Silver, Explained

ListenSilver often flies under the radar of its metal counterpart, gold, but silver has unique properties that make it attractive as both a precious and an industrial metal. The following analysis seeks to shed additional light on silver by answering five key questions:

- How and where is silver extracted?

- How is silver used?

- How does silver compare to gold?

- What are silver’s supply and demand dynamics?

- What are the differences between investing in physical silver, futures, and silver mining stocks?

How and Where Is Silver Extracted?

Silver ore is mined through both open-pit and underground methods. The open pit method involves using heavy machinery to mine deposits relatively near the Earth’s surface. In underground mining, tunnelling deep shafts into the ground allows for the extraction of the ore. With extraction completed, the ores are crushed, grounded, and then separated through a process called “flotation” to achieve mineral concentrations 30-40 times higher than natural occurrences. Refiners then further concentrate this extraction through the process of electrolysis or amalgamation.1

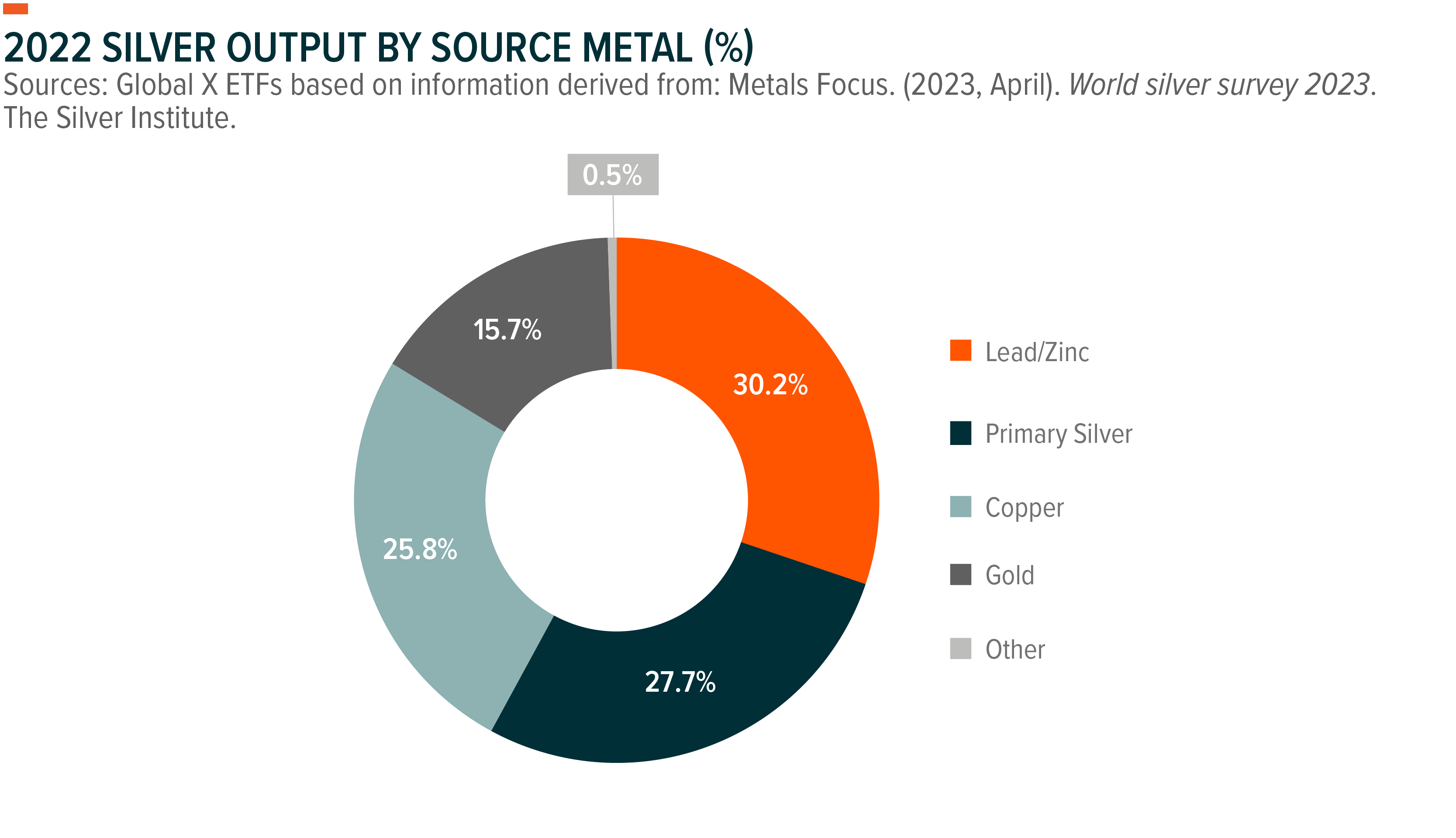

Only 28% of silver derives from mining activities where silver comprises the primary source of revenue. The remaining 72% comes from projects where silver is a by-product of mining other metals, such as copper, lead, and zinc.2 As expected, the revenues of firms focused on primary silver production tend to be much more impacted by silver prices than firms that produce it as a by-product.

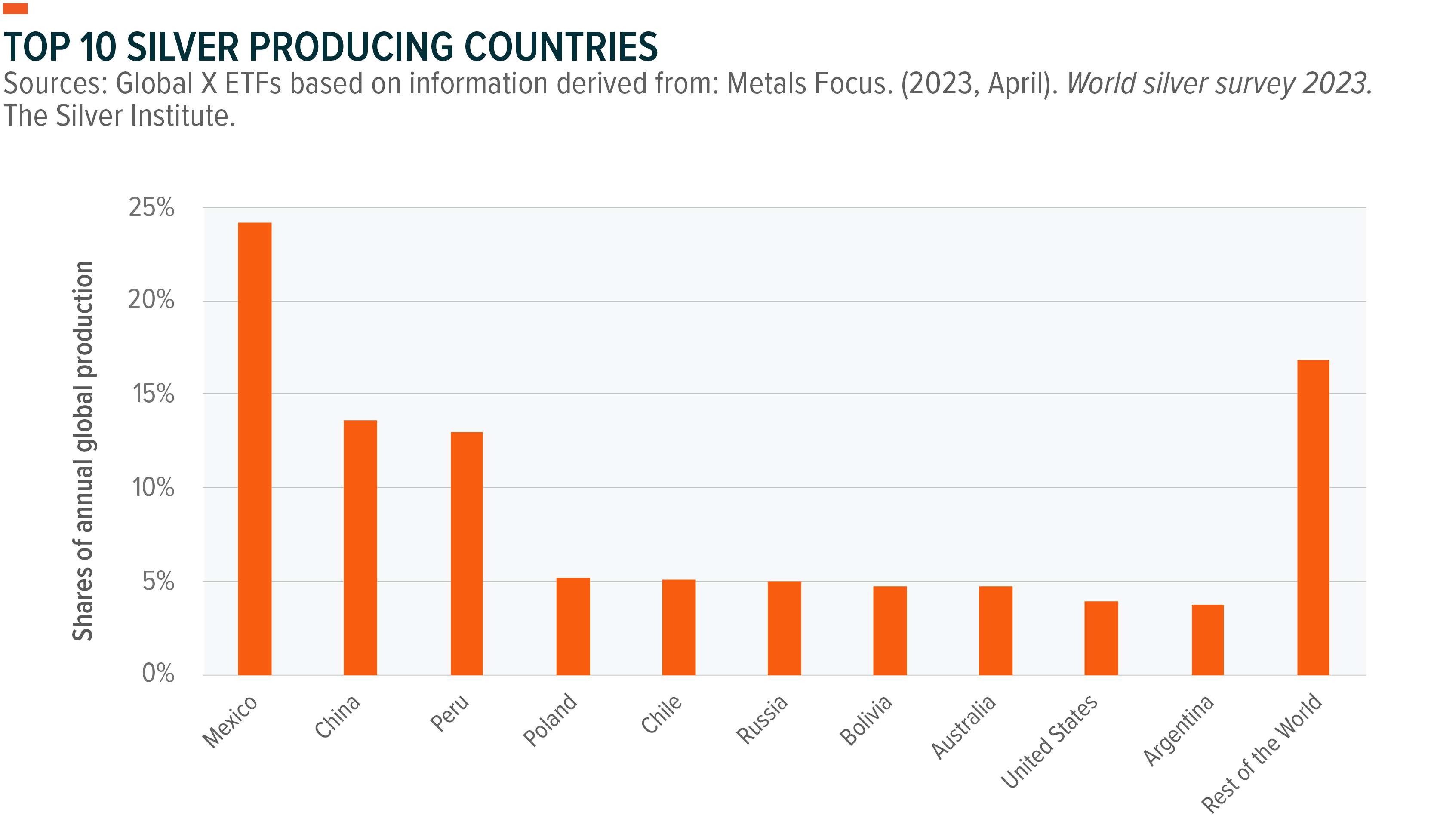

Silver can be found across many geographies, but approximately 50% of the world’s silver production is found in the Americas, with Mexico, Peru, and Chile supplying 42%. Outside of the Americas, China, Australia, and Russia combine to make up nearly 24% of the world’s production.3

How Is Silver Used?

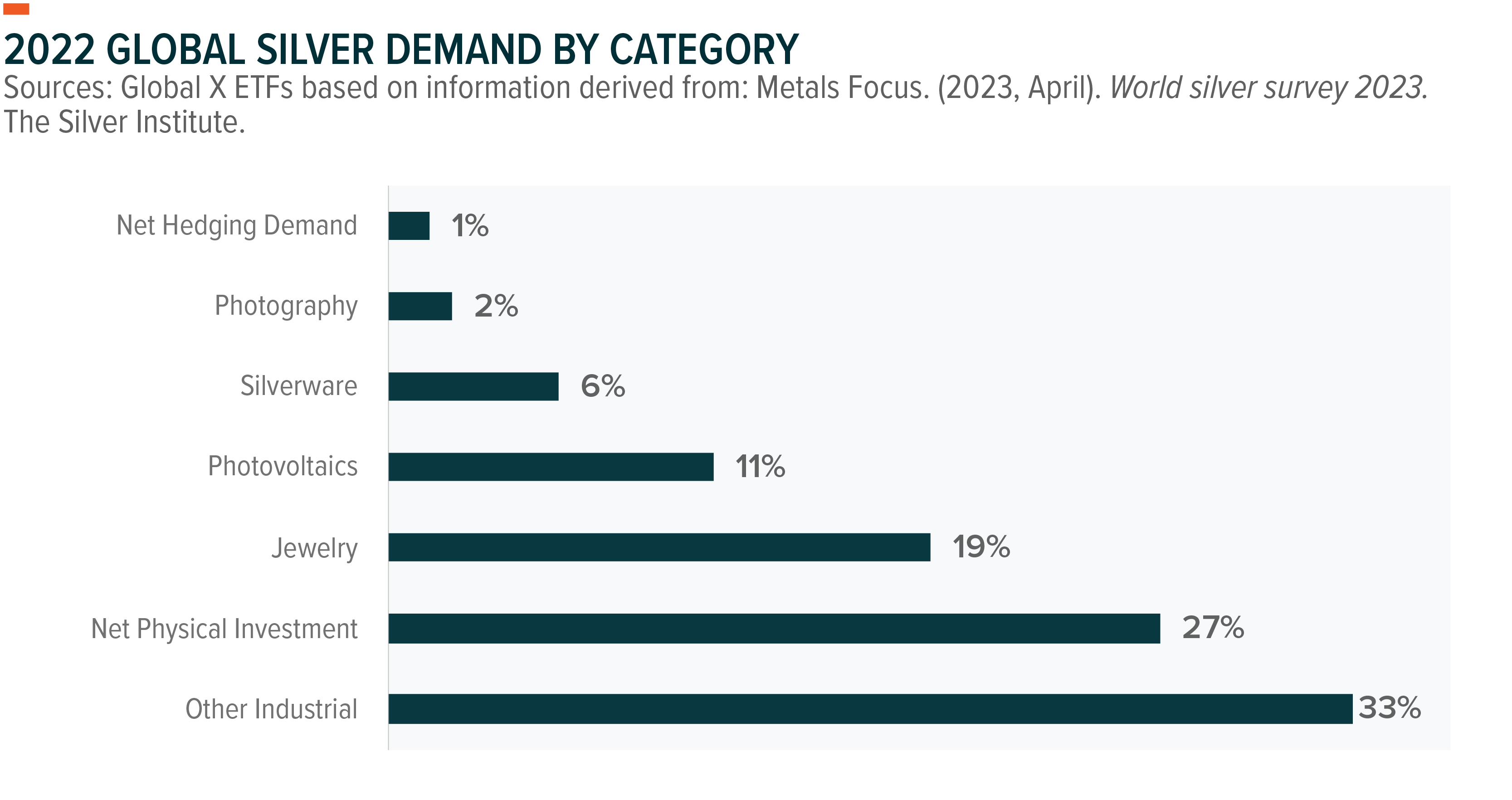

For centuries, silver has been used in a variety of luxury goods, such as jewelry, tableware, and fine art. Many buyers look favorably upon the durable nature of silver and its collectability aspect. Today, around 25% of silver’s consumption stems from this pocket of the market, including jewelry and silverware.4 Silver is a significant material for industrial uses as well: its industrial usage has substantially increased in the last years due to silver’s great characteristics of thermo-electro conductivity, ductility, malleability, and high sensitivity to light. The metal is used extensively in a variety of faster-growing electronics segments, such as solar panels, LED lighting, flexible displays, touch screens, RFID tags, cellular technology, and water purification. Silver’s unique properties, as well as the relatively small quantities of the metal required in many applications, often make it an irreplaceable input.5

How Does Silver Compare to Gold?

Silver and gold are often compared to each other, given their common classification as precious metals. Note two important differences between them: Silver’s additional industrial usage and their relative market sizes.

As discussed in the section above, industrial usage of silver has substantially increased, accounting today for about 46% of its annual demand.6 Gold, by comparison, has only about 6% of its demand driven by industrial use, with the rest attributed to jewelry, gold bars and central banks buying.7 This difference means that gold is more purely a precious metal, whereas silver and its price is impacted by both demand for precious metals, as well as industrial demand. Moreover, the market for silver is smaller than gold’s one8 and tends to be more volatile.9

The Gold-Silver Ratio

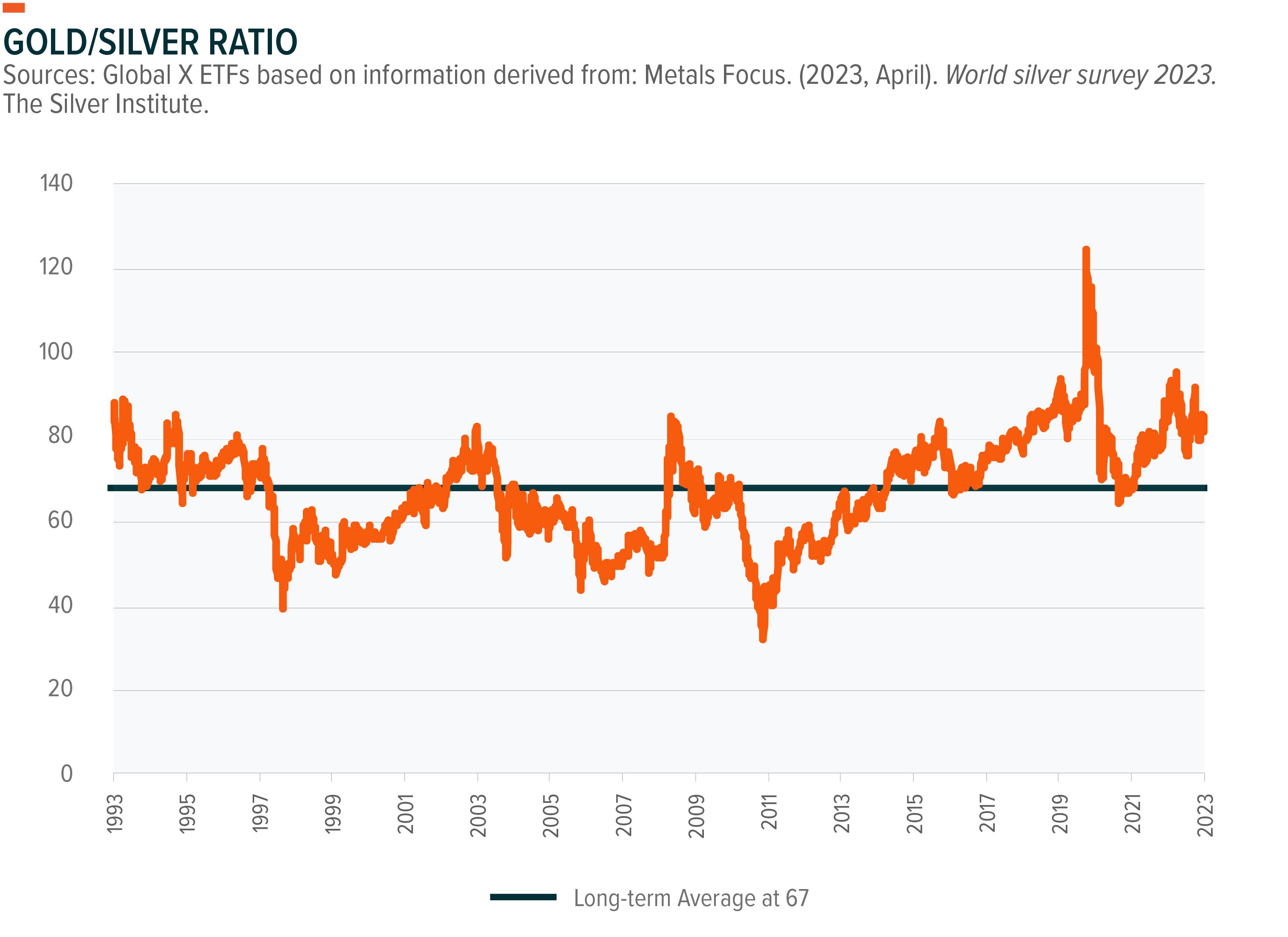

The gold-to-silver ratio is a commonly cited figure that represents the amount of silver required to purchase one ounce of gold. This ratio tracks the prices of these metals relative to each other and can indicate when one is potentially cheaper or more expensive than usual. Over the last 30 years, this ratio has been at an average of around 67. The Gold/Silver ratio is considered most useful at its extremes. When relative valuations hit extremes, the ratio tends to revert to historical levels, triggering a mean reverting mechanism. Currently the ratio is near 82, which possibly indicates that silver is undervalued relative to gold.10,11

Notwithstanding the mentioned relevant differences, silver is often considered as a “second gold” given its relationship with yield and the US dollar and its demand as a store of value. Historically, when US real yields are lower and the US dollar weakens, precious metals tend to perform well, creating a favorable environment for silver investments.12 In our view, if the US Federal Reserve were to pause in its tightening cycle or were to signal a more accommodative stance with potentially lower interest rates, the profitability of precious metals investments, including silver, could potentially strengthen. On the other hand, when interest rates increase, it raises the opportunity cost of holding precious metals, potentially reducing their investment appeal.

However, over the past decade, silver has shown a negative correlation of -0.15 with US interest rates, which is weaker than gold’s one at -0.41, while the correlation with equities is relatively stronger: Silver exhibits 0.26 with the Standard and Poor’s 500 (SPX) index while gold’s -0.09, indicating silver’s significant industrial demand and underlying its unique position as both a precious and industrial metal that makes it an appealing addition to portfolios.13

In addition, precious metals are often sought after when volatility is high, as investors seek investments that can potentially preserve their value in a volatile market. Precious metals remain a solid potential hedge against inflation and store of value in times of economic downturns and geopolitical unrest.14 Today, we expect persistent geopolitical risks, such as the lingering war in Ukraine, to keep them in demand. This implies that demand for silver as a store of value and an investment can dramatically swing prices, particularly given the volatile nature of such demand. Therefore, if owning precious metals becomes more attractive to investors, then silver prices could potentially rally significantly.

What Are Silver’s Supply and Demand Dynamics?

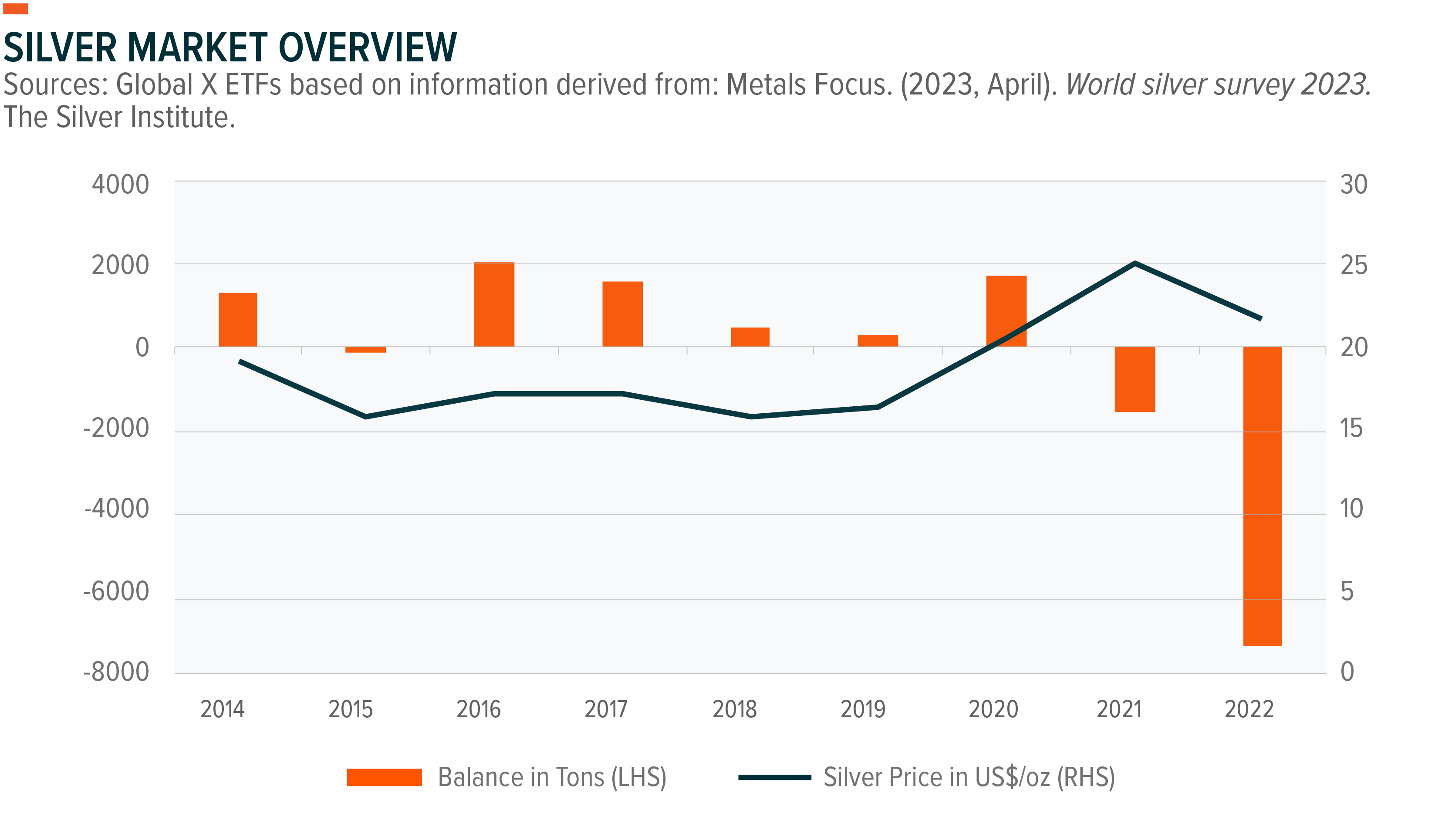

Before 2022, global demand for silver has remained aligned with global supply. In 2022, demand outpaced supply by 7,393 tons. Global consumption of PV silver powder in 2022 reached 140.3Moz (4,365t), almost triple the level in 2010.15 PV cell output grew faster than silver thrifting, helping boost silver global electronics & electrical demand. Additionally, vehicle electrification, power generation, and distribution investments benefited the sector. Thrifting and substitution (outside PV) were also minor, helping the total.16

In fact, one trend that has the potential to dramatically change silver’s supply and demand landscape involves increased solar power installations. Solar is entering a new age after nearly two decades of development. Due to the green economy and energy sovereignty awareness, installed capacity growth has outpaced predictions, and a technological breakthrough has brought new high-efficiency N-type cells with more significant silver loadings into mass production. Due to the move towards N-type cells and the promising future of PV installations, powder offtake should increase even though traditional cell silver loadings per unit declined.

Manufacturers have indeed invested heavily and made impressive progress in silver thrifting and substitution in recent years, mainly through process optimization, alternative materials, and improved cell structure design to reduce silver price volatility and enhance competitiveness. We expect that technology will continue to minimize silver intensity in most installations: silver is one of the most expensive components in solar PV cells and is, therefore, predicted to continue to decrease in material intensity by 30% in 2030.17 Nevertheless, silver powder use has increased with PV installation expansion and silver prospects are still bright as shifts between PV technologies counter thrifting.18

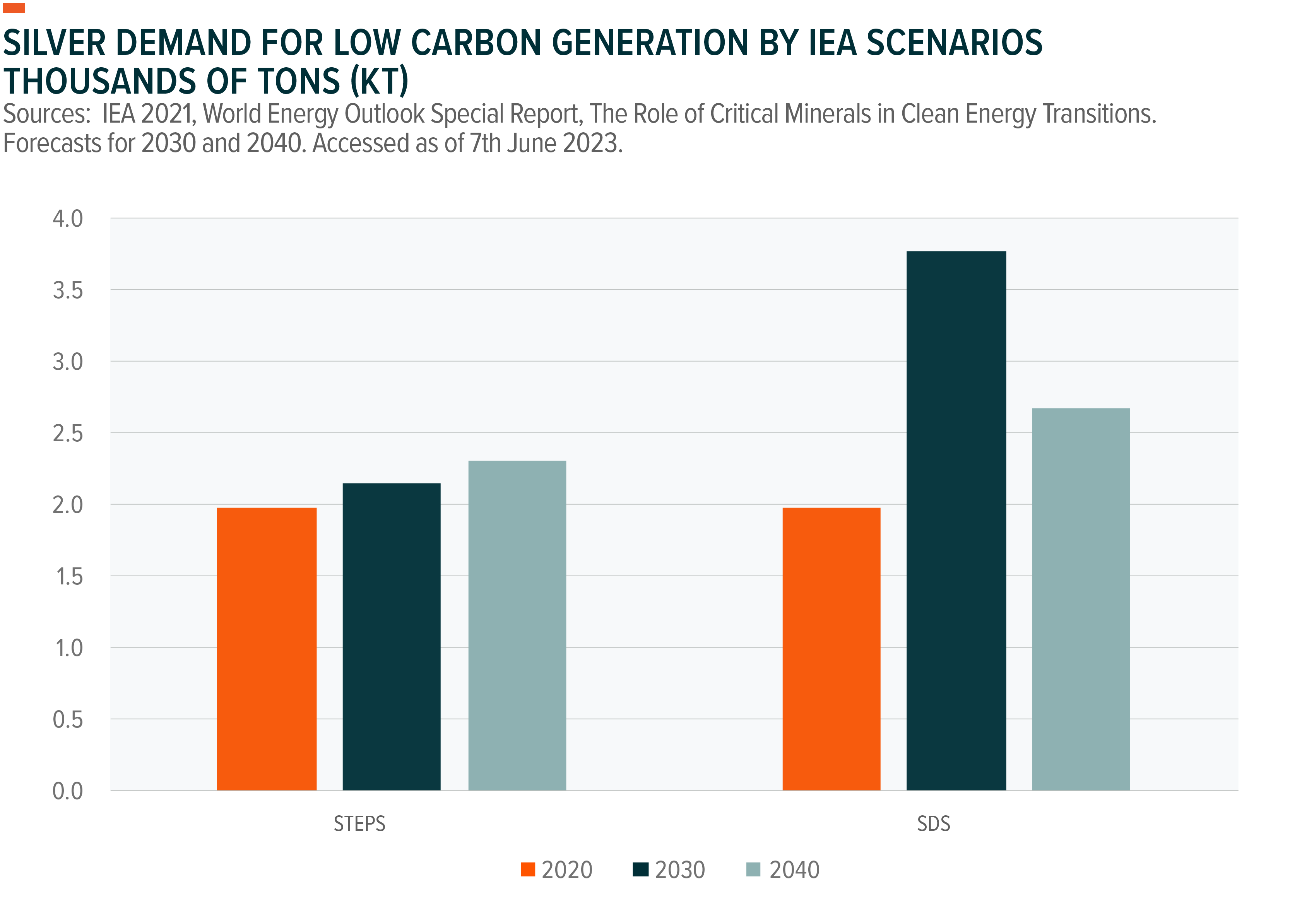

Overall, the usage of silver in solar panels translates to a faster rate of demand growth. Deployment of solar PV accelerates in all most recent International Energy Agency’s (IEA) scenarios, setting new records every year to 2030. In the IEA’s STEPS (Stated Policies) scenario silver demand is the highest in 2040 (17% higher than 2020), while in SDS (Sustainable Development) scenario silver demand is the highest in 2030 (90% higher than 2020 while in 2040 is 35% higher than 2020).19

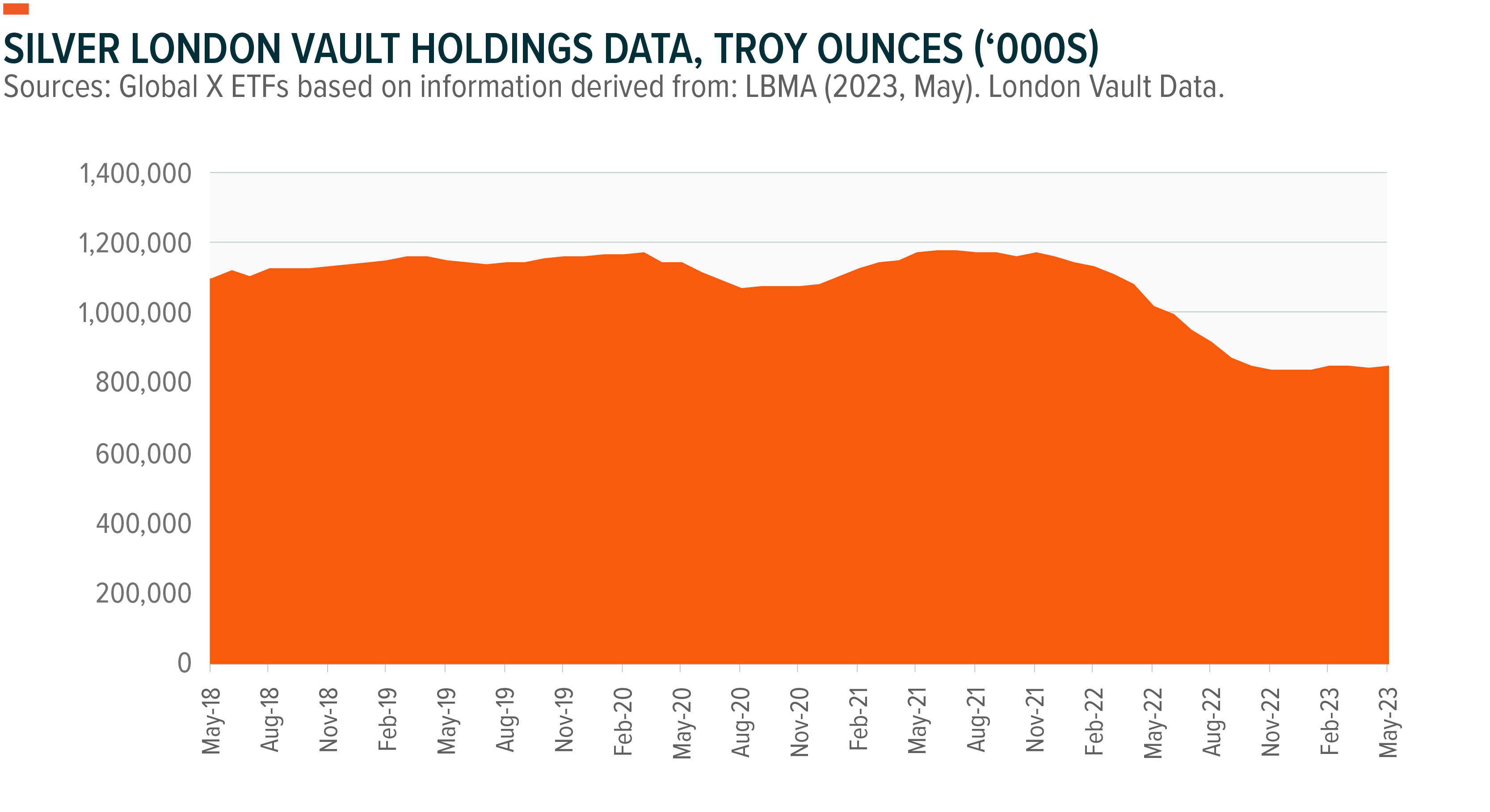

The balance of deployment of solar panels varies by region and country. In the United States, China, and India, for example, solar PV are becoming the leading technology.20 India has increased enormously its imports of silver last summer. We can notice that by looking at inventories’ levels: the stockpile of silver, held in the LBMA vaults in London reached an all-time low in November and continued to be around record lows while COMEX inventories dropped very quickly too.21

On the supply side, changes in Mexican regulation will make it more difficult for mining conglomerates to be granted mineral concessions, increasing the risk that corporations may cut back on investments in new projects and putting Mexico’s status as the world’s top producer at risk.22 In addition, in the first four months of 2023, silver production in Peru fell by 7% year over year.23

Multiple market participants have raised scarcity alarms in light of the rising demand for silver brought on by the shift to renewable energy sources.

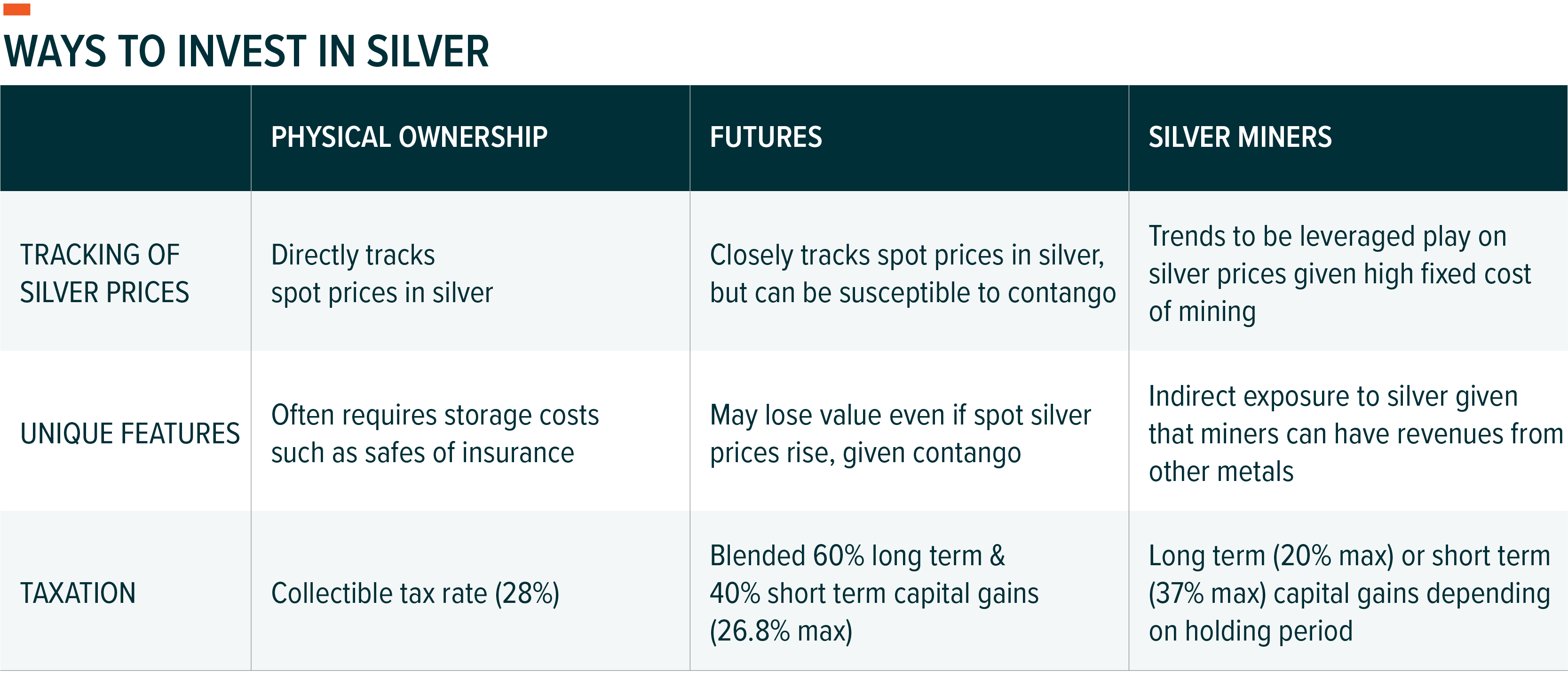

What Are the Differences Between Investing in Physical Silver, Futures, and Silver Mining Stocks?

Physical Silver

Silver bullion can be bought directly from precious metal dealers, who sell it at spot market prices. The advantage of physical ownership is that its value closely tracks the price movements of the broader silver market. This also allows owners to potentially physically possess the metal, giving them direct access to their investment. One downside is that dealers can charge premiums to buy and sell silver, which can dramatically reduce returns. In addition, there can be costs of storage, such as buying a safe or renting a safety deposit box. Moreover, when an investor sells physical silver, gains are currently taxed at a maximum of 28%.24

Silver Mining Stocks

Silver mining stocks can offer indirect exposure to silver prices. These stocks tend to be leveraged plays on silver prices, owing to the high fixed costs of extracting the metal. Mining stocks are considerably more liquid than physical silver as they can be bought and sold during market trading hours. Silver mining stocks can also be advantageous from a tax perspective, as long-term holders are taxed at long term capital gains rates, which are currently at a maximum of 20%. A potential drawback is that investors are exposed to idiosyncratic risks associated with owning the stock of a particular company. To counteract this, investors may look to an ETF, which owns a broad basket of companies involved in silver mining.25 Exposure to the commodities markets may subject the funds to greater volatility than investments in traditional securities.

Futures

Paper trading of silver is conducted through the futures market. Paper trading provides investors with exposure to silver without needing to physically hold the metal, potentially improving liquidity and reducing the cost of ownership. Unlike the bullion market, futures markets can also allow investors to use leverage. One downside of futures is contango, when future prices of a commodity are higher than their spot price. This can erode gains over time, even if the spot price of silver rises. The use of futures contracts is subject to market risk, leverage risk, and liquidity risk. They may experience losses that exceed losses experienced by securities that do not use futures contracts. The use of leverage may amply the effects of market volatility.

Conclusion

Silver is a unique metal because it has properties of both a precious and an industrial metal. We believe this makes silver a useful portfolio holding as it can potentially appreciate in both environments where demand for precious metals can rise, such as during periods of heightened volatility, as well as in eras of strong economic growth where industrial demand is expanding. For long term investors, we believe that a basket of silver mining stocks is a desirable way of gaining exposure to silver, given their leveraged exposure to the underlying metal’s price movements.

Related ETFs

SIL – Global X Silver Miners ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.