The Enduring Case for U.S. Energy Infrastructure

We believe that the U.S. energy sector’s production boom has the often-overlooked U.S. midstream energy infrastructure industry well-positioned in the current economic and geopolitical landscape. U.S. energy’s growing market share coupled with rising energy needs around the world makes the utility of processing, storage, and transport of its energy increasingly critical. Even as domestic consumption pivots towards renewable energy, U.S. oil and gas, and the infrastructure that they require, will likely remain an integral part of the global energy mix for decades to come. In our view, midstream energy infrastructure companies present an attractive strategic allocation opportunity.

Key Takeaways

- Fundamentals for midstream MLPs and infrastructure companies improved in recent years, highlighting the resilience, diversification, and income benefits that they can bring to an investment portfolio’s broader energy exposure.

- U.S. energy production reached record levels in 2023, signaling an industry that has strong growth prospects domestically and abroad. This production growth carries both economic and geopolitical implications for energy markets.

- As the U.S. energy sector grows increasingly export-oriented, midstream pipelines and infrastructure will be needed to channel exports, particularly toward rising consumption in developing markets.

U.S. Midstream a Critical Conduit and Compelling Allocation Opportunity

Advancements in lateral drilling and fracking technology and growing production in regions like the Permian Basin, the Bakken Formation, and the Marcellus Shale revolutionized the U.S. oil and gas industry over the past decade. Working alongside the oil and gas drillers, the energy sector’s extensive network of transportation pipelines, storage facilities, and liquid natural gas (LNG) terminals has grown to provide the infrastructure capacity to meet domestic and foreign energy demand.

Midstream companies offer diversified exposure to an indispensable segment of the U.S. energy industry. They use fee-based revenue models that depend less on spot energy prices and more on pipeline flows and storage volumes. As a result, their revenue streams are more predictable, leading to more consistent distributions and lower-volatility returns over time, than upstream exploration and drilling companies, which are highly exposed to boom-and-bust production cycles.

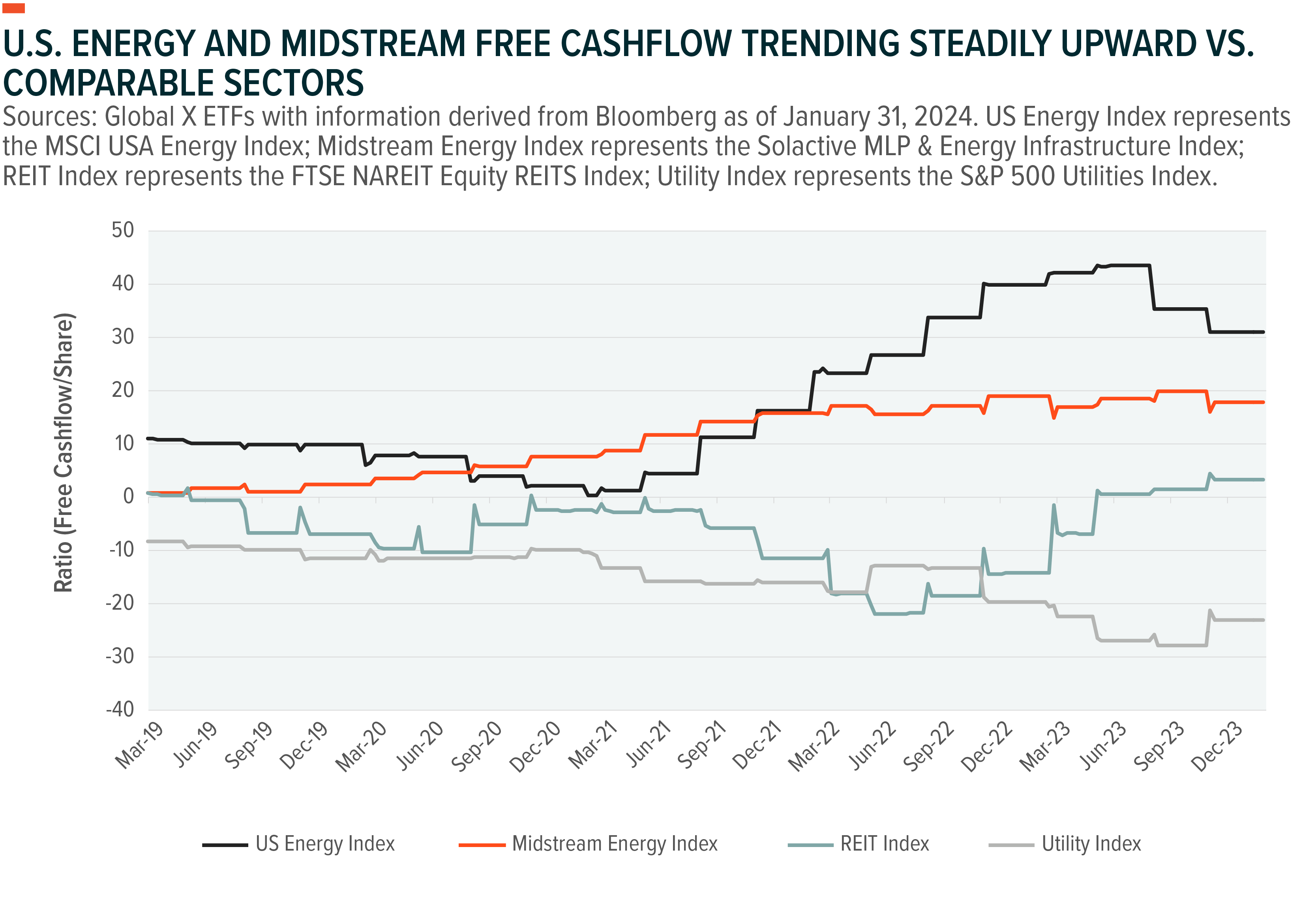

In recent years, midstream companies benefited from record U.S. oil and gas production and elevated prices across the energy supply chain, and they steadily raised their distributions amid record cashflows. Increased operating flexibility helped them internally fund capital expenditures, pay down debt, and consolidate via mergers and acquisitions. Also, unlike other income-focused investments like REITs and utilities, midstream operators are typically more resistant to rising interest rates.

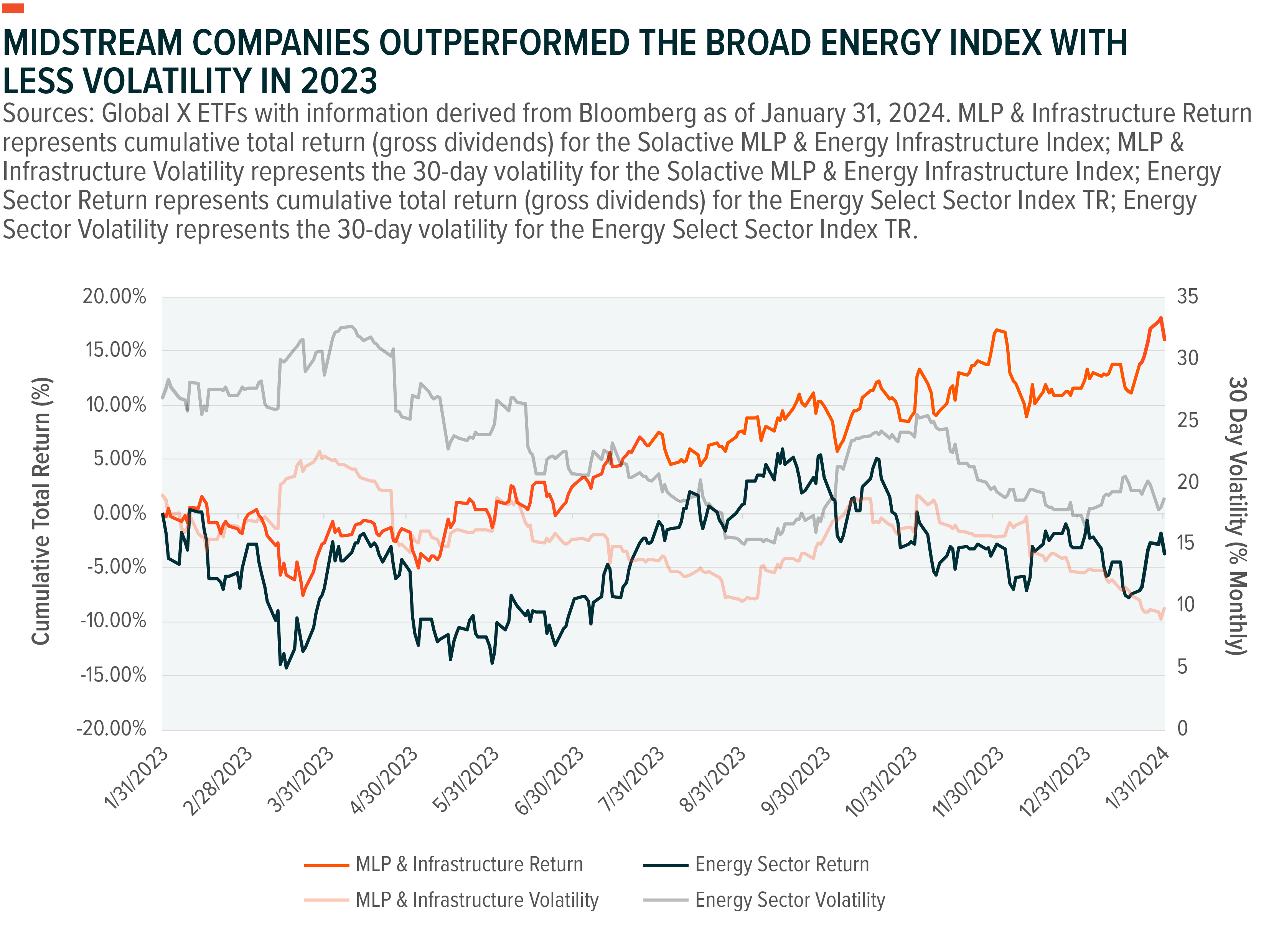

Midstream companies generated steady returns in 2023 despite oil & gas price volatility. The industry chose to internally fund capital expenditures and pay down debt, amid augmented cashflows, thereby reducing the need for external financing. This efficient capital allocation and reduced leverage helped stabilize midstream performance while allotting them the flexibility to raise distributions; this contributed to the attractive low volatility returns midstream saw versus the broader energy sector in 2023.

The Solactive MLP & Energy Infrastructure Index (the “Midstream Index”) returned 16.13% versus -3.68% for the broader Energy Select Sector Index during the 1-year period, ending January 31, 2024. Throughout this period, the midstream index was able to consistently achieve a lower level of price volatility versus the broader energy index. As midstream companies made up less than 10% of the Energy Select Sector Index, we believe this argues for midstream exposure as an attractive diversifier against a backdrop of continued energy price volatility.1

Breakneck Growth in U.S. Oil and Gas Production Highlights Midstream’s Utility

American oil production nearly tripled over the past two decades, reaching record levels of 13.3 million barrels per day as of late December 2023.2 While output expanded, cost efficiency increased. The improved drilling techniques reduced the cost of drilling in the U.S. shale patch by as much as 36%, according to JP Morgan. In March 2020, the United States had 683 active drilling rigs. As of mid-January 2024, the active rig count was only 499, yet output continues to reach new highs.3

Compared to 2014, when the Kansas City Fed’s breakeven price for oil production hovered around $80 per barrel, currently the breakeven price is in the $50–60 range for new wells and around $30 for existing wells, illustrating the U.S. energy sector’s resilience.4 This resilience makes it much more difficult for energy rivals such as OPEC+, the larger group Organization of Petroleum Exporting Countries, to manipulate prices as they have in the past.

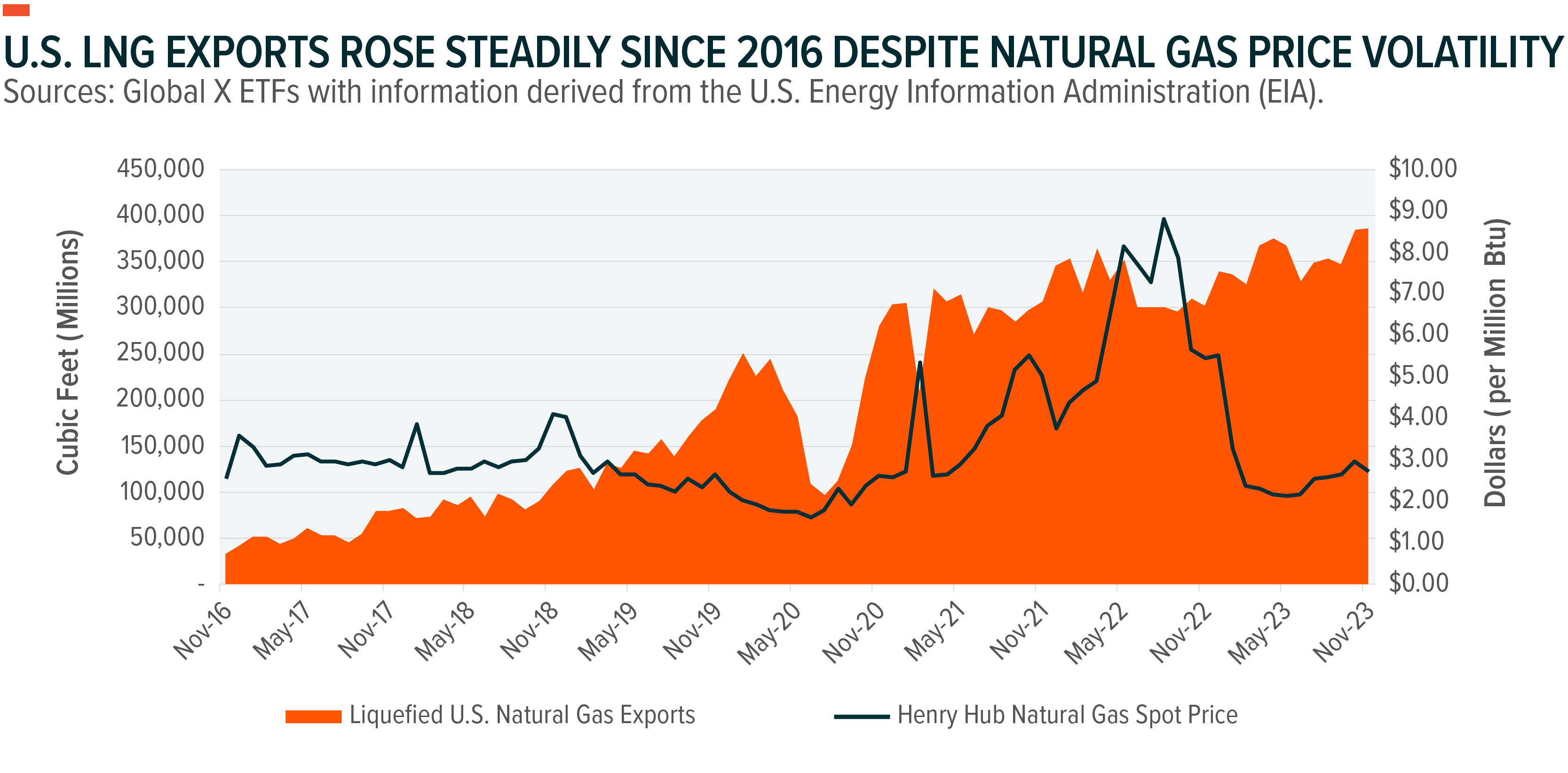

According to S&P Global, the United States now exports an equivalent amount of crude oil, refined products, and natural gas liquids (NGLs) as Saudi Arabia, historically the world’s dominant oil producer. The increased capacity comes at the right time, as the world’s need for energy and energy security continues to grow. Much of the continued growth in the energy sector is expected to come from LNG exports. U.S. LNG exports hit a record high 8.6 million metric tons in December 2023, exceeding volumes from exporters like Qatar and Australia.5

These exports are a strategic imperative amid rising geopolitical tensions globally. Following Russia’s invasion of Ukraine and the halt of natural gas flows from the Nord Stream pipelines, natural gas prices more than doubled, from $3.76 per million British thermal units (MBtu) in December of 2021, to as high as $8.81 MBtu at its peak in August 2022.6 During this period, U.S. energy producers stepped up liquified natural gas (LNG) exports to meet growing supply gaps in Europe and the rest of the world. The U.S. LNG industry looks poised to continue handling such demands. In addition to its existing capabilities, five major export terminals under construction on the Gulf Coast have the potential to double the nation’s LNG capacity by 2027.7

Emerging Markets Can Keep U.S. Oil and Gas Exports in Demand

Organization for Economic Co-operation and Development (OECD) countries are likely to continue adopting clean energy and working to reduce their energy footprint. Conversely, non-OECD countries are likely to ramp up their consumption of oil and gas and sustain demand for U.S. energy. According to the Energy Information Administration (EIA), global energy consumption is expected to increase by 34% from 2022–2050, likely outpacing gains in energy efficiency.8 By 2050, the non-OECD share of global energy consumption is expected to reach 70% by 2050, accounting for almost 100% of global energy demand growth.9

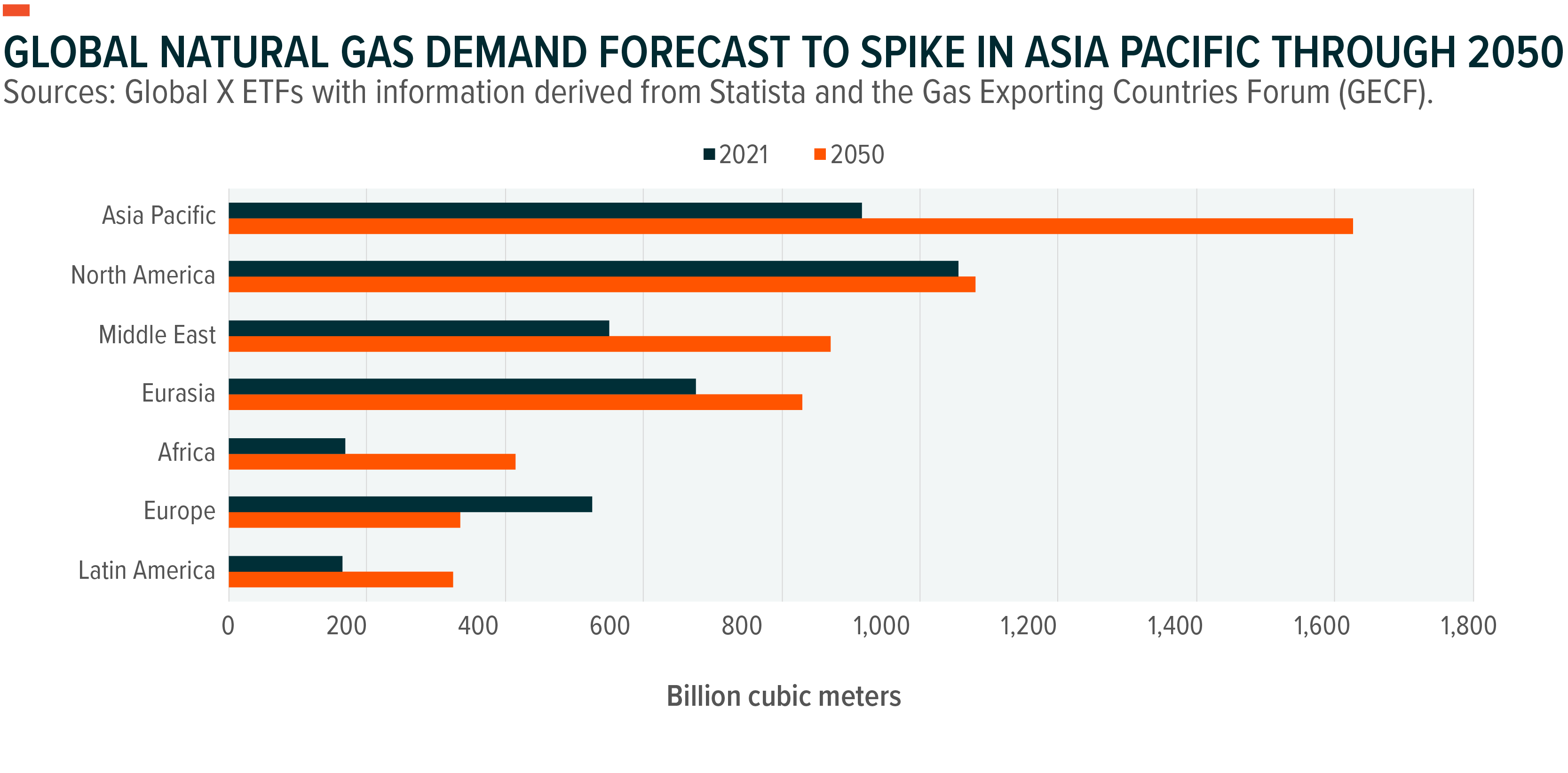

Reasons for the expected jump in energy demand within these emerging economies include population growth and rising standards of living amid industrialization efforts. Excluding China, emerging economies account for two-thirds of the world’s population and are projected to drive the majority of population growth this century.10 By region, energy consumption in Asia Pacific is forecast to rise by 1.3% annually between 2022 and 2050, over twice the rate of growth expected in the Americas, Europe, and Eurasia. India’s energy consumption is expected to rise the fastest at 3.9% year-over-year during this period, three times the level of the greater Asia Pacific region.11

Supporters of clean energy state that growing energy needs should be met with renewable sources, but certain industries currently lack cost-effective substitutes for fossil fuels, such as manufacturing, construction, and long-distance transportation. For example, oil and natural gas are key ingredients in the petrochemical feedstocks that drive the manufacturing of plastics, polymers, and synthetic materials used for electronics, construction, pharmaceuticals, apparel, and adhesives.

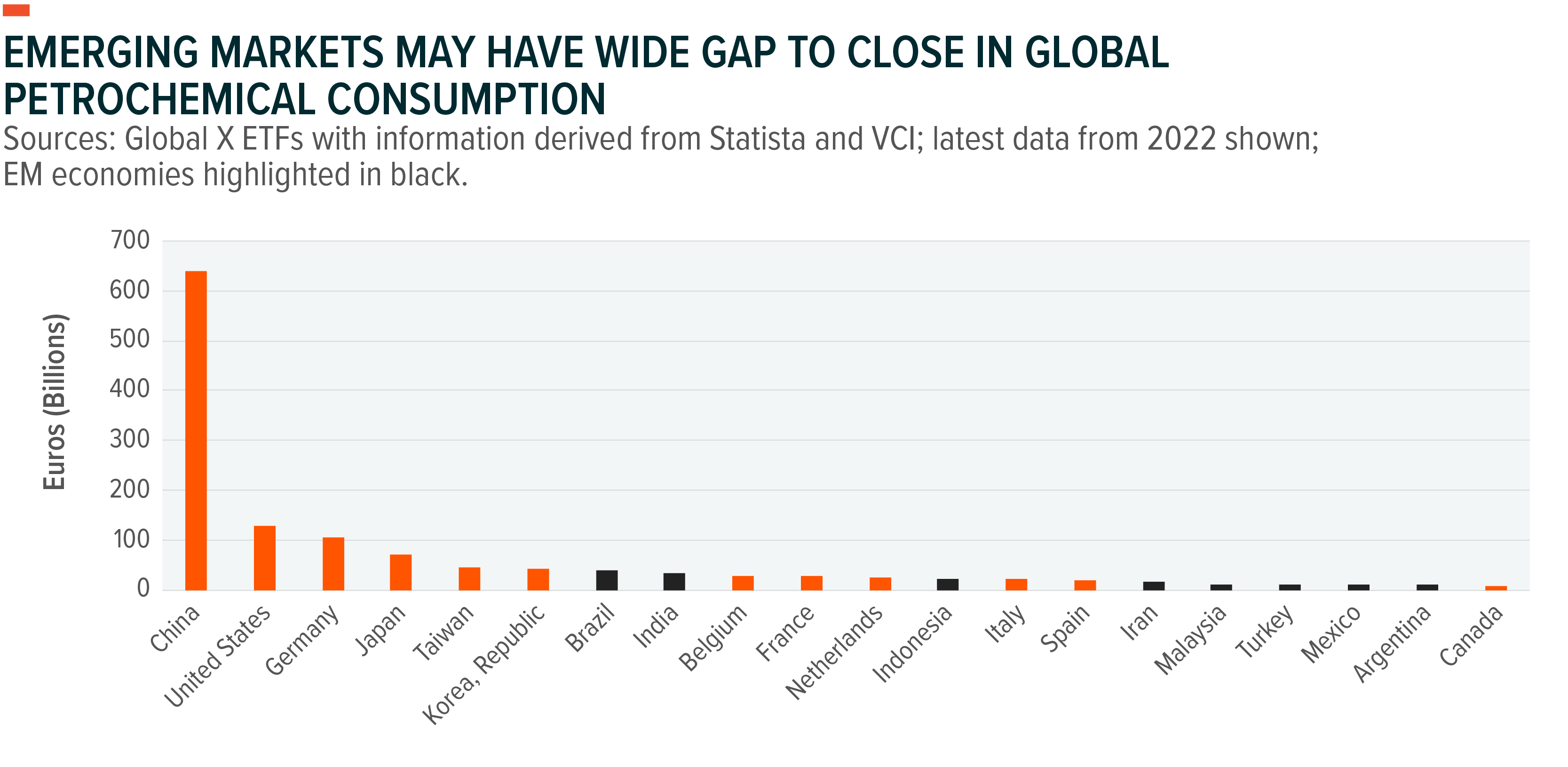

The International Energy Agency (IEA) expects demand for petrochemicals among industrializing EMs to offset the contraction in demand from advanced economies. Petrochemical feedstock, which currently accounts for 15% of global oil demand, is the fastest growing segment of global energy demand. China, the main driver of that demand, is expected to develop enough petrochemical capacity this year to rival the combined capacity of all OECD countries across Europe and Asia. Since 2019, petrochemical feedstock accounts for 80% of the growth in China’s oil demand and 50% of the world’s oil demand.12 In 2023, Chinese petrochemical demand drove oil usage to record levels even as China’s economic growth slumped.

Should other EMs replicate a fraction of China’s industrialization, they can be a significant source of demand over the next decade, not only for petrochemicals but across all end use cases for oil and gas. For example, despite high population growth and real GDP growth approaching 6.3%, the Indian sub-continent only comprised 4% of global petrochemicals consumption in 2023.13

Conclusion: U.S. Energy Infrastructure to Remain a Key Piece of the Global Energy Puzzle

Even as investment in renewables kicks into high gear, we believe oil and gas will remain major components of the world’s energy mix for decades to come as energy consumption continues to rise. With U.S. production booming and the nation now a leading energy exporter, we believe that the U.S. midstream infrastructure industry presents an attractive investment case as its pipelines, storage, and terminals help deliver energy around the world. We believe that midstream companies offer an attractive opportunity in this environment to diversify energy sector exposure, amidst steady performance and improving fundamentals.