Ten Questions About the Disruptive Materials at the Center of the Clean Energy Transition

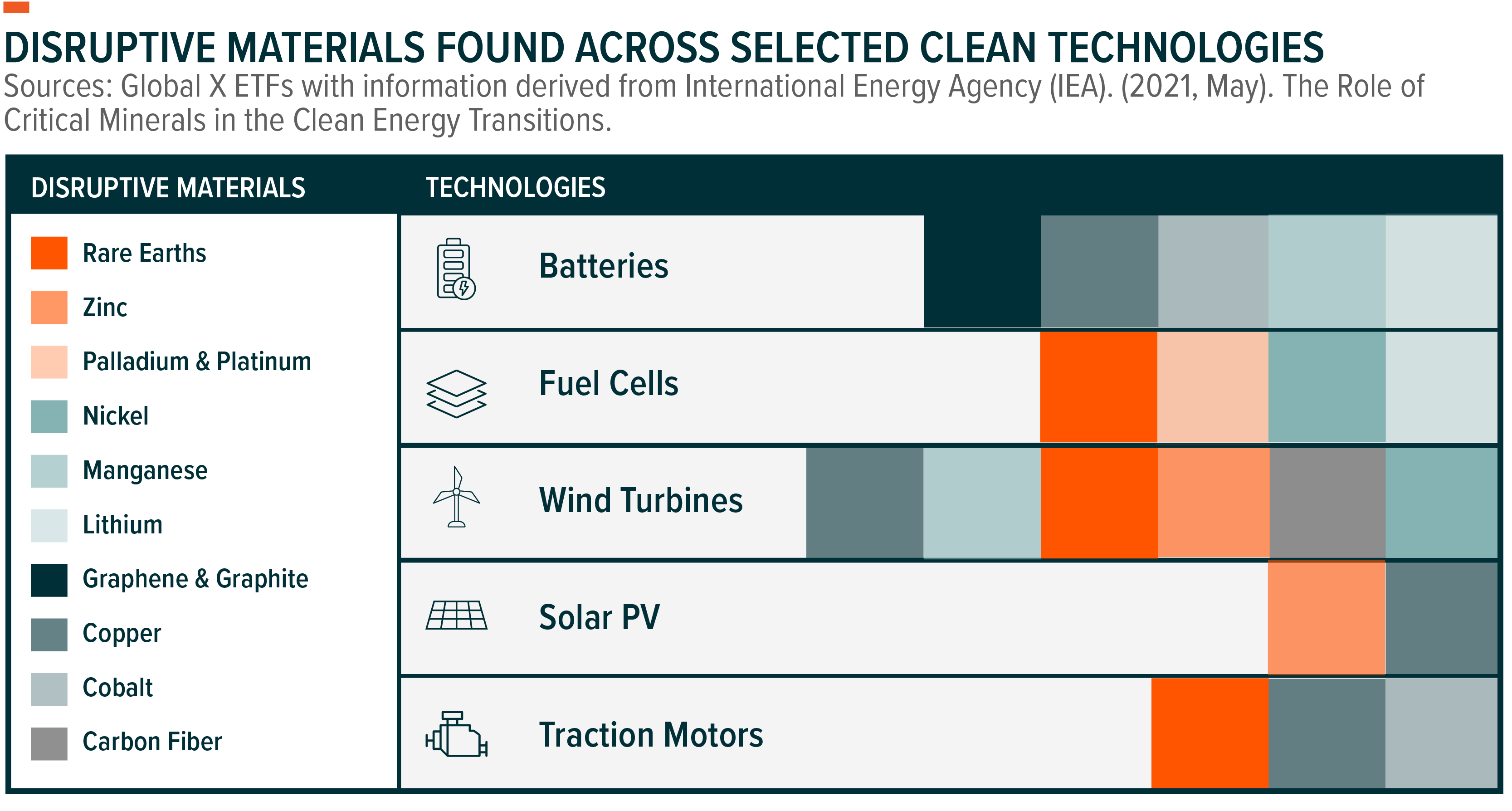

PreviewThe world is rapidly embracing clean technologies like electric vehicles (EVs), battery energy storage systems, hydrogen fuel cells, wind power systems, and solar power systems. Core to the manufacturing and performance of these technologies are 10 key disruptive minerals and materials, listed in the table below. In our view, increasing demand for these disruptive materials coupled with often limited supply creates compelling opportunities for companies and investors to play key roles in the shift to cleaner energy. In this piece, we provide answers to questions concerning their current supply and demand dynamics as the world pushes towards a greener economy.

Key Takeaways

- Disruptive materials form the foundation for the clean energy transition as they are essential components of clean technologies like electric vehicles and renewable energy systems.

- We believe that strong demand outlooks for disruptive clean technologies could create a supercycle for certain materials. By one estimate, mining revenue from disruptive materials for clean technologies can increase fivefold from 2021 to reach $400 billion by 2050.1

- Disruptive materials’ supply chains could face shortages, resulting in long periods of above-trend price movements that can benefit companies involved in materials mining, refining, and production.

1. Copper: Is the “as China goes, so goes copper” motto still valid?

Good news for China typically means good news for copper because China buys more than half of the world’s copper, making it the largest consumer of the “eternal metal.”2 While China’s economic slowdown is something to watch, we believe that demand for infrastructure and electric vehicles in China is likely to keep the copper market well supported. Additionally, China implemented several measures that can be positive for copper demand, including a substantial rescue package for its beleaguered property sector.3 The end of the government’s Zero-COVID policy is another potential positive.

Globally, annual demand for copper is expected to double by 2030.4 Amid the ongoing green transition, Europe and the United States are likely to increase their share of copper demand throughout the decade and shift some of the balance away from China.5 For example, a major source of new demand is Europe accelerating its shift to renewables and weaning off Russian gas.6

2. Nickel: How could Indonesia’s recent moves affect nickel prices?

Indonesia, the world’s largest producer of nickel, plans to increase its status as a critical global supplier of nickel for EV batteries, which is essential to the EV transition. As a result, Indonesia may help avoid shortages of nickel in the short-term. However, Indonesia has proposed creating an organization like OPEC to coordinate nickel supply. Also, Indonesia has no plans to resume nickel ore exports, meaning that its processing is likely to remain in the country prior to being exported.7,8 Given recent market illiquidity, any supply tightening or unexpected Indonesia policy moves could further tilt the nickel price risk to the upside.9

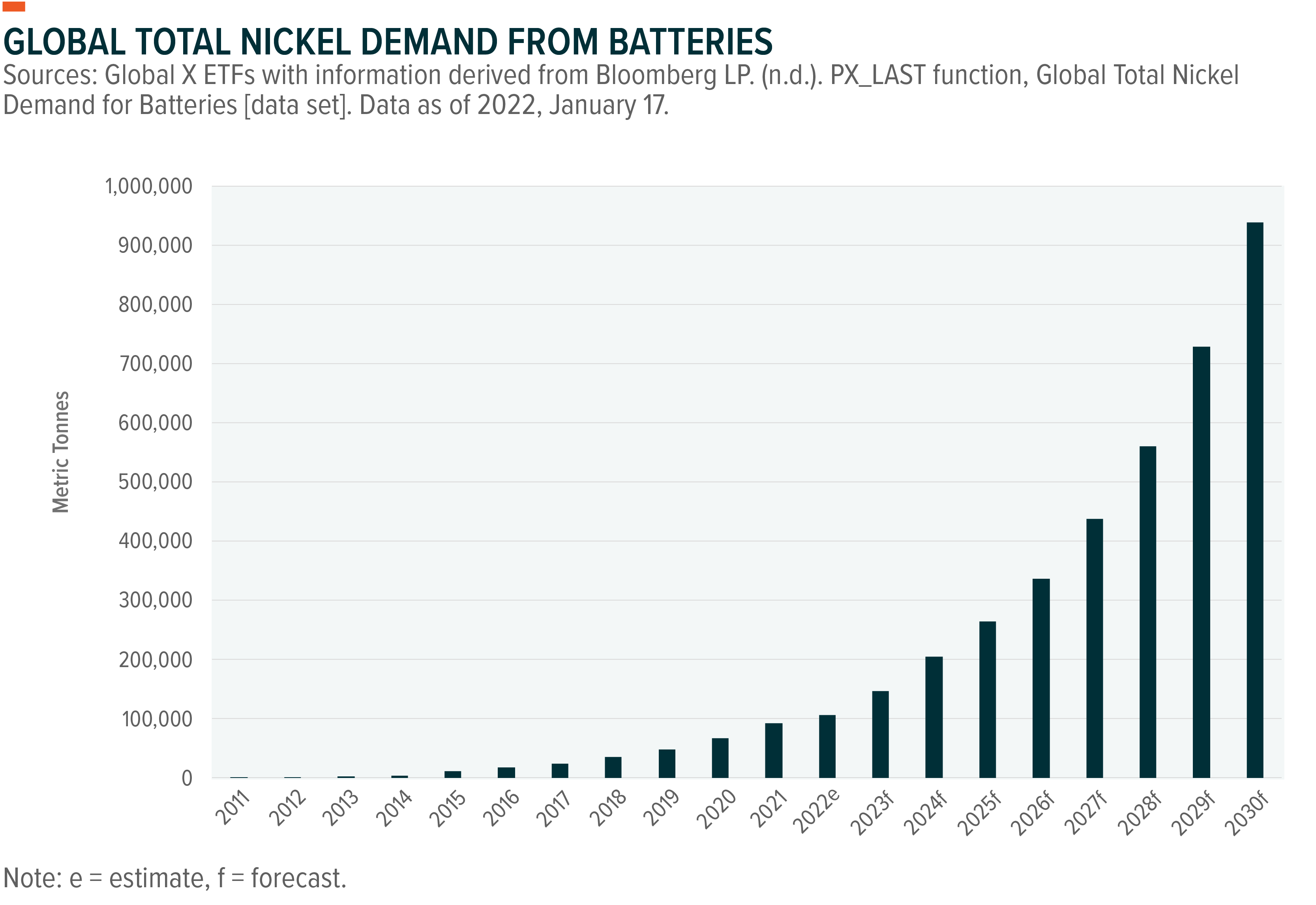

Over the long-term, the world needs to produce more Class 1 nickel, the grade required for batteries.10 In 2021, 8% of lithium-ion batteries were high-nickel NMC batteries. By 2030, it could be almost 50%.11 This could result in significant potential demand growth. Currently, Russia produces about 20% of the world’s Class 1 nickel. In 2023, Russia’s MMC Norilsk Nickel PJSC, which controls about 10% of the global nickel market, may slash nickel production by 10% as European clients are expected to avoid Russian supplies.12 Even though the United States sanctioned Nornickel’s principal shareholder and not the company itself, the war in Ukraine has disrupted logistics, insurance, and shipping for the mining company, adding pressure on nickel supplies.13

3. The Platinum Group Metals (PGMs): Fundamentals are supportive, but how could geopolitical risks and monetary policy impact platinum and palladium?

After two years of surpluses, platinum supply is expected to be at a deficit in 2023 due to higher automotive demand and low South African platinum and palladium supply. On the supply side, loadshedding from South Africa’s state-owned energy company Eskom may drive even greater downward revisions to production.14 In addition to these current supply dynamics, also potentially supportive to pricing is that markets expect a less hawkish path for Federal Reserve (Fed) policy in 2023, which suggests a weaker U.S. dollar. PGMs as precious metals historically have a negative correlation with the dollar.

In addition, palladium’s near-term upside risks include exports from Russia, which account for 40% of palladium mine production.15 The market is concerned about a disruption, as Russia may decrease palladium exports as a way to put strategic pressure on Western governments.16 A palladium shortage could hurt global automakers.

4. Lithium: What are companies doing to address the growing lithium supply-demand gap as EV adoption rises?

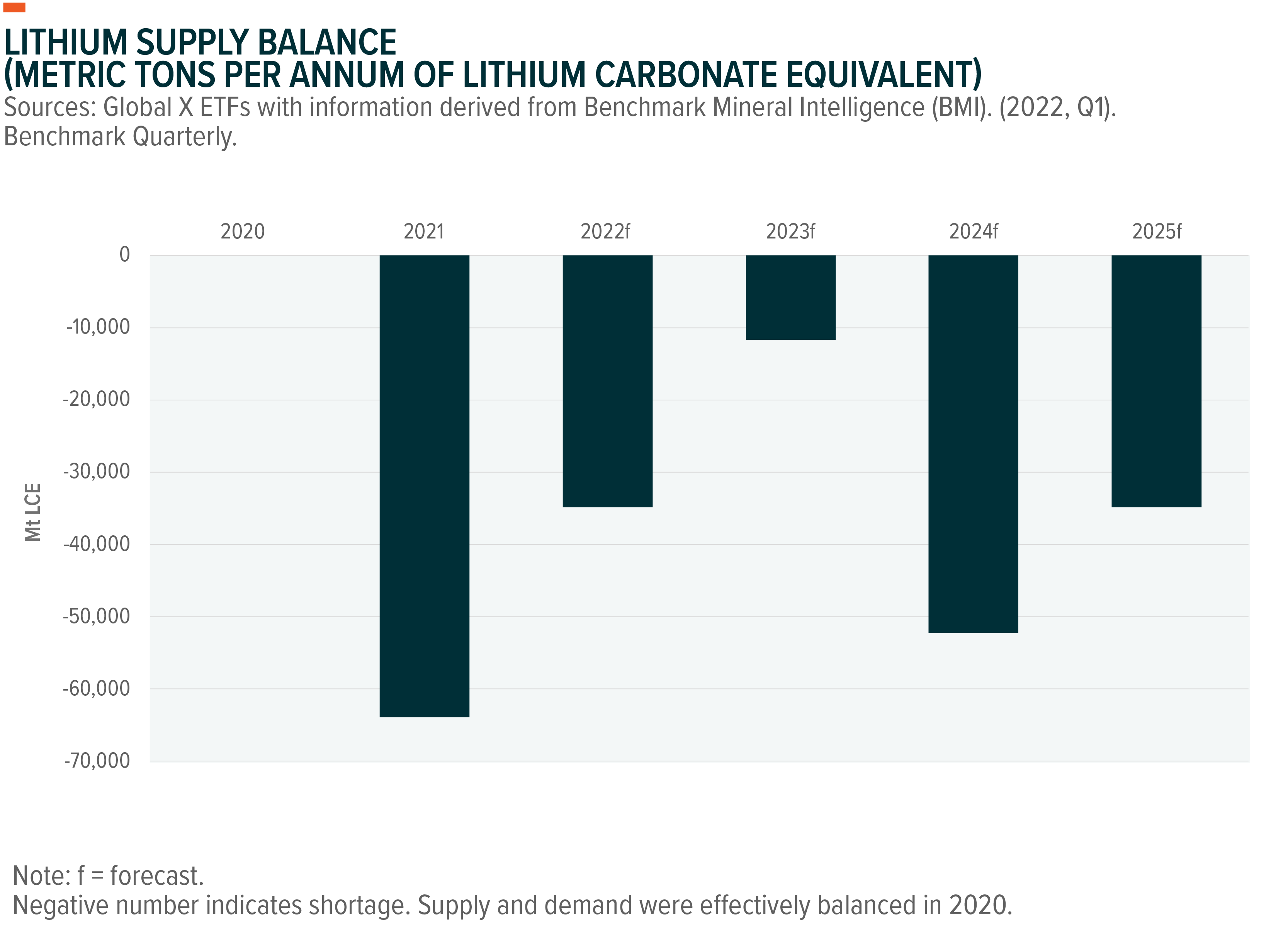

Lithium supply is likely to lag demand through at least the first half of this decade due to the accelerating pace of EV adoption combined with supply constraints. EVs are forecast to account for 23.5% of global light-duty vehicle sales in 2025 and 40.8% in 2030, a notable increase from a 12.8% share in 2022.17 By 2040, EV’s share could reach nearly 80% of annual light-duty vehicle sales, and lithium demand could be up to 42 times higher than 2020 levels.18,19

As a result, several prominent lithium miners recently announced capacity expansion plans, including Albemarle, Sociedad Quimica Y Minera de Chile (SQM), and Ganfeng Lithium. In Q3 2022, Albemarle unveiled plans to increase lithium production capacity more than fivefold to 500,000 tonnes per annum (tpa) by 2030.20 Junior lithium miners considering expansion plans include Sigma Lithium’s potential project that could triple production from an expected 270,000 tpa in 2023 to 768,000 tpa in 2024.21

5. Graphite: Is the supply-demand imbalance that increased graphite prices in 2022 expected to continue?

We believe the favorable pricing environment for graphite miners is likely to remain through at least the medium term. In 2022, demand for anodes grew by more than 45%, while supply growth for natural flake graphite was only 14%.22 The supply-demand imbalance led to a 25% price increase for natural graphite.23 Prices for synthetic graphite increased by 30% amid the tightened supply for natural graphite and higher demand for the material overall.24 While graphite supply is forecast to grow by 15% in 2023, the expected strong growth in EV sales in 2023 and beyond means that the supply-demand balance is likely to remain tight.25

Graphite mining and processing companies are expected to continue to announce expansion plans to take advantage of the increasing demand and likely higher prices. One of the leading graphite miners, Syrah Resources, has a U.S. processing plant under construction that is scheduled to begin operations in fall 2023.26 Notably, Syrah has an offtake agreement with Tesla for the facility.

6. Cobalt: The short-term demand outlook is weaker, but what about the long-term outlook for miners and refiners?

Global macroeconomic headwinds and weakened demand in China may negatively affect demand for cobalt in the short term, but cobalt’s essential role in battery tech keeps the long-term demand outlook positive.27 In 2021, EVs surpassed phones as the top driver of demand for cobalt, accounting for just over a third of total global demand.28 The continued electrification in the transport and power sectors is expected to result in cobalt demand increasing anywhere from 6–21 times by 2040 relative to 2020 levels.29

We expect this expansion to present opportunities for established cobalt miners and refiners and newcomers. The Democratic Republic of Congo (DRC) is likely to maintain the largest share of mine production with companies including Trafigura, MMG, and Chemaf working on sizable expansion projects. Ongoing U.S. and European Union policy efforts to diversify the cobalt supply chain outside of the DRC for mining and China for refining could result in additional opportunities.

7. Manganese: With mining and refining highly concentrated and new demand for manganese a risk to supply chains, where might companies expand?

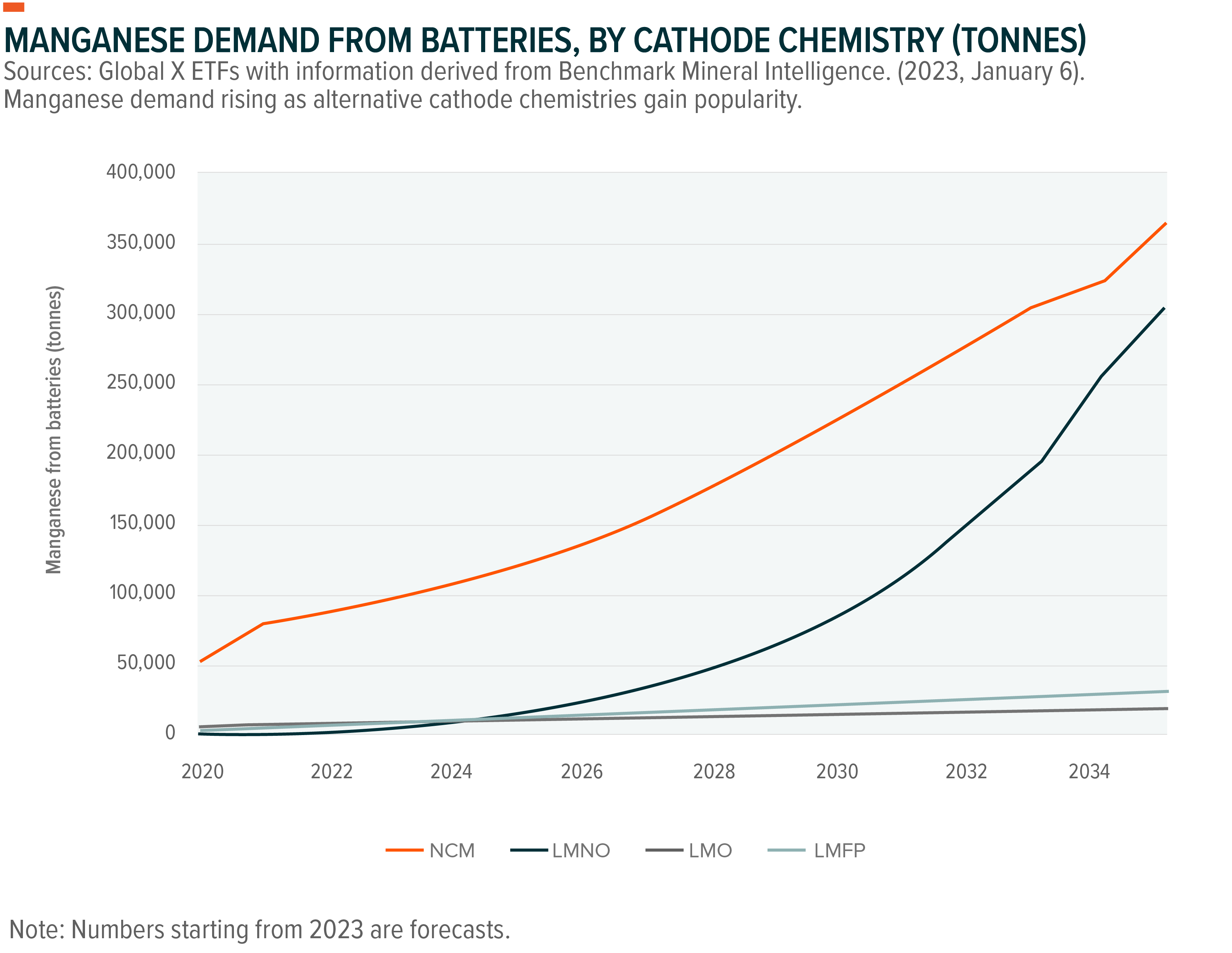

Manganese demand for battery technology manufacturing is forecast to grow fivefold over the next decade due to growing demand for EVs.30 Expected growth in traditional NCM cathodes, as well as the use of alternative cathode and cell chemistries that contain higher levels of manganese such as LMNO cathodes, support the positive demand outlook.31

While there is an abundance of manganese ore globally, supply chain challenges could arise from the highly concentrated nature of manganese mining and refining. South Africa, Gabon, and Australia accounted for a combined 71% of manganese mine production in 2021.32 Slightly further downstream, 95% of high-purity manganese refining capacity is located in China. Japan’s Nippon Denko and Belgium’s Vibrantz Technologies account for the 5% outside China.33

Several companies are considering building plants in Australia, South Africa, Indonesia, Botswana, Mexico, and Canada. Also, the Inflation Reduction Act in the US includes domestic content requirements for EV materials that could encourage new manganese mining and refining capacity in the United States and Free-Trade Agreement countries over the coming years.

8. Rare Earth Elements: How is cleantech’s growth creating new uses for rare earth elements and affecting their mining and production?

Neodymium, praseodymium, terbium, and dysprosium are among the rare earth elements used to manufacture permanent magnets for offshore wind turbines, onshore wind turbines, and EV motors. For example, an offshore wind power project requires 239 kilogram (kg)/megawatt (MW) of rare earth elements.34 Cleantech’s demand for rare earth elements could increase 3–7 times by 2040 compared to 2020 levels.35 Revenue for the rare earths mining and production value chain from the cleantech industry alone could increase eightfold from $400 million in 2020 to $3.2 billion in 2040.36

Currently, China accounts for 63% of rare earths mining and 85% of rare earths processing.37 That supply chain concentration has companies exploring opportunities in other countries. For example, MP Materials, which currently operates the only rare earths mining and processing site in the United States, plans to become fully vertically integrated in the country.38 The company commissioned its refining assets in Q3 2022, and construction continues to advance on its magnetics manufacturing facility in Texas.39

9. Zinc: How could the energy crisis in Europe position zinc for the short and long terms?

Zinc supply is historically low, as the electricity crisis in Europe has numerous smelters operating at reduced capacity or on care and maintenance status. Eurometaux, an industry group for metals, reported that all EU zinc smelters have been forced to reduce or suspend production.40 Typically, smelter curtailments are flexible, which supports zinc prices.

On the demand side, the push for alternative energy sources has zinc surging, and we expect China’s reopening will only add to current demand. A 100-megawatt hour (MWh) solar power park requires 240 tonnes of zinc, and a 10 MWh offshore wind turbine requires 4 tonnes of zinc.41 When used in battery technology, zinc plays a crucial role in reducing carbon emissions. Also, to be corrosion-resistant, EV makers use galvanized steel, which uses zinc.

10. Carbon Fiber: How can cleantech infrastructure, particularly for wind power, bolster long-term demand for carbon fiber?

Transmission lines that use carbon fiber cores instead of steel cores can increase the amount of power that can be carried. These lines can cost more than traditional steel lines, but they are becoming more cost competitive. In the wind power industry, researchers are developing low-cost carbon fiber blades that could boost efficiency and lower costs. Should these more niche uses of carbon fiber scale up over the coming years, carbon fiber producers could benefit.

Related ETFs

DMAT – Global X Disruptive Materials ETF

COPX – Global X Copper Miners ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.