Inflation Reduction Act Could Provide Major Boost for Renewable Energy and CleanTech Industries

PreviewOn 12 August 2022, the House passed the landmark Inflation Reduction Act (IRA), a reconciliation package that represents the United States government’s largest-ever investment in combatting climate change.1 This legislation, which President Biden is expected to soon sign into law, represents a dramatic development in the country’s chances of meeting critical climate goals. It directs nearly $370 billion toward bolstering U.S. climate change mitigation and adaptation, increasing energy security, and lowering energy costs. In this piece, we discuss the bill’s key measures and why we believe they have the potential to create compelling investment opportunities across climate-related industries.

Key Takeaways

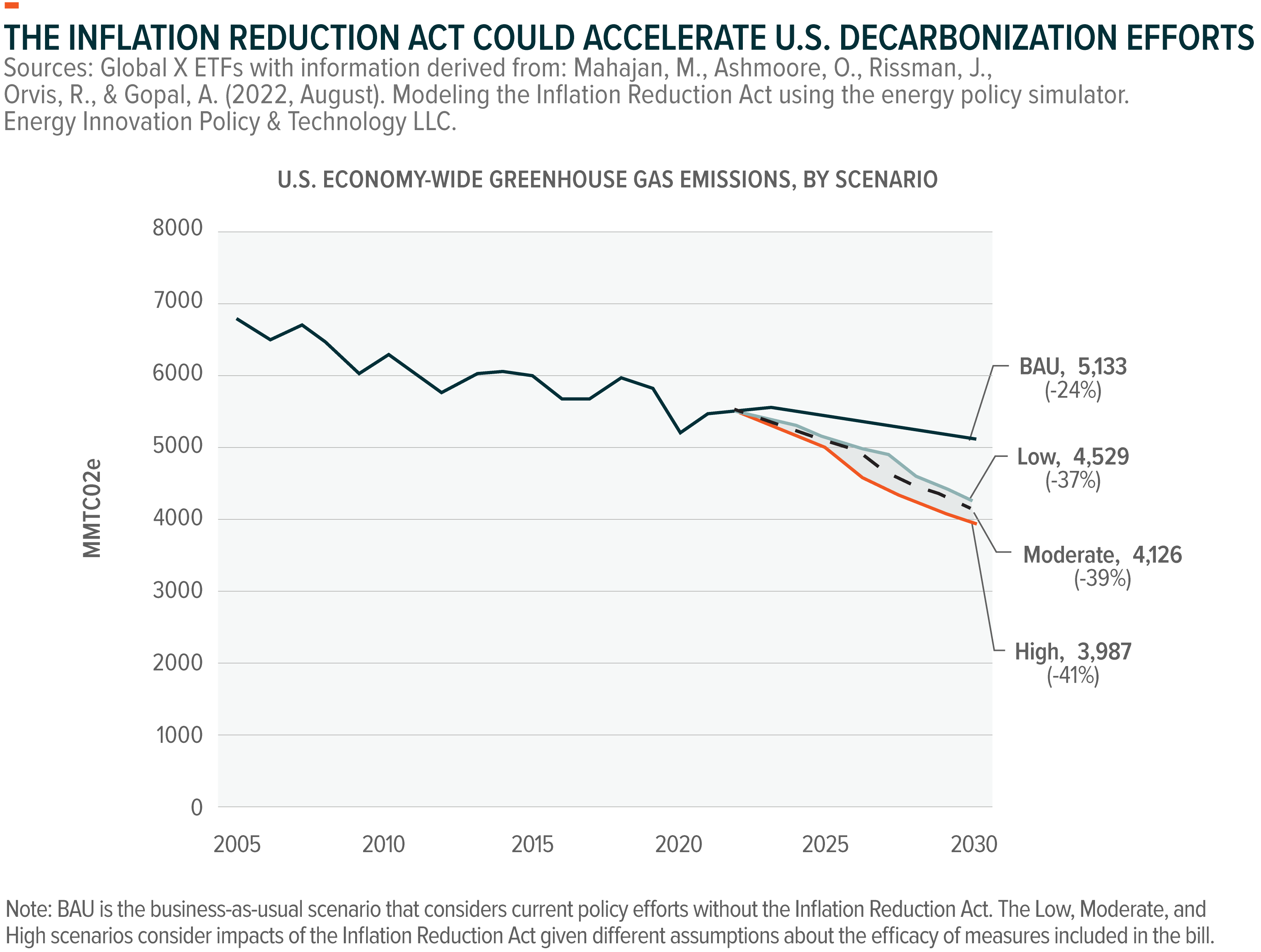

- The Inflation Reduction Act injects major funding into the U.S.’ efforts to become a net-zero economy by 2050. Among its main goals is to put the U.S. on an accelerated path toward achieving the 2030 goal of reducing the country’s net greenhouse gas emissions 40% below 2005 levels.2

- We expect significant growth opportunities to emerge across a wide range of climate change-related themes, including renewable energy, low-carbon hydrogen, and electric vehicles (EVs).

- Cumulative investment associated with the bill is estimated to be in the trillions, giving companies and investors alike short- and long-term opportunities to participate in and potentially benefit from the U.S.’ energy transition.

Bill Creates a New Path to Achieve Emissions Target, Secure U.S. Energy

The Inflation Reduction Act contains tax and non-tax measures aimed at accelerating the U.S.’ climate change mitigation and adaptation efforts, boosting domestic clean energy manufacturing, increasing energy security, and lowering energy costs.3,4 With these measures, economy-wide emissions are forecast to decline 37% to 41% below 2005 levels by 2030.5 Without it, U.S. emissions were forecast to fall well short of the goal, declining just 24% by 2030.6

Among the bill’s most significant measures that can help shift the U.S. economy green, we highlight the following.

- Production Tax Credit (PTC) extension and expansion7,8: The IRA extends the PTC, which is currently being phased out under existing policy, and it returns the credit to a full $30 per megawatt hour (MWh) for qualifying renewable sources. Included are wind power, biomass power, geothermal power, and certain hydropower projects that start construction by December 31, 2024. Starting in 2025, the PTC becomes technology-neutral for net-zero power sources and remains at its full $30/MWh rate until phaseout begins in 2032, or when emissions fall by 75% from 2022 levels.

- Investment Tax Credit (ITC) extension9,10: The bill brings the ITC, which is also being phased out, back to a full 30% credit. Qualifying technologies include solar power, fuel cell properties, and waste-to-energy facilities. The ITC will become technology-neutral for net-zero power sources and remain at 30% for qualifying projects, with the same phaseout conditions as the PTC. Importantly, developers can obtain bonus credit by using domestic materials and by building projects in certain low-income or former fossil fuel communities. Together, bonuses can bring the ITC to more than 50%.

- Direct payment election option11. As part of the PTC and ITC, tax-exempt entities, state and local governments, the Tennessee Valley Authority, Indian tribal governments, Alaska Native Corporations, and electric cooperatives can elect direct payments instead of tax credits. The solar and wind power industries are major proponents of direct pay because it eliminates the need to work with tax equity investors and allows developers to access the credits directly.

- Standalone energy storage investment tax credit12: The overhauled 30% ITC will be available for new standalone energy storage systems over 5 kilowatt hours (kWh). The tax credit will also remain available for energy storage systems that are co-located with solar power projects.

- Low-carbon hydrogen production tax credit13: The Clean Hydrogen Production Tax Credit is a new 10-year credit of up to $3 per kilogram (kg) of clean hydrogen, starting from the date the qualifying production facility begins operations. The full clean hydrogen production tax credit will be available for hydrogen that has a lifetime emissions rate of less than .045kg of CO2 equivalent per kg. Hydrogen produced with emissions greater than .045kg through 4kg will be eligible for partial credits. Clean hydrogen producers can also elect direct payment instead of tax credits.

- EV tax credit extension and expansion14,15: The IRA extends the $7,500 federal tax credit on new EVs and creates a tax credit for used EVs for 30% of the vehicle’s value, up to $4,000. Importantly, these credits no longer cap the number of vehicles sold per manufacturer, so vehicles from manufacturers who used all their credits from the previous scheme are eligible, including Tesla and GM. However, the extension includes customer income and vehicle price limitations and stringent domestic materials and manufacturing requirements. The government plans to release full guidelines by year-end.

- Tax incentives for energy efficiency improvements16: The bill creates tax credits and rebates for consumers to improve energy efficiency in their homes through the adoption of technologies like heat pumps, rooftop solar systems, and efficient HVAC and water heater systems.

- The Advanced Manufacturing Production Credit17: Set to run through 2032, the Advanced Manufacturing Production Credit is an incentive for producers of cleantech components such as thin film and crystalline photovoltaic (PV) cells, PV wafers, solar modules, battery cells, battery modules, inverters, torque tubes, and wind power components.

- Research & Development (R&D) grants18: The bill includes additional grants and funding to boost domestic cleantech research and manufacturing. This includes roughly $300 million in appropriations for competitive grant programs for the R&D and production of sustainable aviation fuels such as hydrogen. It also includes $2 billion in conversion grants for EV production, including hydrogen fuel cell EVs.

Tax Credits Can Drive Renewable Energy and Cleantech Growth

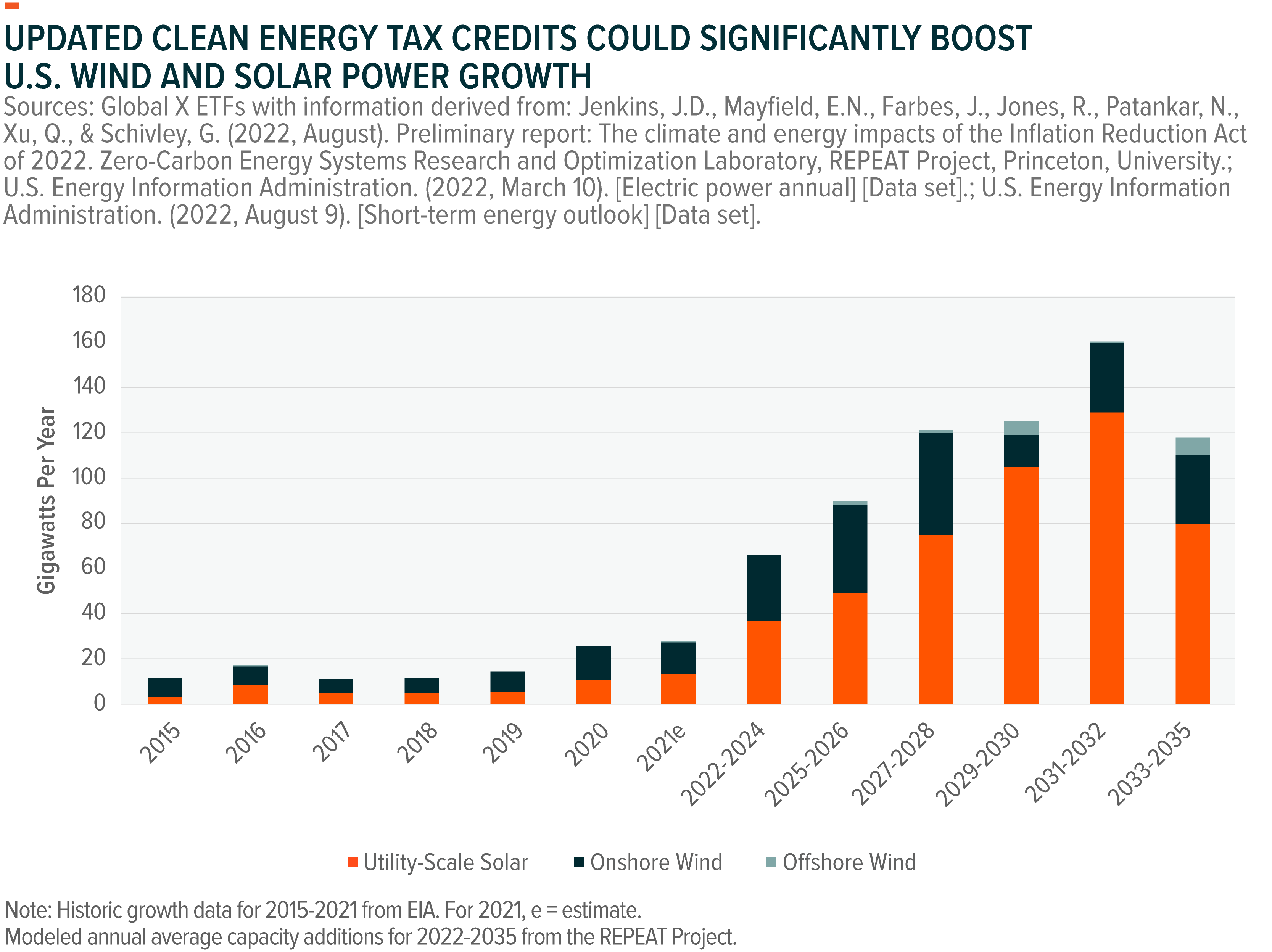

The robust wind and solar power growth in the U.S. over the past 15 years is an example of how tax credits can help the energy transition. According to the Solar Energy Industry Association, the solar industry has grown more than 10,000% since the solar ITC’s implementation in 2006.19

A study from Princeton University concluded that the Inflation Reduction Act could boost annual utility-scale solar capacity additions from 10 gigawatts (GW) in 2020 to an average of 49GW per year by the middle of the decade. Wind power capacity additions could increase from 15GW in 2020 to 39GW per year over the same time frame.20 Enhanced growth over the next decade could equate to total investments in wind and solar power nearly doubling from $177 billion under current policies to $321 billion.21

For hydrogen, the tax credits may help accelerate the development of the nascent low-carbon hydrogen industry in the U.S. Low-carbon hydrogen is a key potential pathway for reducing emissions in hard-to-decarbonize segments such as refining processes, fertilizer production, and long-haul and heavy industry transport. Potential low-carbon hydrogen approaches include green hydrogen, which is produced with electrolyzers powered by renewable energy, and blue hydrogen, which is produced using natural gas that is paired with carbon capture and storage systems. Importantly, the credits may make sustainably sourced green and blue hydrogen cost-competitive with grey hydrogen, which is derived from carbon-intensive processes and accounts for nearly the entire current supply. The cost of producing grey hydrogen ranges from about $1 to $2/kg, while blue hydrogen costs $1.5 to $2.5/kg and green hydrogen $3 to $8/kg.22 In addition, the potential growth and cost benefits within the renewables sector could also yield benefits across the hydrogen value chain, given that renewable energy plays a central role in green hydrogen production.

For the EV space, the IRA’s impact may be more limited in the near term. Income and materials sourcing requirements mean that few of the EV models currently available in the U.S. are eligible for the new tax credits that begin in 2023.23 Longer-term, the bill wants to encourage the development of the domestic EV battery supply chain and shift dependence away from China. A key stipulation in the bill requires at least 40% of the critical materials contained within EV batteries to be sourced from the U.S. or its designated trading partners.24

In our view, this policy supports further development of supply chains, which could prove healthy for the U.S. economy as well as the overall EV space. Additionally, the income requirements, purchase price limitations, and tax credits on used cars may make EVs more accessible for a wider range of U.S. consumers and accelerate adoption.

Conclusion: A Potential Multi-Trillion Dollar Climate Action

By one estimate, the Inflation Reduction Act could drive $3.5 trillion in cumulative investment in climate change-related activities over its 10-year lifespan.25 Critically, we believe that this robust investment has the potential to fundamentally shift the U.S. economy green with important emissions deadlines fast approaching. Poised to benefit from this shift are renewable energy developers and producers; manufacturers of wind, solar, battery, and energy storage components; companies throughout the entire hydrogen and electric vehicle value chains; energy efficiency and green building companies; and miners of critical minerals such as lithium. By any measure, the U.S. government passed a historic climate action that we expect to reverberate across sectors and create compelling investment opportunities over the short and long terms.