemical conversion process to produce lithium carbonate or lithium hydroxide. Battery producers combine carbonate or hydroxide with materials to form a cathode and an anode, together forming an individual battery cell. Thousands of cells may be combined to create a battery pack for an EV.

In this piece, we highlight four companies that represent key players in this ecosystem:

- Ganfeng Lithium: A leading Chinese lithium mining company that has evolved into refining and processing lithium, battery manufacturing, and recycling.

- Panasonic: A top-3 global EV battery manufacturer from Japan.

- Livent: A top-5 lithium producer from the US.

- Contemporary Amperex Technology Limited (CATL): A top-3 EV battery manufacturer from China.

Ganfeng Lithium: A Vertically Integrated Lithium Producer

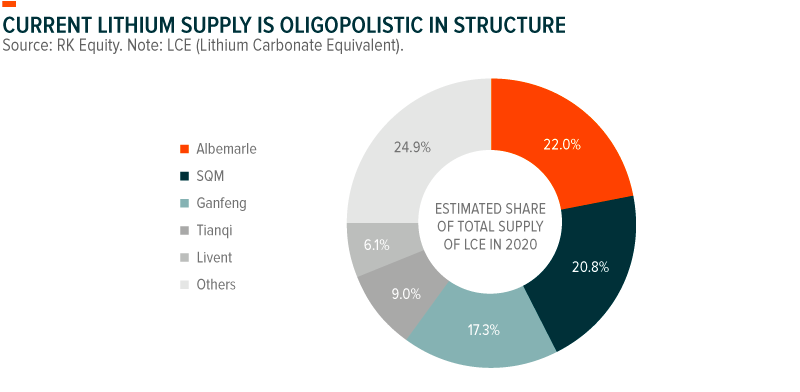

Ganfeng Lithium along with Albemarle, SQM, Tianqi Lithium, and Livent control more than 70% of the world’s lithium supply. Established in 2000, Ganfeng is the third-largest lithium compound producer in the world and the leading producer in China. The company is unique because it covers a wide swath of the lithium-ion battery supply chain, including lithium resource development, refining & processing (75% of total revenue), battery manufacturing (17% of total revenue), and battery recycling & other (8% of total revenue).1

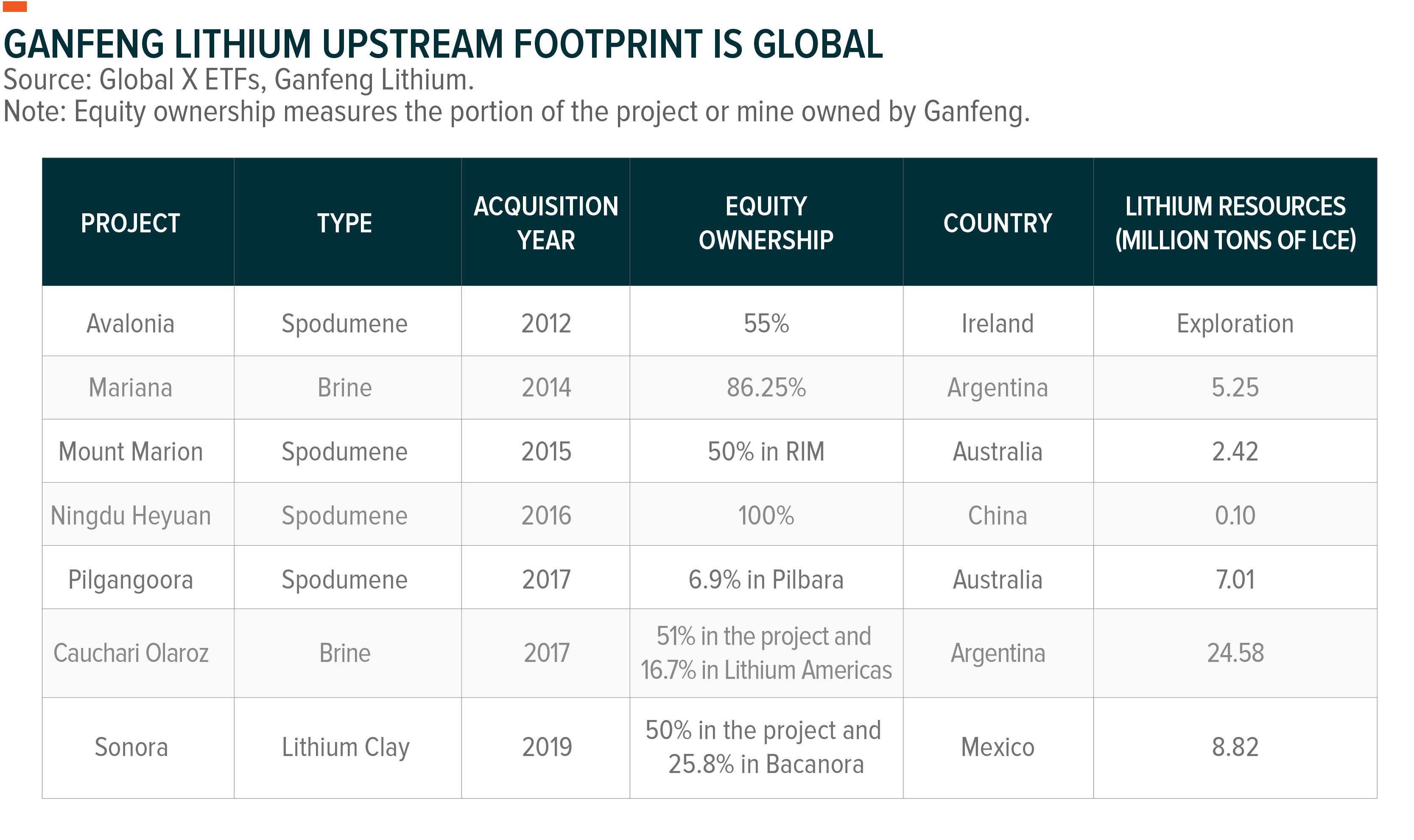

Ganfeng has a broad international footprint with lithium operations in Australia, Argentina, Mexico, and Ireland, in addition to its resources throughout China. Mount Marion in Western Australia is Ganfeng’s primary source of lithium. Different locations require unique approaches to efficient lithium extraction. In Australia the company uses hard rock lithium extraction processes.2 In Argentina, Ganfeng extracts lithium via a brine process as is common in Latin America’s Lithium Triangle (Argentina, Bolivia and Chile). In Mexico, the company is exploring new lithium clay extraction methods with an expected production start in 2023.3

The company boasts long-term supply contracts with major battery producers and OEMs like Tesla, Panasonic, LG Chem, Volkswagen, Samsung, and, recently, BMW. Helped by the predictability of these contracts, Ganfeng expects to double its capacity from 100,000 metric tons in 2020 to 200,000 by 2025.4 Given the growth potential of EV sales, OEMs and battery producers are likely going to enter additional offtake agreements to secure access to lithium. This surging demand should help companies like Ganfeng secure long-term contracts at higher prices.

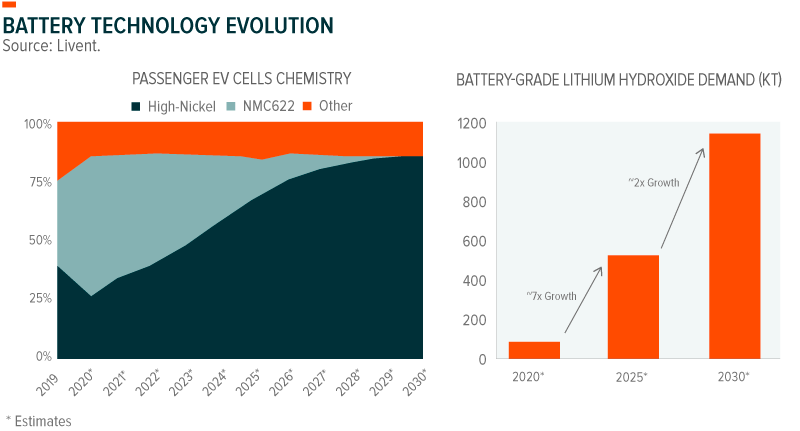

Ganfeng is also focused on growing its lithium hydroxide production and sales. Lithium hydroxide is better suited than lithium carbonate for the next generation of EV battery technology. Batteries with NMC 811 cathodes and other nickel-rich batteries, require lithium hydroxide.5 By 2021, the company expects to produce and sell 50,000–60,000 metric tons of lithium hydroxide and 20,000–30,000 metric tons of lithium carbonate.6

Panasonic: Tesla’s Longtime Partner

With more than 100 years of history, Japan’s Panasonic is the world’s third-largest supplier of EV batteries.7 The company is considered a Tier 1 lithium-ion battery producer according to Benchmark Mineral’s classification standards.8 The designation means that the company produces the highest-quality lithium-ion batteries, for automotive uses.

Panasonic’s efforts in the EV supply chain are well known, particularly through its relationship with Tesla. In 2014, Panasonic and Tesla partnered to build Giga Nevada, the world’s largest lithium-ion battery factory. Recently, Panasonic started working on Tesla’s featured battery cell called 4680.9 The new format is expected to store more energy and have an easier manufacturing process, two keys to further reducing battery costs. Currently, a battery represents approximately 29% of the total cost of an EV.10 As EV manufacturers seek to gain market share from ICE vehicles, reducing battery costs is critical.

To date, Panasonic is the sole provider of lithium-ion batteries to Tesla for EVs manufactured in the U.S. But Panasonic is also expanding its EV battery customer base beyond Tesla. The company recently partnered with Toyota to build a lithium-ion plant in Japan to supply 500,000 EVs starting in 2022.11

Livent: Focused on Lithium for the Next Generation of Batteries

Livent, which was spun out of FMC Corporation in 2018, is a Philadelphia-based company with a lithium history that dates back to the 1940s. Compared to the other large Western players, namely Albemarle and SQM, which own and operate some non-lithium businesses, Livent is a pure-play company focused only on lithium.

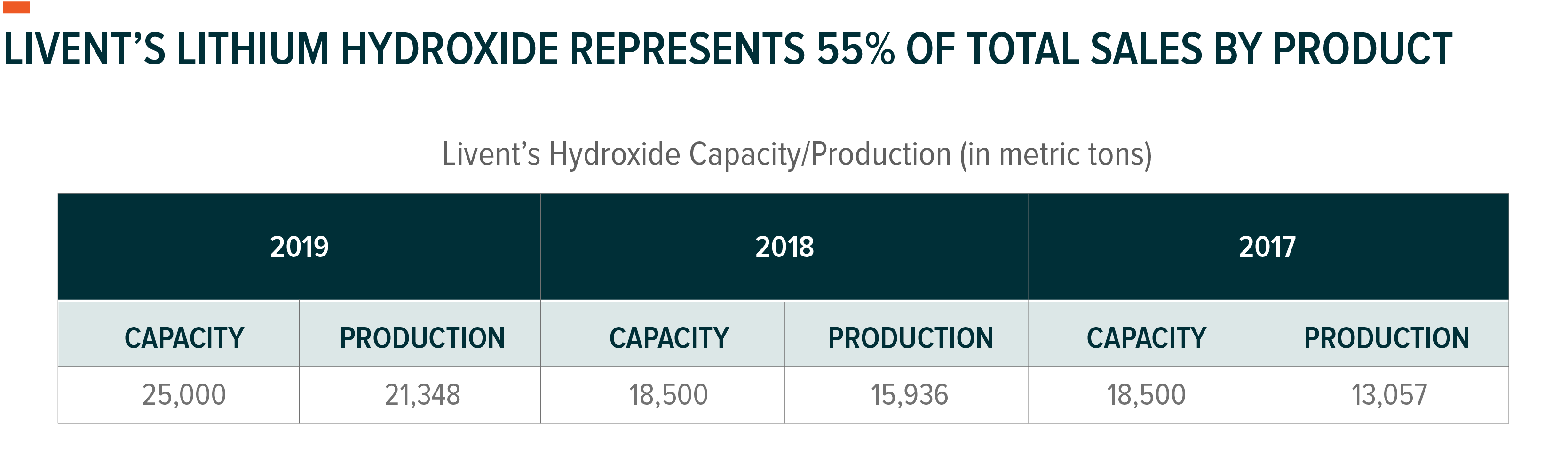

Livent operates one of the lowest-cost lithium mineral deposits in the world, the Salar del Hombre Muerto in Argentina. The company’s operations sit at the low end of the global cost curve to produce lithium carbonate. Yet, the company’s strategy is to focus on lithium hydroxide. As such, it is important to note that brine-based raw materials like these require a two-step process to get to lithium hydroxide: a conversion into lithium carbonate first and then a conversion into lithium hydroxide. This extra step adds costs, but the all-in cost structure for lithium hydroxide, which we estimate to be about $5,800, remains below today’s depressed lithium prices.12

The growing prevalence of nickel-rich batteries, which require lithium hydroxide, supports Livent’s business strategy. The company estimates nickel-rich batteries should increase their market share from about 25% today to 75% by the end of the decade.13

Livent is known for its relationship with Tesla, being one of its main lithium hydroxide suppliers. In November, the company announced the extension of a multi-year supply agreement with Tesla through 2021, with a commitment to deliver greater volumes than in 2020.14 Management also indicated that they are working to extend their partnership for 2022 and beyond.

In addition, Livent recently announced a 50/50 joint venture with private equity firm Pallinghurst Resources to buy Canada’s lithium projects previously managed by Nemaska Lithium. Pallinghurst, through Quebec Lithium Partners, is expected to own 50% of New Nemaska Lithium. Given that arrangement, Livent is expected to see 25% of the potential economic benefits of New Nemaska Lithium.15 The Canadian location can help Livent meet the growing demand of battery grade lithium from North American and Europe.

Contemporary Amperex Technology (CATL): China’s EV Battery Crown Jewel

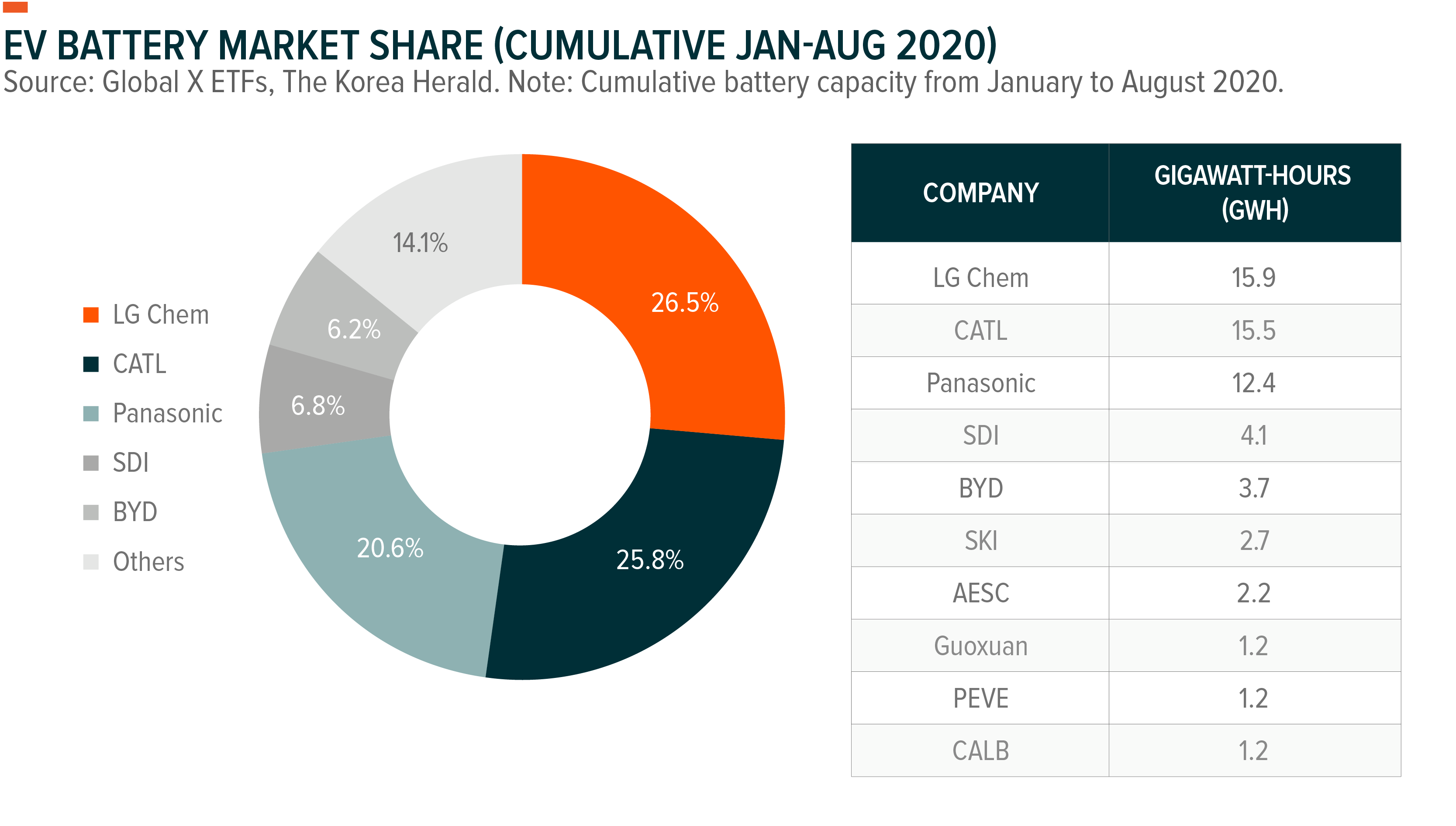

CATL is the world’s second-largest battery producer, behind LG Chem. CATL is a Tier 1 battery producer, joining the select group of LG Chem, Panasonic, Samsung SDI, Tesla, SK Innovation, and AESC.16 What distinguishes CATL is that it is the battery maker with the largest number of relationships with OEMs, including Tesla, BMW, Daimler, Geely, Great Wall, Honda, Hyundai, Volkswagen, and NEVS.

Tesla is a key relationship for CATL. In February, the two companies agreed to produce batteries for EVs manufactured at Giga Shanghai, Tesla’s second battery megafactory.17 Tesla is currently producing Model 3’s at an annualized rate of 250,000 EVs.18 Helped by CATL’s cobalt-free lithium iron phosphate (LPF) batteries and local procurement, the Model 3 is the lowest priced premium mid-sized sedan in China at $36,800.19, 20, 21

Recently, CATL also announced a project to roll out a “million-mile” battery that costs less than $100 kWh by 2021.22 Such a battery could support decades of heavy use for an EV, well beyond the lifespan of an internal combustion engine vehicle.

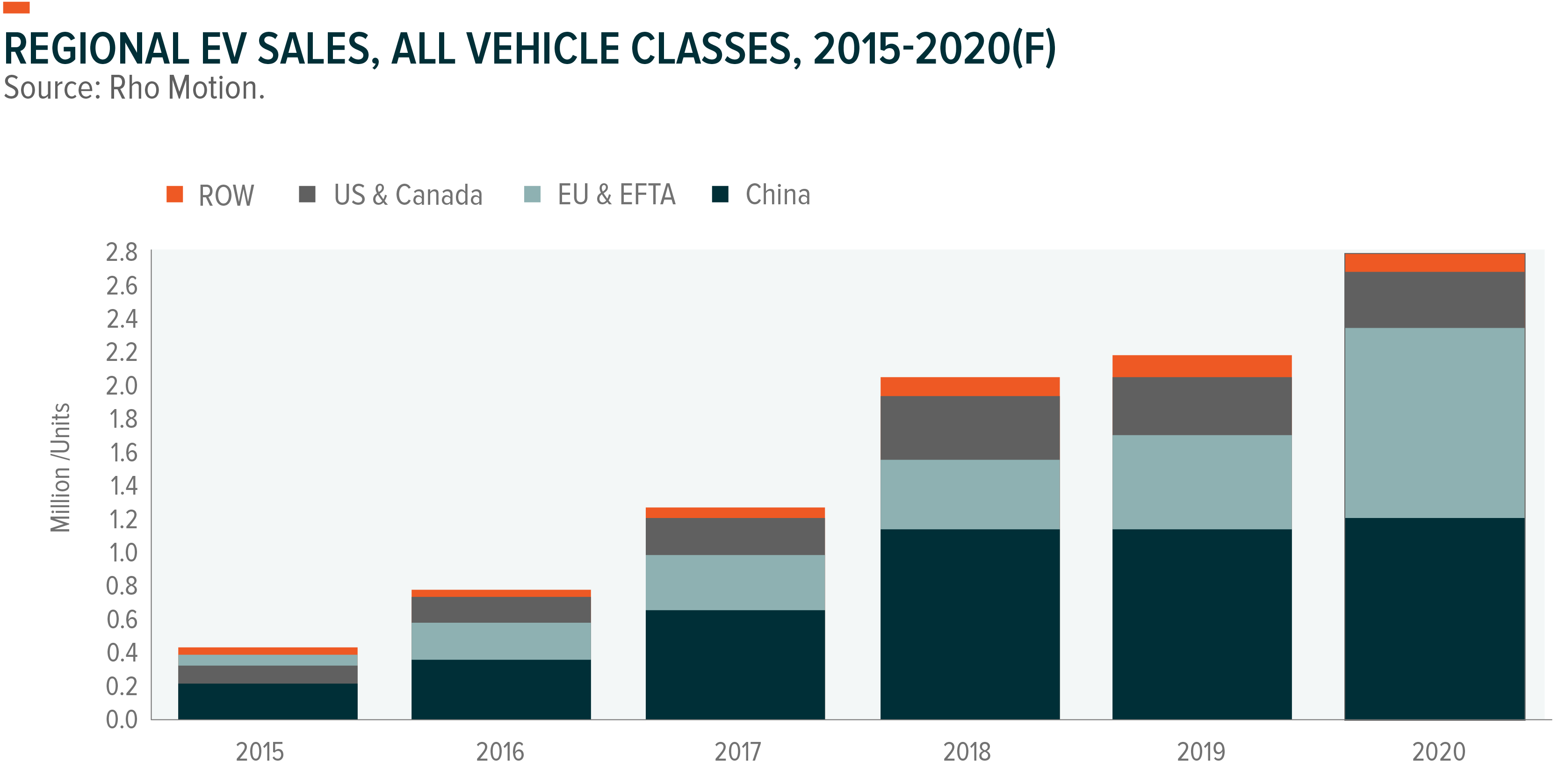

CATL’s relationships with OEMs across multiple regions, especially those in the Chinese and European markets, should allow the company to remain a key player in the EV supply chain. CATL is positioned to continue to grow as EV demand recovers from the economic fallout from COVID-19. Recent reports from the China Association of Automobile Manufacturers show that new energy vehicles sales, which include EVs, increased 105% year-over year in October 2020.23 Sales totaled approximately 160,000 during the month, marking the fourth consecutive month of gains.24

While sales data in China is notable, it’s Europe that’s eventually projected to command the greatest share of EV sales growth. According to research firm Rho Motion’s estimates, EV sales in Europe could double by the end of 2020 from 2019 due to significant policy support from European regulators.

Conclusion

The four companies highlighted here represent key aspects of the lithium and battery technology ecosystem. But beyond these firms, there are still dozens of other lithium miners and battery producers around the world, who together an enabling the rapid growth of electric vehicles. While many of these firms are relatively unknown by most investors, they could ultimately replace major energy corporation as the next generation of transportation transitions away from fossil fuels.