Global X Covered Call Report: August 2022

Editor’s Note: Please see the glossary at the end for all terms highlighted in sea green found in the order that they appear.

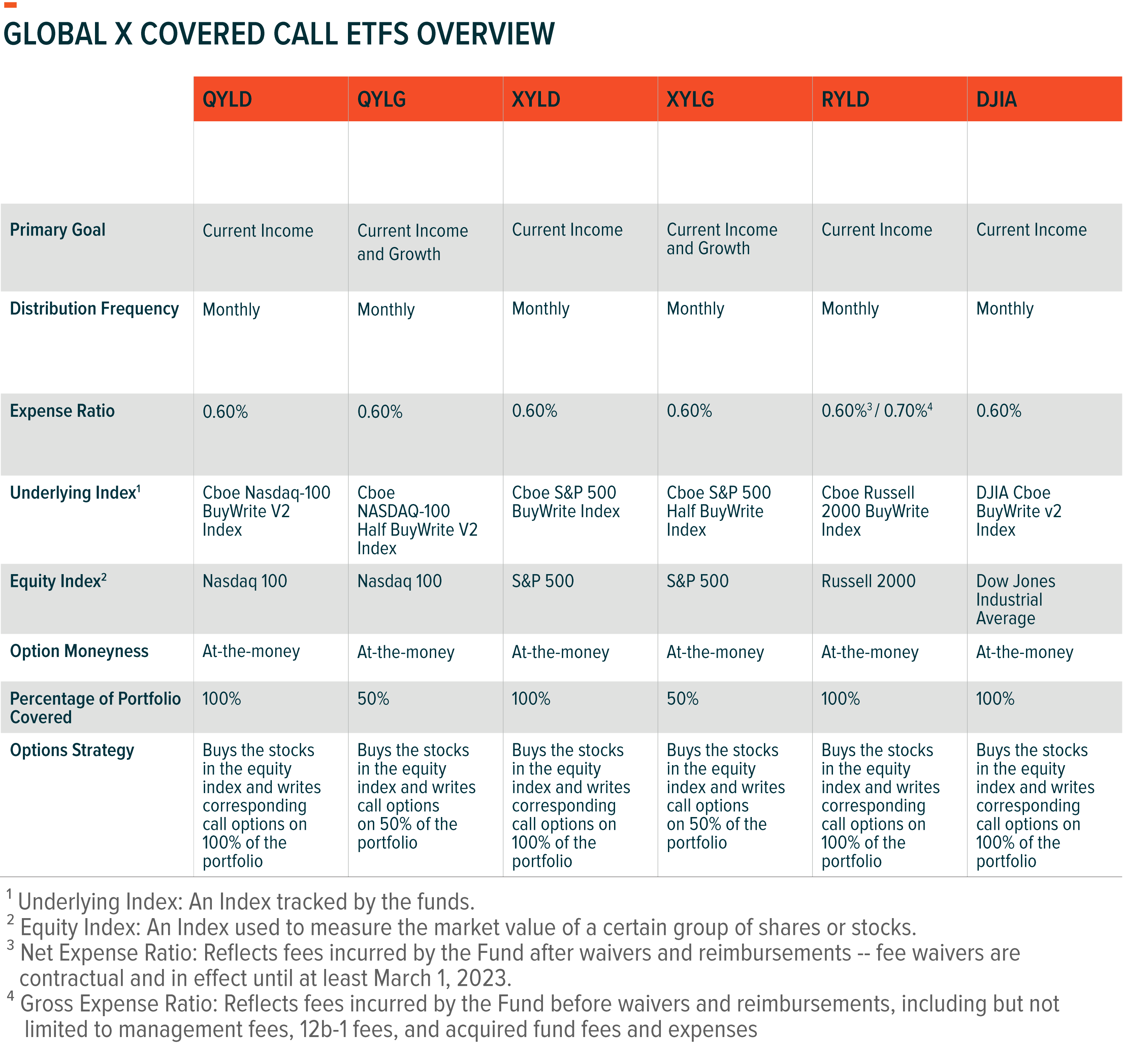

The Global X Research Team is pleased to release the distribution and premium numbers for our covered call ETFs for August. Global X’s Covered Call suite of ETFs invest in the underlying securities of an index and sell call options on that index. These strategies are designed to provide investors with an alternative source of income, while offering different sources of risks and returns to an income-oriented portfolio.

Click here to download the August 2022 Covered Call Report

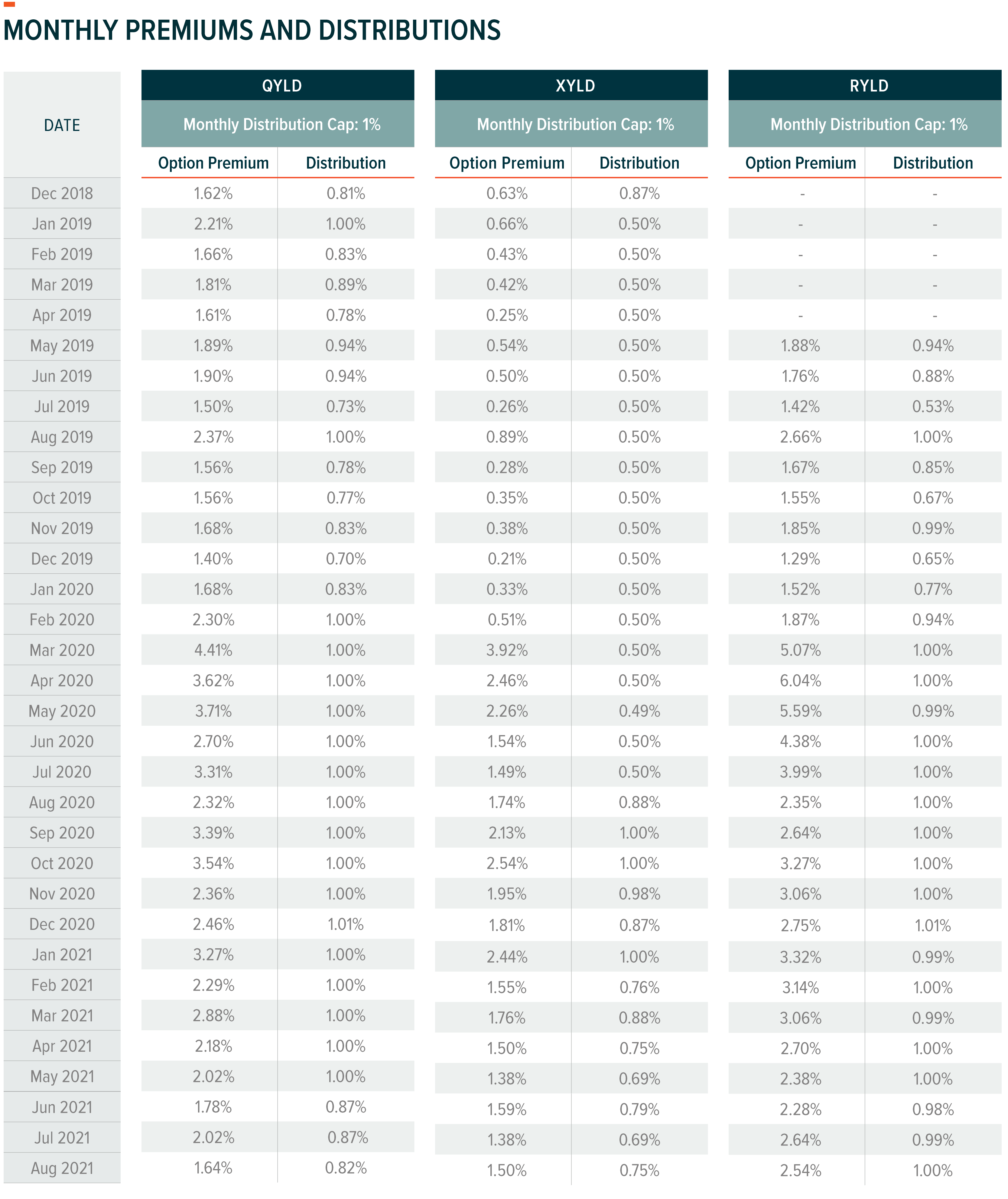

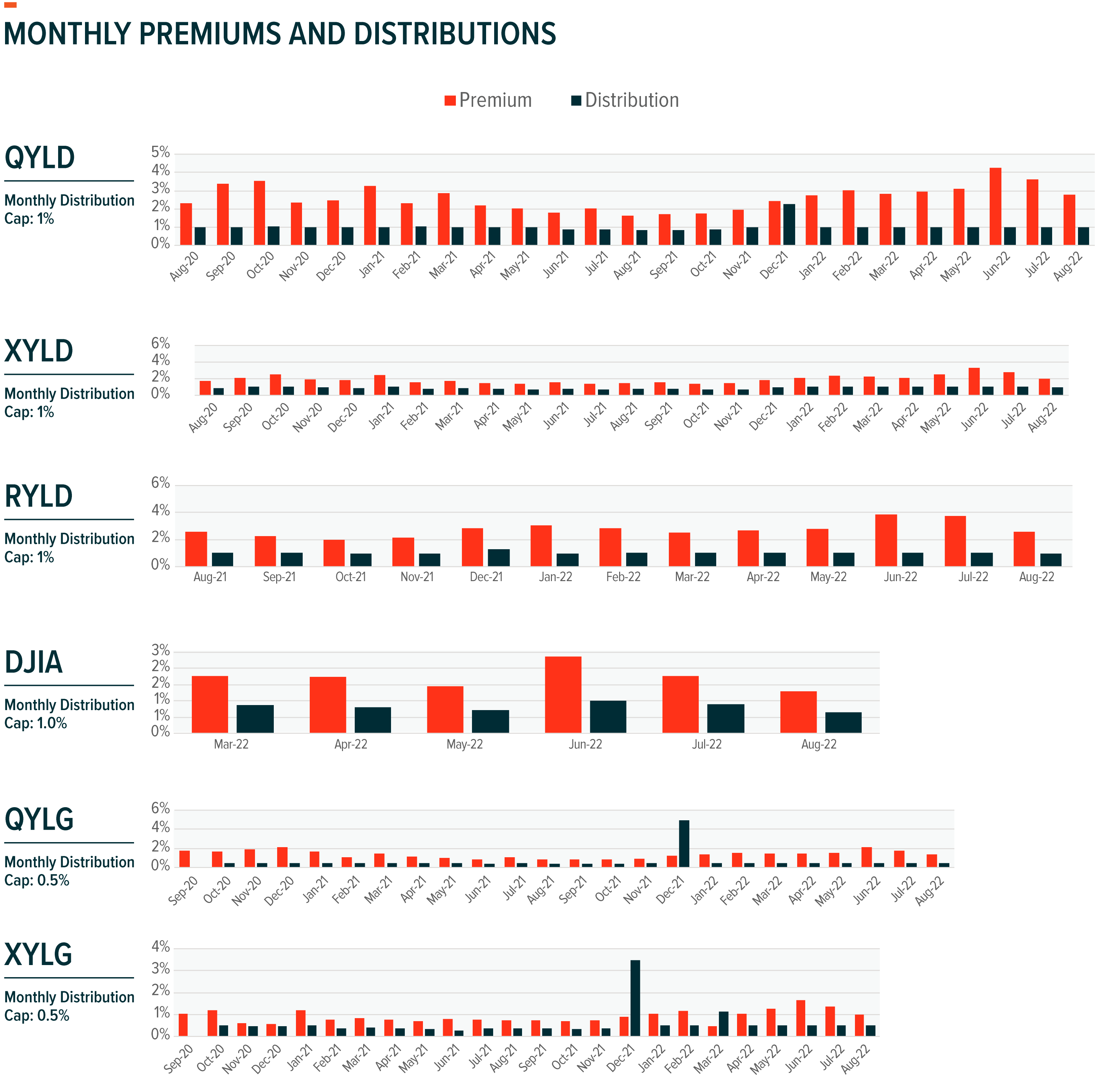

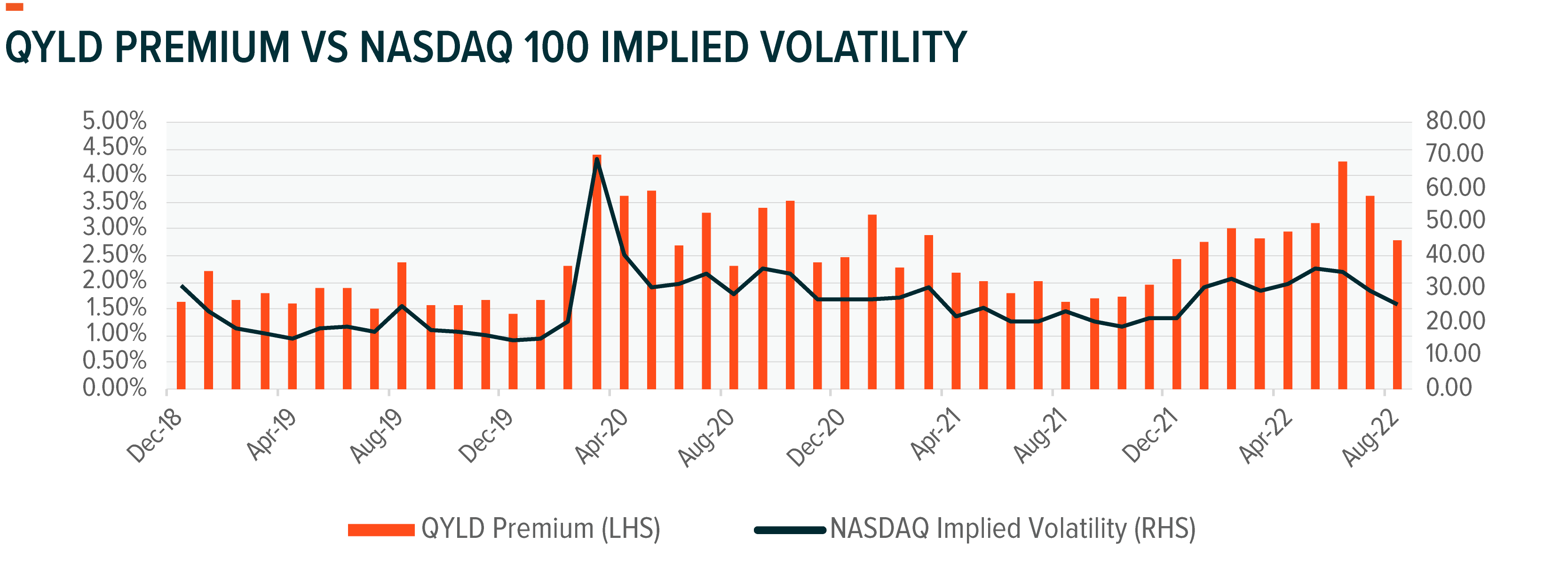

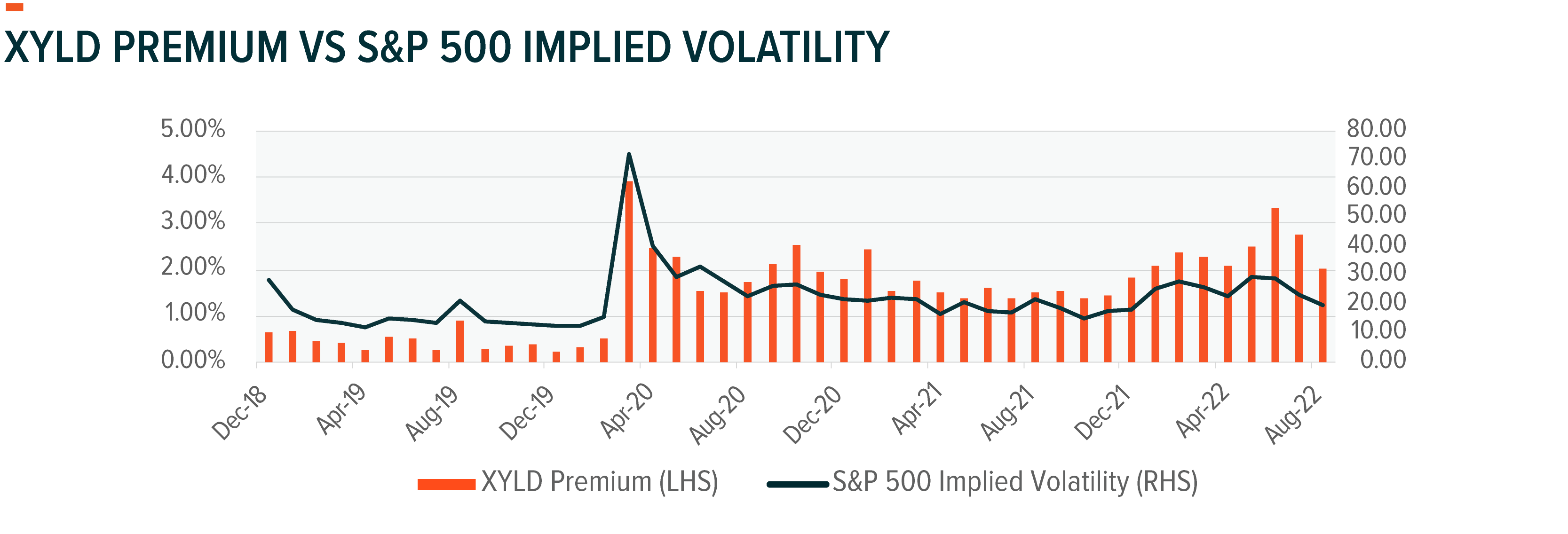

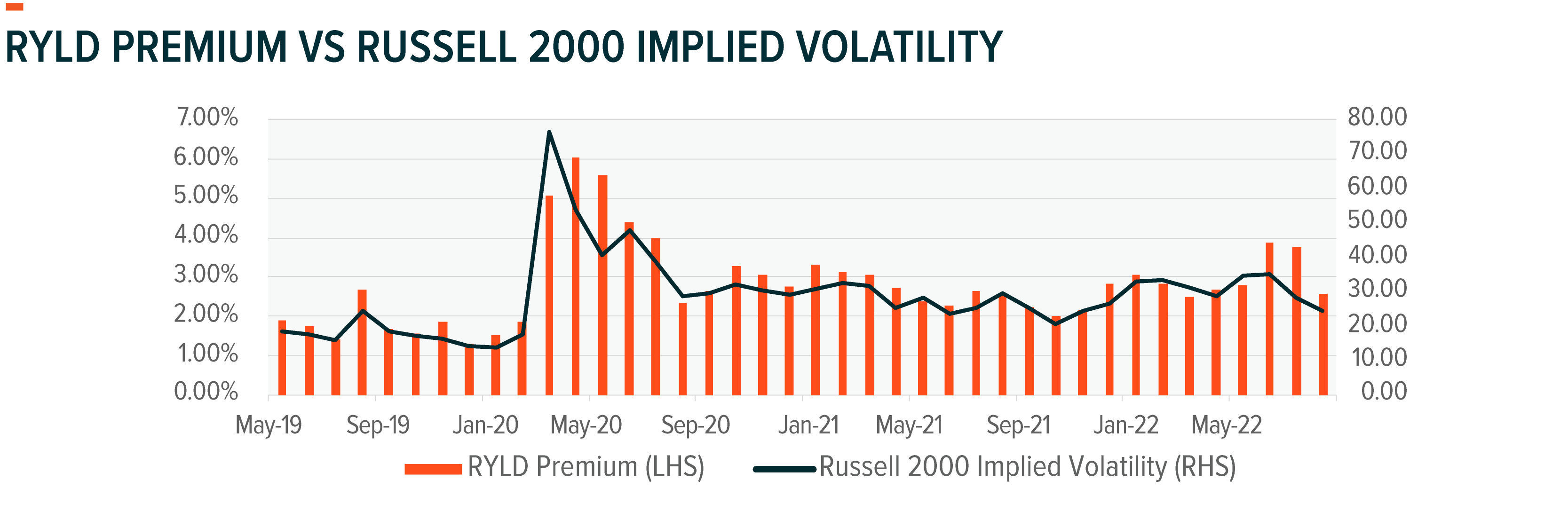

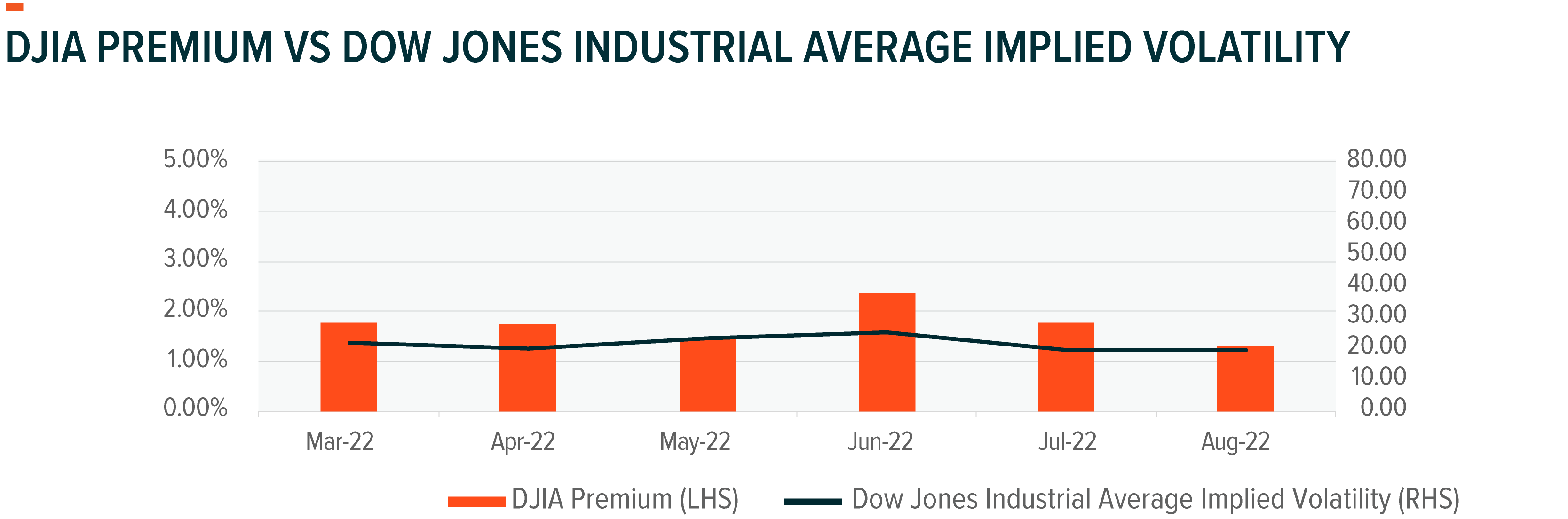

In the month of August, the VIX increased from 22.84 to 25.87. This relatively elevated volatility level compared to historical averages led to higher premium levels in the month of August for our covered call funds. For instance, QYLD had an August premium of 2.78%. However, volatility is still below where it was in the late spring and early summer months, as markets have now become accustomed to the Federal Reserve’s rate hiking path, and their reinforcement of current policies. In the month of August, treasuries also sold off, with 10yr yields rising to 3.20% from 2.65%. Major indexes like the S&P 500, Nasdaq 100, and Russell 2000 all sold off in the month of August, with the Nasdaq 100 leading the pack down over -5.1%. This compares to a -4.1% decline for the S&P 500 and -2.1% decline for the Russell 2000 in that time span. With the pressure that rising rates has put on equities, this has subsequently led to this increased volatility in the market, leading to a continuation of elevated options premiums on covered call writing strategies relative to historical norms.

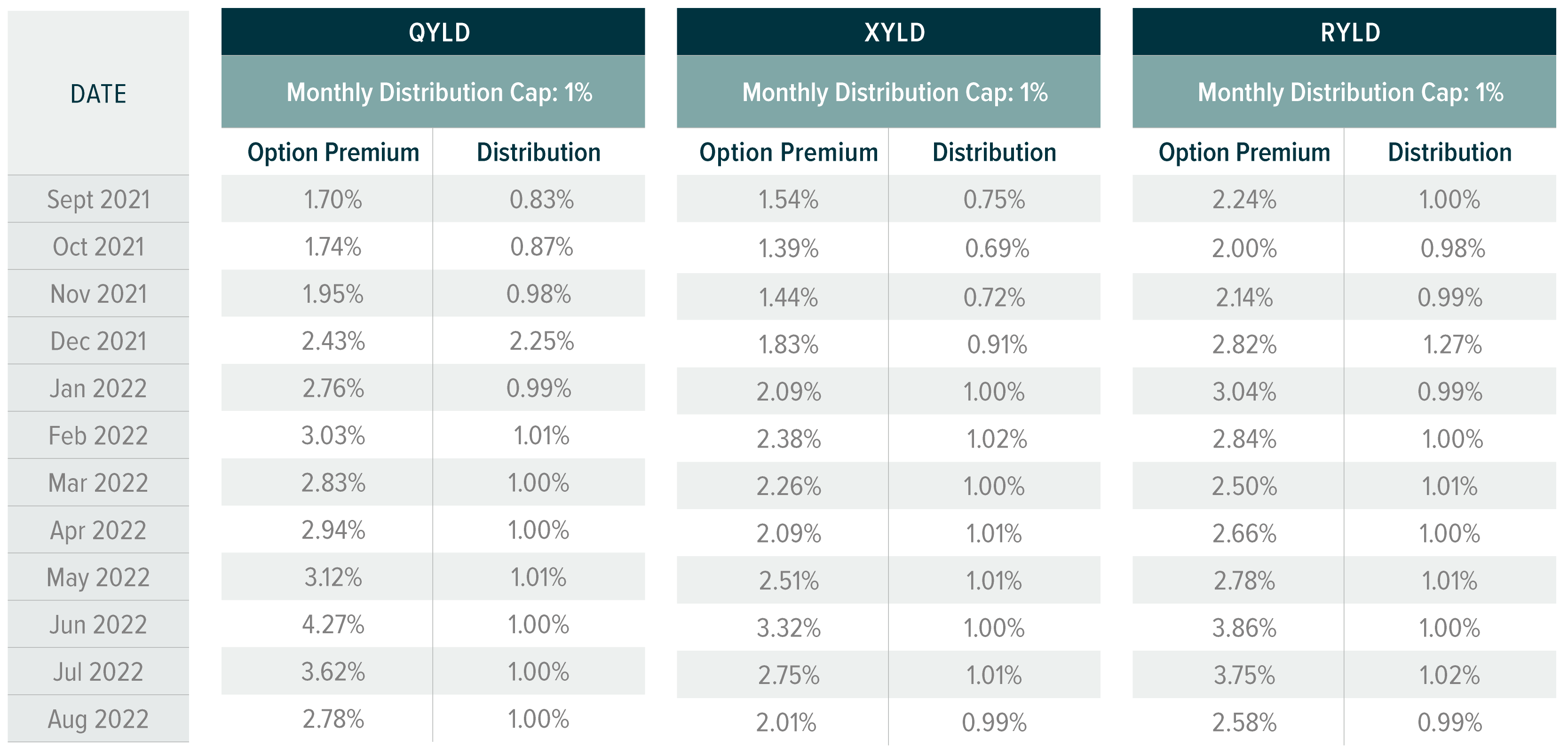

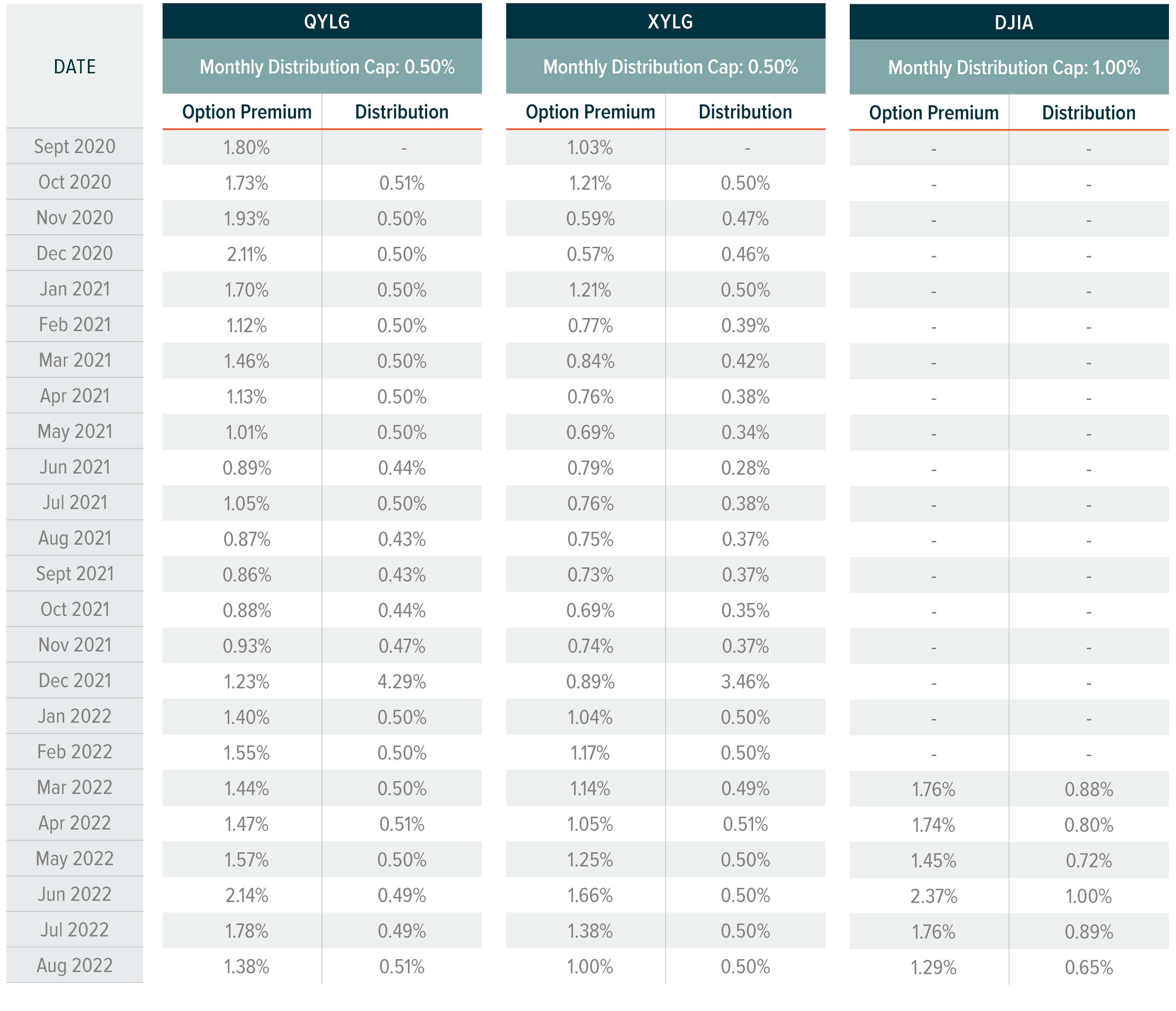

As a general guideline, the monthly distribution of each fund is capped at the lower of: a) half of premiums received, or b) 1% (for QYLD, RYLD, XYLD and DJIA)/0.5% (for QYLG and XYLG) of net asset value (NAV). The excess amount of option premiums received, if applicable, is reinvested into the fund. Year-end distributions can exceed the general guideline due to capital gains that are paid out at the end of the year.

Fund Premiums and Implied Index Volatility

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about our covered call options, read the latest research from Global X, including:

- QYLD: A Covered Call Strategy for Rising Yields

- Covered Call Strategies, Explained

- Income Outlook: Q3 2022- Record Inflation Continues to Drive Markets

Related ETFs:

QYLD: The Global X Nasdaq 100 Covered Call ETF follows a “buy-write” (also called a covered call) investment strategy in which the Fund buys a basket of stocks, and also writes (or sells) call options that correspond to the basket of stocks. The Fund uses this strategy in an attempt to enhance its portfolio’s risk-adjusted returns, reduce its volatility, and generate monthly income from the premiums received from writing the call options.

XYLD: The Global X S&P 500 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on the same index.

RYLD: The Global X Russell 2000 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys exposure to the stocks in the Russell 2000 Index and “writes” or “sells” corresponding call options on the same index.

DJIA: The Global X Dow 30 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Dow Jones Industrial Average (also known as the Dow 30 Index) and “writes” or “sells” corresponding call options on the same index.

QYLG: The Global X Nasdaq 100 Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on approximately 50% of the value of the portfolio of stocks in the same index.

XYLG: The Global X S&P 500 Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on approximately 50% of the value of the portfolio of stocks in the same index.

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.