Artificial Intelligence to Wield Its Influence on the Commodities Supply Chain

PreviewCommodities supply chains require continuous efforts to optimize productivity. Like many sectors, the mining and oil & gas sectors are discovering that artificial intelligence (AI) is a tool that can hone business operations, differentiating everything from discovery and drilling processes to product inspection and predictive maintenance. Over time, we anticipate more AI-based innovation to take hold, including by way of technology like robotics company OffWorld’s Swarm Robotic Mining systems, which offer surface surveillance, precision excavation, and material processing capabilities.1 And as AI adoption proliferates throughout the commodities supply chain amid the ongoing energy transition, we expect it to play a significant role in bolstering the long-term investment cases for these sectors.

In this post, we show specific instances of where AI and associated technologies are being used by specific companies in specific industries to highlight opportunities for investors. Despite being in the early stages, AI technology and its applications are already being deployed, setting the scene for potentially more robust usage in the broader mining and commodities supply chains in the years to come.

Key Takeaways

- The expected copper supply and demand imbalance has companies looking to increase production with the help of AI and the operational efficiencies that it can bring to the process.

- The use of AI in data preparation and analysis is already a critical component of many oil and gas companies’ exploration and production efforts.

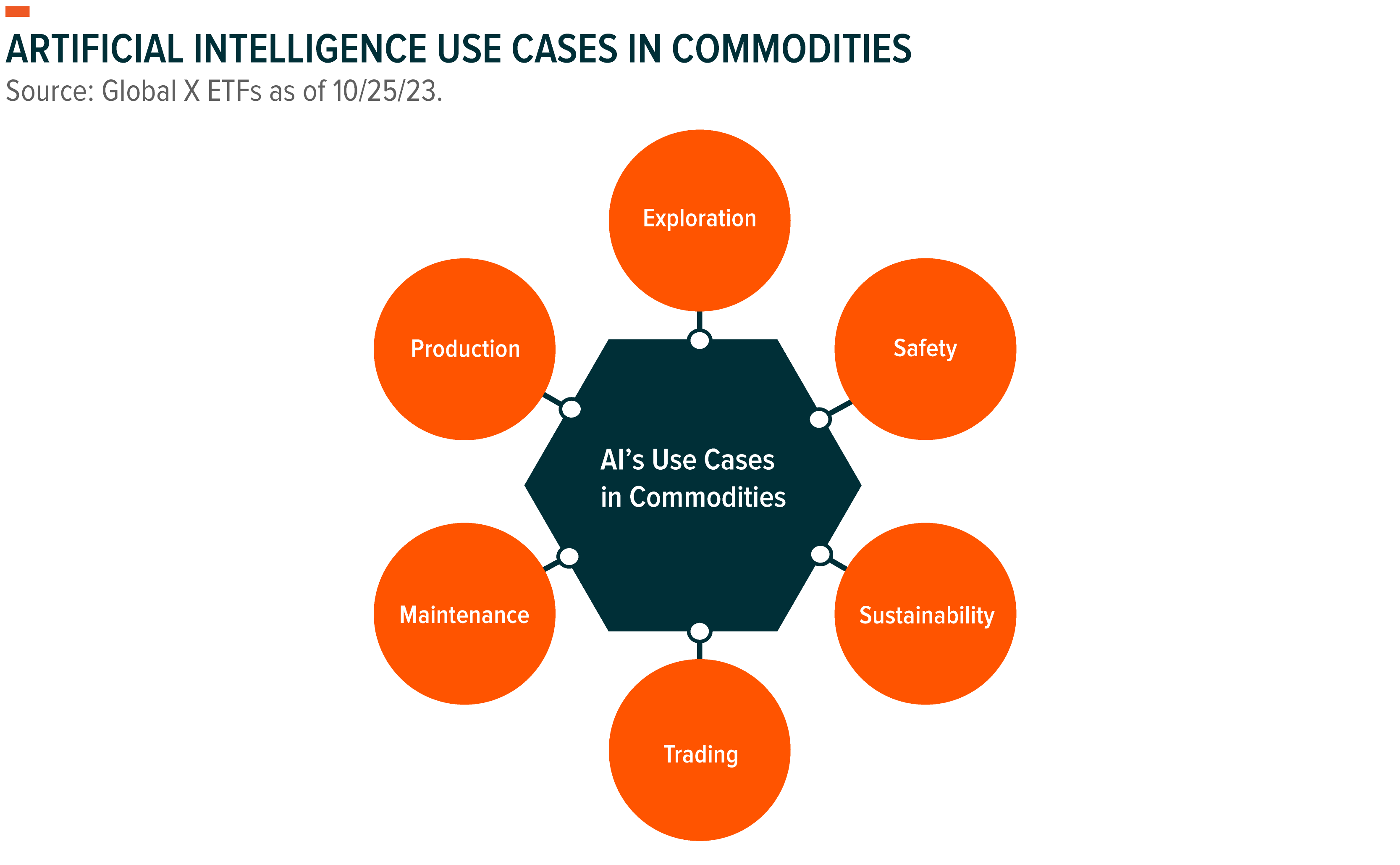

- AI can assist mining businesses in managing system operations, enhancing workplace safety, and improving sustainability, while commodities traders use it to streamline their processes.

AI Joins the Hunt for Copper

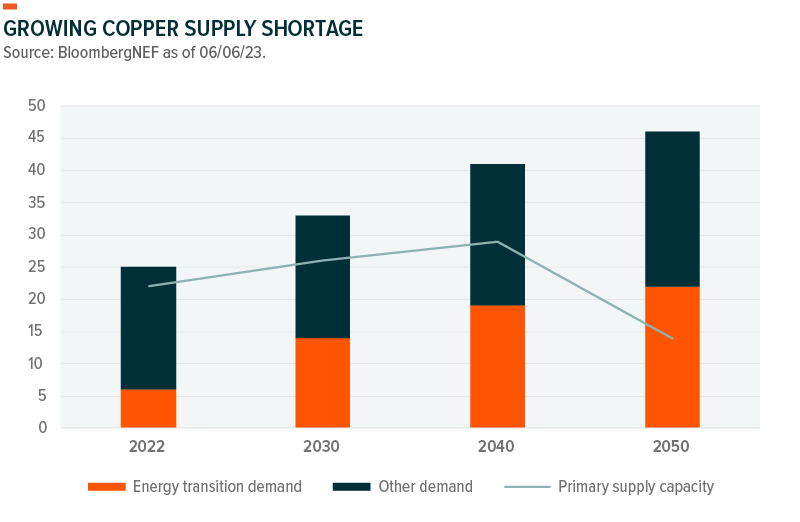

Without greater investment, copper supply will likely struggle to keep up with demand, especially with the bulk of demand likely coming from power grids and transport as decarbonization efforts grow. Primary copper supply was already 4 million tonnes short in 2022, so the need is acute.2 If current reserves are not replaced by new geological discoveries and initiatives, this gap could increase to 32 million tonnes by 2050.3

Several notable copper mining companies are turning to AI to help fill this gap, and more could follow suit in the coming years. In Chile, Codelco is using AI to extract more copper from its ageing mines as suppliers seek to improve efficiency due to a lack of fresh deposits and rising demand. Codelco launched a machine learning-powered digital data centre in 2020 to combat dropping grades, rising expenses, and growing environmental concerns. The state-owned firm said that the platform is helping the company add 8,000 metric tonnes at its century old Chuquicamata mine, the equivalent of $80 million in annual earnings.4

There’s growing reason to believe that a multitude of copper mining companies could use AI in the foreseeable future to optimize specific properties and ores. Australia’s BHP partnered with Microsoft to develop AI and ML solutions to optimize concentrator performance at Escondida, the world’s largest copper mine.5,6

AI can also be used to streamline operations. A computer vision system can be used to inspect products for quality and find flaws, such as faulty pipeline threading or machinery errors. Consequently, artificial intelligence can assist in avoiding such issues and significantly cut costs.

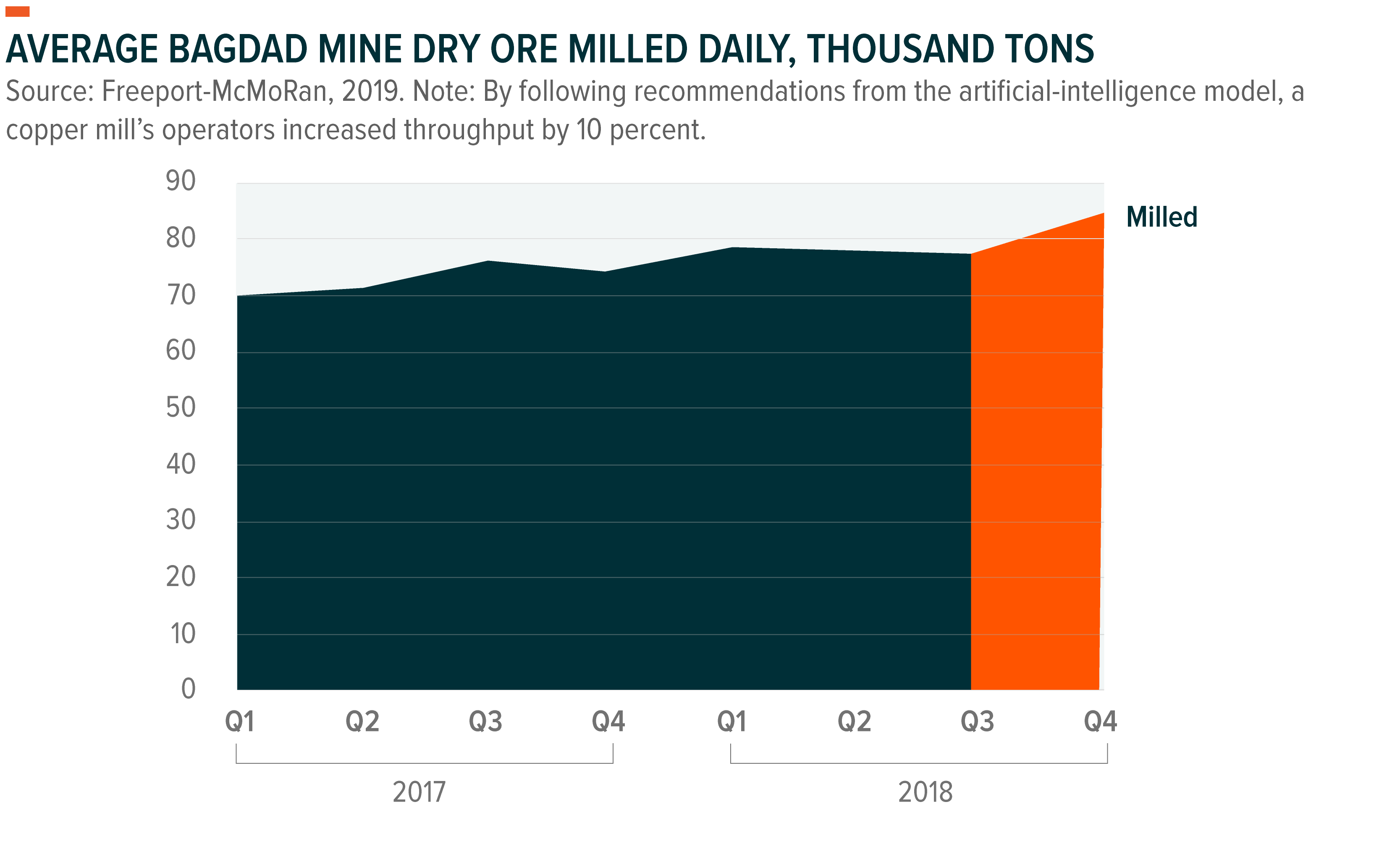

In the United States, Arizona-based mining company Freeport-McMoRan sought operational modifications that would boost copper output without a major financial input. Together with data scientists from McKinsey AI, the company developed a minimum viable product (MVP) optimization model, TROI, that can make recommendations every 12 hours for each of the mill’s two shifts. TROI helped to increase mill production significantly. Following implementation, its copper concentration mills ran at a higher rate without sacrificing efficiency. Throughput at the company’s Bagdad Mine’s hit 85,000 tonnes of ore per day in Q4 2018, up 10% from the previous quarter, while its copper-recovery rate climbed by 1%.7

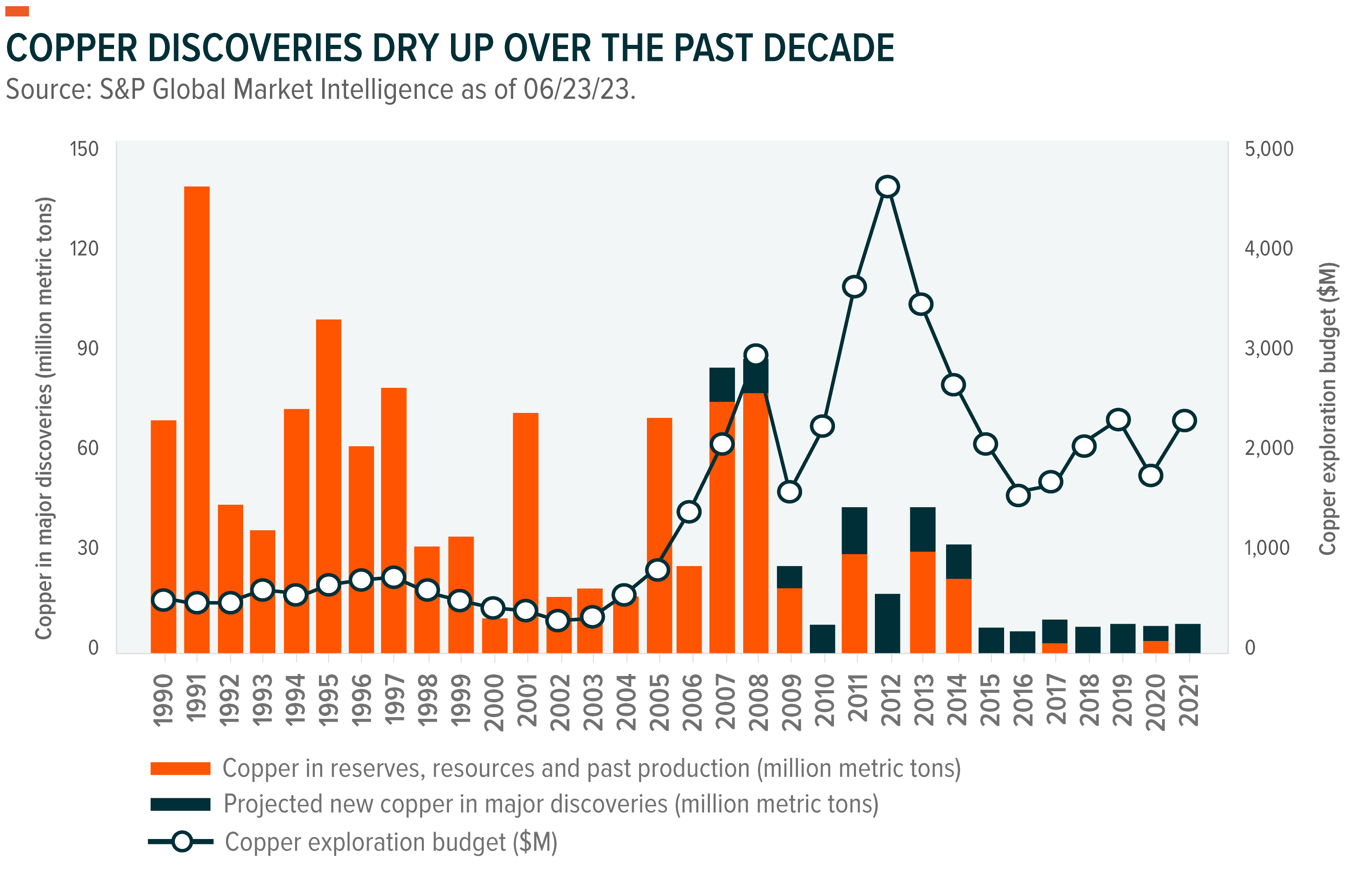

One of the most significant uses of machine learning is in the discovery processes. AI and machine learning improve mineral exploration accuracy and efficiency. AI systems can quickly evaluate geospatial data to find mineral reserves and other resources. Recently, U.S. mineral exploration company KoBold Metals announced in March 2023 that it would complete an economic evaluation on a project in three years by using AI to locate and define hidden copper reserves hundreds of metres deep.8

This and other disruptive technologies like drones replacing expensive and time-consuming fieldwork will most likely substantially speed up the exploration process in the coming years. While still in the early stages, there are many reasons to believe the mentioned copper mining companies will not be one-off instances of AI usage in mining but potentially become more pervasive as the technology advances.

AI Gives Oil and Gas Deep Data Insights

Oil and gas companies continuously assess project risk, whether the project is operational or still in the planning stages. AI is helping industry data scientists extract critical insights from available data much more efficiently. For example, in 2019 IBM teamed with ExxonMobil to modernize well development planning, which includes scaling data to understand how a specific region evolved over time. Historically, preparing and interpreting this seismic data is a painstaking process that takes 12–18 months. However, an AI-powered platform for ExxonMobil cut data preparation time by 40% and planning time from nine to seven months.9

According to observation and anecdote, many oil and gas businesses already rely heavily on AI for data preparation and analysis as part of their exploration and production processes. In 2019, British Petroleum’s venture capital arm, BP Ventures, invested $5 million in Belmont Technology’s Series A funding to boost BP’s Upstream AI and digital capabilities. The investment helps BP’s exploration of machine learning and cognitive computing across its global oil and gas operations. The Houston-based startup created an AI-powered cloud-based geoscience platform that connects and specifies workflows to improve the company’s underground asset picture. BP then interprets the results using AI neural networks to speed up their processes.10

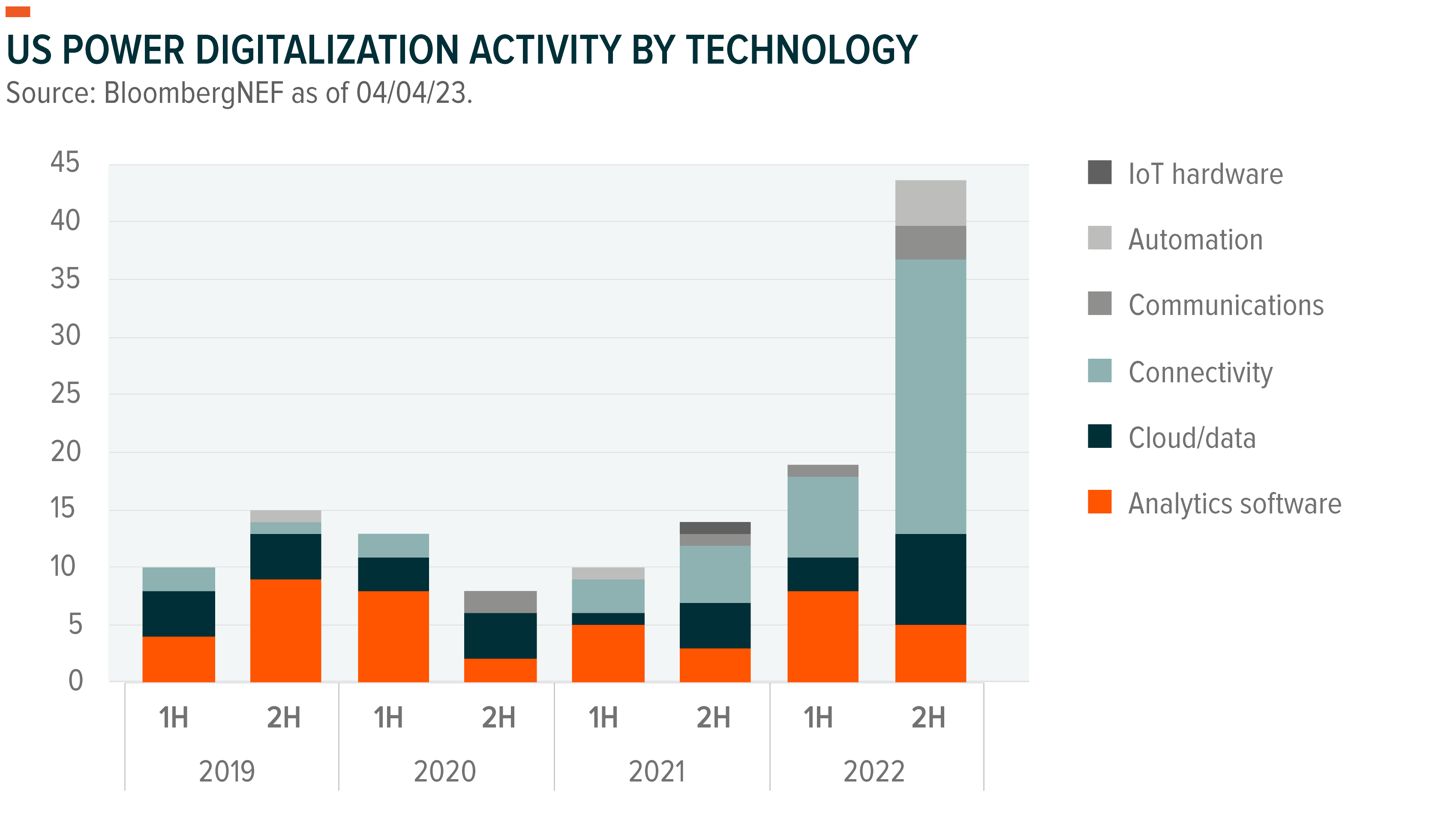

In 2020, Baker Hughes, one of the biggest oil field services firms in the world, and enterprise technology firm C3.ai launched BHC3 Production Optimization. This AI-powered tool lets operators see production data in real time, identify anomalies in the data, predict future production, and optimize operations to boost oil and gas production.11 More broadly, paving the way to more AI applications is already the digitalization in place in the energy sector. In 2022, the US made a turn for the better and became a global leader in the digitalization of the electricity sector, announcing a record number of projects and partnerships.12

Shell is a pioneer in implementing AI. In 2015, the company launched Shell Virtual Assistant, the first AI-powered customer service in the lubricants industry.13 In May 2023, Shell Plc announced that it will deploy Spark Cognition AI-based technology in deep sea exploration and production to enhance offshore oil output by analyzing seismic data. This new technology can cut exploration from nine months to nine days.14

Looking forward, AI is about to transform oil & gas. All the top 20 global oil and gas producers, whether state-owned or public, have an AI strategy for their upstream, downstream, and midstream businesses. EY found that 92% of oil and gas businesses worldwide are “either currently investing in AI or plan to in the next two years.”15

AI’s Use Cases Include Mining System Monitoring, Workplace Safety, and More

AI can help mining companies oversee system operations. At Boliden’s Garpenberg mine in Sweden, robotics company ABB’s System 800xA automation platform coordinates sub-operations long considered independent activities by controlling its strong mill motors, hoists, and high-voltage transformers.16

Predictive maintenance systems use machine learning algorithms to evaluate sensor data from machines to foresee when repairs will be necessary, drastically cutting down on unscheduled downtime while simultaneously boosting productivity. These algorithms can also identify patterns and root causes of machinery breakdowns, allowing for more proactive maintenance. By using these tools, mines can improve their decision-making and streamline their processes.

AI can be a tool to improve workplace safety. Mines are now safer than ever because of improved health and safety standards. AI, which predicts failures and reduces accidents, is accelerating this change. Wearable sensors using AI can identify physical discomfort, sleepiness, and exhaustion in workers.

Machine learning can forecast and prevent catastrophic failures by recognizing failure symptoms, reducing repair costs and operator risk. Global Data analysts surveyed 138 mines between December 2021 and February 2022 and found that collision avoidance, fatigue detection, and remote-control vehicle technology were the top priorities for investment over the next two years.

Sustainability is an area of mining’s interest in AI. Although mining is inherently destructive, the use of AI has already significantly mitigated the industry’s detrimental effects on the environment. For example, Vale has an AI-based initiative that minimizes off-road truck fuel usage at the company’s units that is estimated to reduce CO2 emissions by around 74,000 tonnes per year. The strategy can help Vale cut direct and indirect emissions by 33% by 2030.17 Computational techniques and machine learning are demonstrating their strategic utility, with diverse applications ranging from studying the impact of land use changes on climate to advancing the development of high-performance materials that contribute to the attainment of the ‘net-zero’ objective.

The commodity trading world is another area for AI as organizations look to streamline their business processes. Integrating AI and ML with commodity trade and risk management (CTRMs) systems can facilitate complicated price forecasting, logistics data validation, and real-time trend detection for receipt and delivery. Now may be a particularly opportune time for commodity enterprises to leverage the analytical insights and business optimization that AI and ML provide, given the added complexities of the energy transition and the rising frequency of significant market disruptions.

Conclusion: The Commodity Supply Chain Is Ripe for AI

Commodities companies are already reaping benefits from implementing AI into their operations, and we expect more companies to prioritize investment in AI solutions to find new efficiencies and to stay competitive. In our view, the mining and oil and gas sectors offer investors a unique way to capture AI’s growing influence, especially its assistive role in the energy transition. Investing in commodities can present challenges, more so than other asset classes, due in part to swings in underlying spot prices. We believe for investors an exchange-traded fund (ETF)’s basket of securities can mitigate these risks while providing investors exposure to a multitude of AI use cases across the commodities spectrum.