Equity Income Whitepaper

Challenges of Higher Inflation and Interest Rates

Inflation has reached levels not seen in 40 years, pressuring the Federal Reserve (Fed) to raise interest rates and reduce their balance sheet. Expectations currently range between five to seven 25 basis-point policy interest rate increases in 2022 as of 3/2/2022. As we transition into a higher interest rate environment, investors will need to be more selective in portfolio positioning. Fixed income investors, particularly those with long duration exposure, may be negatively impacted by the prospect of higher interest rates and more persistent inflation. This creates a challenging environment to obtain yield with traditional fixed income securities while favoring alternative sources of income. This whitepaper outlines current macroeconomic and market conditions for equities and fixed income products while suggesting potential yield-focused solutions.

Key Takeaways

- Investors currently prefer profitable and income generating equities.

- Equity income products provide solutions that are well-suited to the current macroeconomic environment.

- CPI Inflation expected to stay elevated through this year and expected to normalize towards 2% long term.

- Between five to seven policy rate hikes are expected in 2022.

- Geopolitical tensions and war could dampen rGDP growth prospects globally.

Macroeconomic Challenges for Traditional Yield

After two years of pandemic-induced easy monetary policy, we’re back to a rising rate environment due to exceptionally high Consumer Price Index (CPI) and Producer Price Index (PPI) readings, a tight labor market, positive but slowing earnings growth, and wider credit spreads. All these variables combined make for a challenging environment for investing in fixed income.

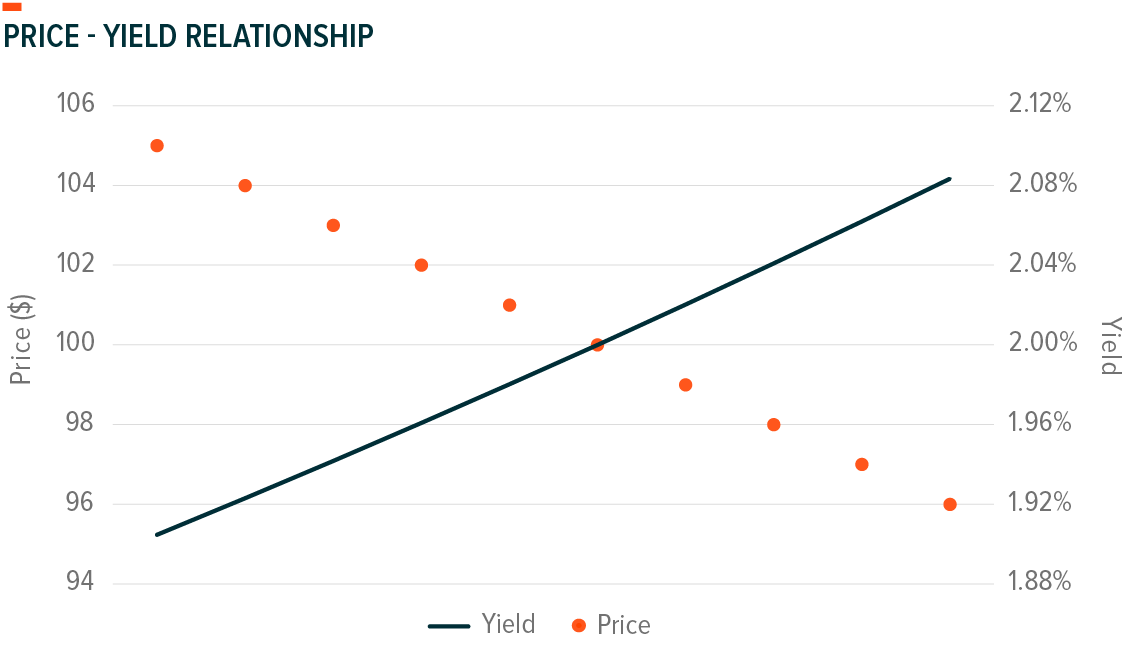

When Rates Go Up, Bond Prices Go Down

This simple phrase is an incredibly effective way to explain the complex relationship interest rates have with bond prices. It works as follows: Let’s say you have a bond that pays a fixed 2% every year. You bought it when 2% was the standard rate in the market. And now you have 5 years until it matures, and you receive your principal back. All that sounds great. But now, let’s assume the standard rate in the market rises to 3% because that’s what investors require in the current economic environment to let companies, or the Treasury borrow their money. If 3% is now the norm, your 2% bond with 5 years left to mature seems a lot less appealing to another investor. Even worse would be if that bond had 10 years to mature, i.e., a longer duration bond. This rate increase causes your bond to lose pricing power and some of its value because you must incentivize another investor to buy it from you by reducing the price to compensate for the lower yield it pays. This is what is currently happening to fixed income securities as we transition from easy to tighter monetary policy.

Conditions Dampen Macroeconomic Outlook for 2022

Inflation pressure, supply chain issues, and reduced economic activity due to Omicron dampened Q1 2022 real GDP (rGDP) expectations to around 2.25%.1 These headwinds reduced 2022 rGDP growth expectations from roughly 4% to 3.6%.2 Fed actions to control inflation could detract from economic activity, potentially increasing the risk of minimal to no economic growth, or even worse, a decline in nominal economic growth with elevated inflation.

Elevated energy prices are a significant driver of higher consumer prices. The Russia-Ukraine War and the sanctions on Russia will cause energy prices to stay elevated, pushing up longer-term inflation expectations. While the war may result in further supply chain disruptions and impact longer-term inflation expectations, higher energy prices and increased uncertainty may reduce consumer sentiment and aggregate demand when adjusted for inflation.

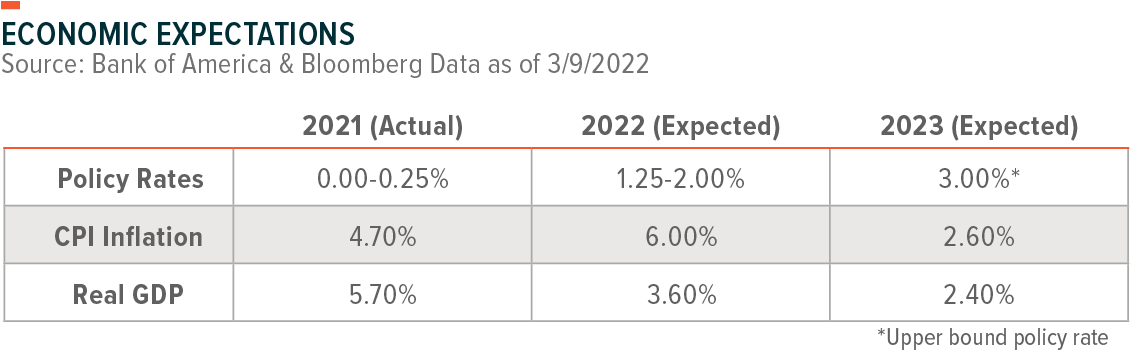

The market is estimating between five to seven interest rate increases in 2022 to bring policy rates between 1.25-2.00% by year-end (as of 3/9/2022 ) after closing 2021 at 0.00–0.25%. 1.25% would be the lower bound of five rate hikes, and 2.00% would be the upper bound of seven rate hikes. More persistent pricing pressure increased expectations for higher policy rates. CPI is expected to rise from 4.7% in 2021 to 6.0% in 2022, which remains well above the Fed’s 2% target. Longer-term inflation expectations remain anchored near 2%, with CPI expected at 2.6% for 2023.3,4 Additionally, longer-term inflation expectations remain capped as supply chains bottlenecks are expected to normalize towards the end of 2022.

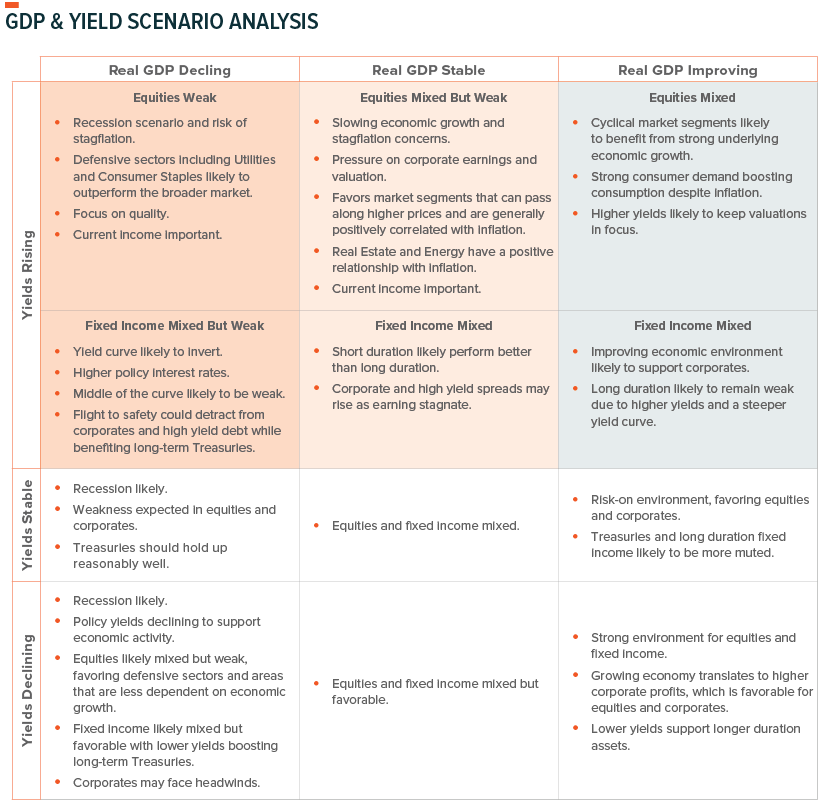

Positioning for Higher Policy Rates with Slow to No Real Growth

The scenario table below outlines the typical relationship between key asset classes and economic variables. Given the current environment, interest rates can only go up, so the main variable is what happens with rGDP in 2022 and 2023. As such, the “Yields Rising” section of the table highlights the most likely scenarios.

Currently, our default scenario is rising yields and slow to stable rGDP. However, when considering positioning, there are applicable elements from the least favorable scenario: rising yields and declining rGDP. Investors had to reassess global GDP growth expectations after Russia invaded Ukraine. The effects on global trade, commodity prices, and further disruptions to supply chains are now in flux. The length of the conflict will ultimately determine the impact to the global economy.

- Inflation pressure requires some cyclical exposure, particularly in segments that can pass along higher prices, such as Real Estate and Energy.

- Defensive exposure and a greater focus on quality would fare better through economic shocks.

- Current profitability and consistent dividend distributions to shareholders are critical.

Equity Income Opportunities

Equity income presents numerous solutions that are well-suited to generate yield in the current environment. Solutions include covered call strategies that benefit from rangebound markets and lower beta solutions such as preferreds. Yield can also be achieved through targeted common equity exposure. The next few sections provide detail on the opportunities available to investors in the equity income space.

Covered Calls & Collars Offer Differentiated Yield

Covered calls perform best when markets are rangebound. The way it works is that a fund writes (sells) call options on a specific index, either the S&P 500, Nasdaq 100, or Russell 2000. The income from selling the options is paid out to investors in the form of yield. Investors have full exposure to the downside, as the calls expire worthless in a down market. And they have capped exposure on the upside, as the underlying can be called away. When volatility rises, the premium received rises to compensate for the higher volatility in the market.

In a reasonably tight range, covered calls benefit from receiving the premium income and a potentially small improvement in the underlying equities, while not having the underlying called. In a rising market, covered calls typically underperform the overall market due to the underlying being called away, which affects the capital gain return, not the income return. In a declining market, covered calls provide a small buffer of protection due to their premium income.

For investors looking for downside protection in a declining market, a collar strategy can be appropriate. Like a covered call strategy, calls are sold on an index like the S&P 500 or Nasdaq, but with a collar, puts are also purchased on the index. The risk/reward tradeoff is a lower yield relative to the covered call on its own. However, the downside protection might be more prudent, depending on short-term views about the current environment.

Preferred Equity Has Equity and Fixed Income Characteristics

Within the capital structure, they are above common stock and below bondholders. Preferred equity investors receive dividend income before common equity investors do. They can either have a fixed or variable yield, and they are usually issued by financial corporations. In addition, yield from preferred stocks can be treated as qualified dividend income (QDI) instead of ordinary income, resulting in favorable taxation.

We like preferred equities due to their position on the capital structure and lower beta. Their lower sensitivity to equity market price movements helps contribute to lower level of volatility relative to common equity. Given the rising rate environment, we like variable preferreds because they can capture a higher yield and avoid price compression relative to fixed rate preferreds. Compared to an asset class like high yield bonds, preferreds offer higher credit quality while providing similar yield.

Common Equity Yield Opportunities

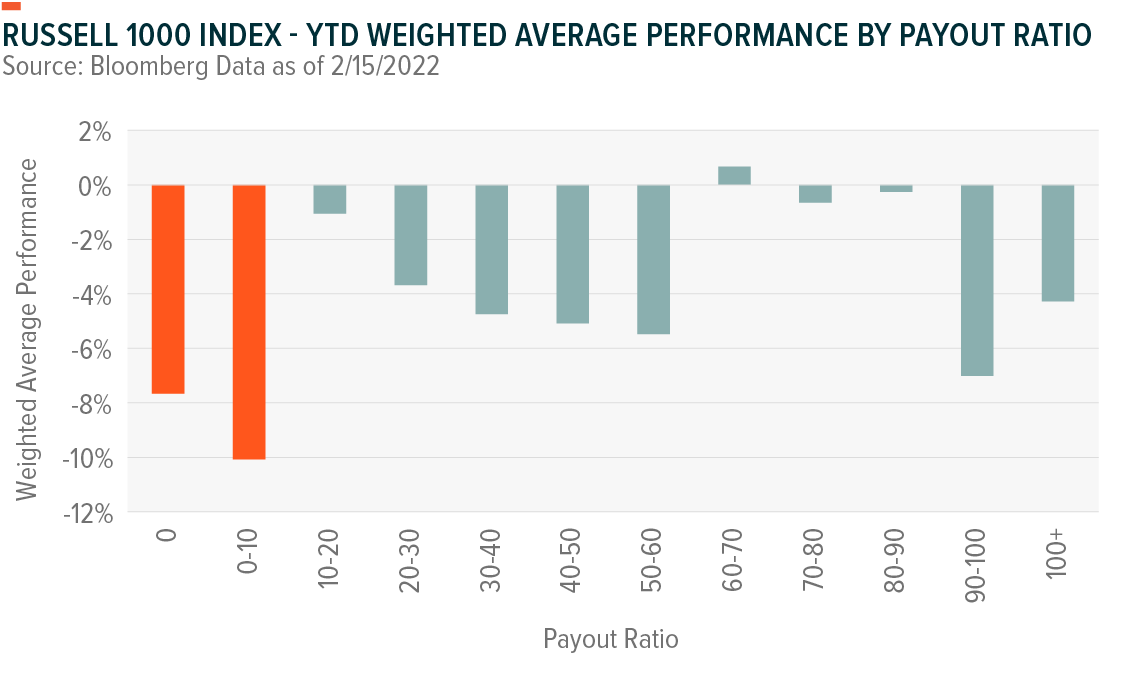

Value and dividend yield have been the most rewarded factors according to Bloomberg’s Factors to Watch year to date and on a 1-year basis. This analysis looks at long positions on the 20% of S&P 500 Index members with the highest factor exposure and short positions on the 20% with the lowest factor exposure.5 Currently, dividend-paying companies show historically low leverage, attractive EPS stability, and depressed dividend payout ratios, all of which make them attractive vehicles to invest in at a time when positive earnings are increasingly important.6 This dividend focus aligns with our view that the macroeconomic environment currently favors shorter duration and higher quality equities, the types of companies that historically pay and grow their dividends.

Building on this view, we analyzed the underlying companies in the Russell 1000 Index to determine if payout ratios affected YTD performance.7 We separated them into segments: 0% payout ratio, 0–10% payout, 10–20% payout, and so on until 90–100% and then 100%+. As the chart shows, the weakest segments of the Russell 1000 Index are those with minimal to no dividend yield and segments with potentially less sustainable payout ratios. Companies that don’t pay a dividend comprised about 30% of the Russell 1000 Index but contributed almost half of the YTD decline. The 0–10% segment, which makes up about 5% of the index, contributed almost 10% of the index’s decline.

Payout ratios differ across sectors, so some of this performance bucketing reflects sector-specific areas of weakness or relative strength. The Communication Services, Consumer Discretionary, and Information Technology sectors largely drove weakness in the low payout ratio sections. The Real Estate sector was mostly responsible for weakness in the 90–100% segment. Historically, Real Estate has the strongest negative relationship with rising 10-year Treasury yields. In line with history, Real Estate was the weakest sector during this 6-week period where Treasury yields rose sharply from 1.51% to 2.04%.8

Some S&P 500 Sectors Are More Likely to Pay Out Dividends Than Others

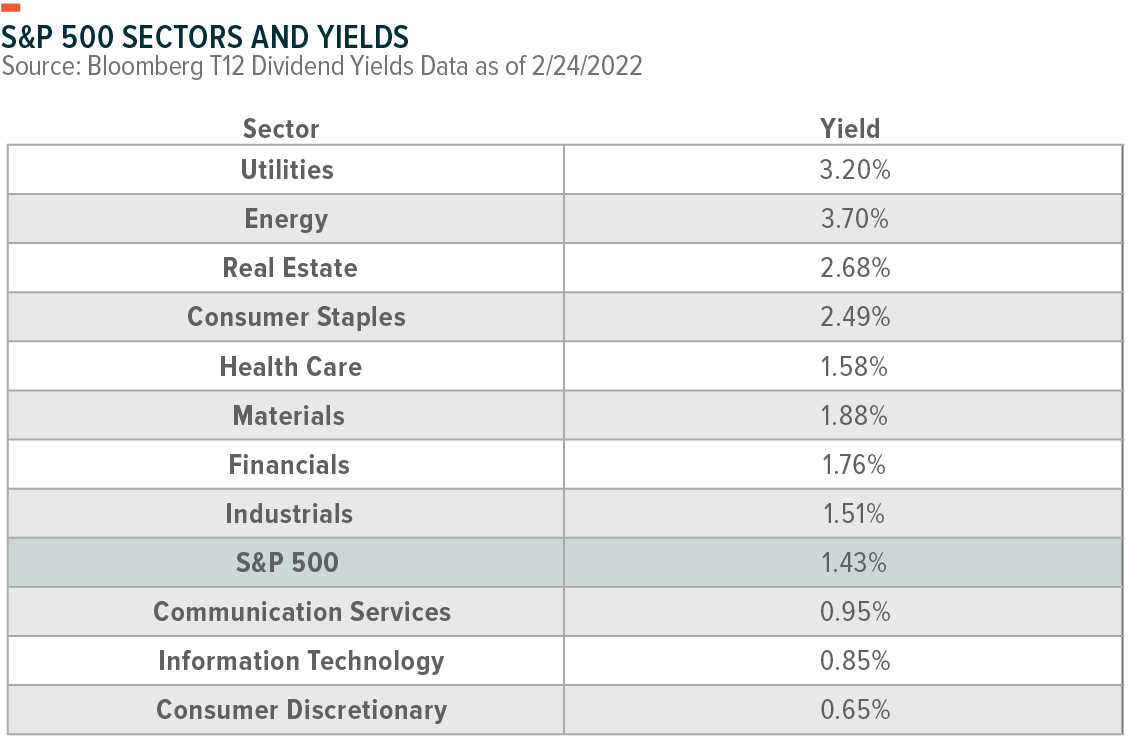

When searching for equity income across sectors, we prefer more established companies that generate a steady stream of cash flow, can cover their reinvestment capex, and pay out a reasonable amount of earnings. The table below lists the current dividend yields by S&P 500 sector. We like Utilities for their recession-proof characteristics and 3.2% dividend yield. However, higher yields and inflation negatively impact his sector. We favor Energy and selective Real Estate for their positive relationships with inflation.

High Dividend Yield, MLPs & REITs

Energy has been on a tear since 2021. Prices are at all-time highs due to surging demand as the economy reopened and people re-engaged, and due to disruptions from the geopolitical tensions with Russia and their war with Ukraine. Russia is one of the largest oil producers in the world, providing about 10% of global oil. Russia is also the second-largest producer of natural gas, providing Europe about 40% of their natural gas. If it continues, BofA Securities estimates crude prices have the potential to move into the $110–120/barrel range.9 We expect energy prices to remain elevated until supply and demand can normalize, which is a near-term positive for MLPs and the Energy sector.

Master Limited Partnerships (MLPs), which cover exploration, storage, and distribution of energy like crude and natural gas, can profit from higher energy prices. MLPs tend to have high yields because of the way they are structured from a taxation perspective. MLPs must distribute 90% of their income in the form of dividends to maintain their preferred tax treatment, which includes no federal or state taxes, similar to REITs.

Real Estate Investment Trusts (REITs) are companies that own or finance real estate across different property sectors. Like MLPs, REITs must distribute about 90% of their income in the form of dividends to keep their preferred tax status, so they tend to pay a higher-than-average yield. One of the benefits of REITs is that they cover a wide scope of property types, which helps investors maintain their real estate exposure through different phases of the business cycle. For example, office REITs tend to benefit when employment rises. Residential REITs benefit in areas and times of population growth. Healthcare REITs benefit from an aging population. Mortgage REITs hold mortgages and mortgage-backed securities (MBS) on their balance sheets and profit on the spread between their income earned and the interest paid on their assets.

Investors can also find higher than average dividend yield opportunities within the telecommunications industry of the Communication Services sector. Companies in this space are older, well-established, and have a history of paying above-average dividends.

Quality Dividends

BofA Securities research shows that Fed hikes designed to control inflation aren’t necessarily negative for equities. Historically, stocks with attractive and healthy free cash flow to enterprise value (FCF/EV) or free cash flow to price (FCF/P) have the highest returns during hiking cycles.10 These blue-chip companies fall into the quality dividends category, as they are likely to maintain their dividends across varied economic environments.

We view this segment as a core strategic holding given its focus on profitable growth and quality value. These companies typically provide a lower payout ratio relative to high yield equities, focusing on consistent dividends and dividend growth despite the economic environment. Quality dividend typically produces a lower yield, but it is less sensitive to economic growth. As a result, it usually displays lower beta, so quality dividend-paying companies tend to fare better in market downturns than their high yield equity counterparts.

Holistic Approach for Higher Yields, Especially in This Environment

Finding high yield is important, but so is the approach. In our view, it is essential to take a holistic approach that considers the sustainability of the yield and the investment from a total return perspective. Equity income solutions can fall into similar sectors and segments of the market, and they can be affected by similar economic and market factors. Diversification among equity income strategies is critical. It’s just as critical to round out the exposure with positions that can provide total return in environments where value and dividend exposure is out of favor. In line with this, we advocate incorporating sector and industry exposures that are systematically lacking within traditional equity income portfolios. These exposures can be increased or decreased based on market conditions.

In this environment, traditional fixed income will be tricky to navigate from yield and total return perspectives as policy rates rise and economic growth and margin uncertainty put upward pressure on corporate spreads. Elevated inflation makes cyclical sectors that can pass along higher prices attractive, such as Energy and Real Estate. However, with rising pricing pressure, aggressive Fed action could dampen consumption and real economic growth. Given certain unknowns like higher inflation and Fed action, adding quality dividend and/or preferred equity exposure can improve diversification while reducing sensitivity to economic growth. Investors with negative short-term equity views can pair quality dividend and/or preferred exposure with collar strategies that balance income with downside protection. For investors expecting a more rangebound market, covered calls can be a high yield option that also diversifies a portfolio’s yield. Although the economic outlook includes some dark clouds, well suited equity income solutions provide a silver lining.