Is It Time to Add Gold and Silver to Your Portfolio?

As trade wars, geopolitical risks, and dovish central banks, dominate 2019’s macroeconomic backdrop, precious metals like gold and silver are re-emerging as an attractive asset class. In this piece, we explore why investors may want to consider adding gold and silver to a portfolio in the context of the current environment.

Summary

- Trade tensions & geopolitical risks have investors looking for asset classes that may perform better in an economic slowdown

- Dovish central bank policies are expected to lower global interest rates, which reduces the opportunity cost of owning precious metals

- Valuations for precious metals appear attractive compared to historical levels

- There are a variety of ways to gain exposure to precious metals, each with their own unique characteristics, costs, and tax consequences, which investors should consider

Trade Tensions & Geopolitical Risks

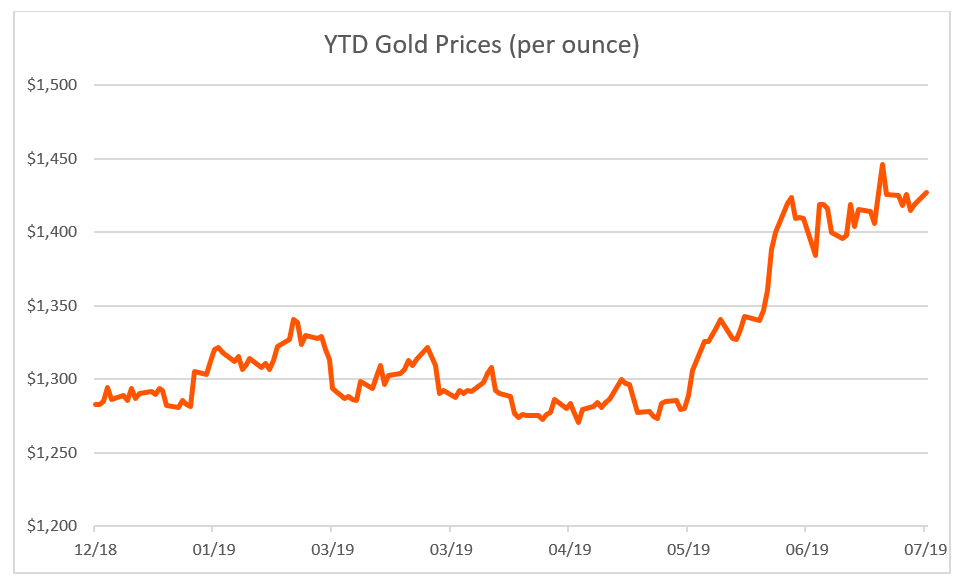

Since the US & China trade wars began escalating in 2018, investors have become increasingly concerned about the fragility of global growth expectations. With the world’s two largest economies raising trade barriers and polarizing the world economy, investors have understandably become concerned about owning risky assets like equities. Other geopolitical risks, like Brexit, the Hong Kong protests, tanker attacks in the Strait of Hormuz, and contested elections around the world, have further created a tenuous atmosphere for investors. As evidence of this, the markets saw two volatility flareups in 2018 where the VIX Index surpassed 30, a point that hadn’t been reached in over three years.1 As such, gold and silver, two precious metals that investors expect to perform well during periods of market uncertainty or an economic recession, have seen strong price increases year to date.

While volatility flare ups and surging precious metals prices doesn’t necessarily spell doom for the broader markets, it does indicate that investors are becoming more cautious at this point of the cycle by diversifying into more defensive assets.

Dovish Central Bank Policies

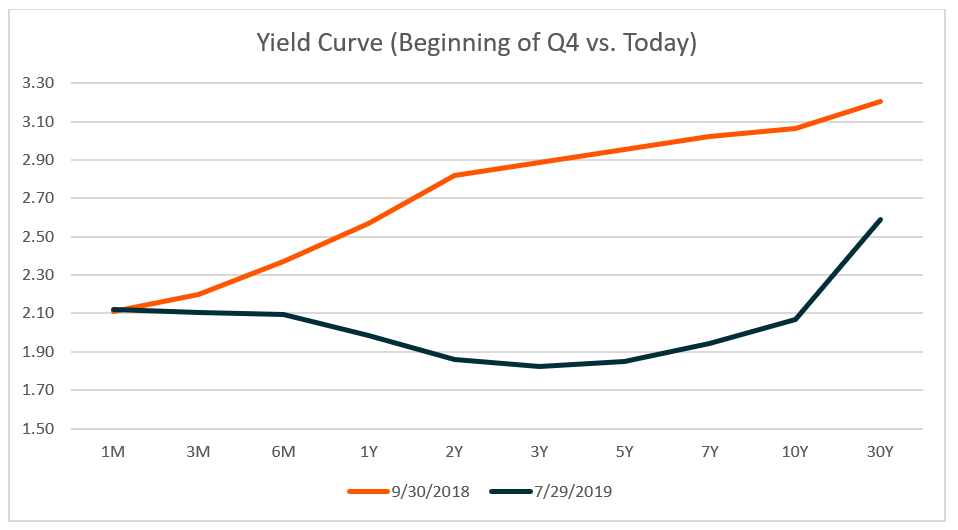

Prior to Q4 last year, consensus expectations held that the Fed would continue its hawkish monetary policy and raise interest rates multiple times in 2019. Those forecasts were quickly cast aside as a Q4 plunge rattled financial markets, trade negotiations intensified, and the global economic growth picture became cloudier. As a result, the Fed hit the pause button on the rate hike plan, electing to take more of a wait and see approach to determine its course. Fast forward through the first half of the year, and the Fed is ending its balance sheet reduction program and markets are pricing in multiple rate cuts through the end of the year.

Source: Bloomberg. Data using yield curve on 9/30/18 and 7/29/19

The shift to more dovish central bank policies is occurring outside the US as well. Since April, New Zealand, India, Malaysia, South Korea, and the Philippines have all cut rates, along with a host of other countries.2

While rising rates can be a headwind for non-yield-bearing precious metals like gold and silver, falling rates can make the two metals more attractive. This is because the opportunity cost is shrinking between holding a government bond with a falling yield and a precious metal with no yield. Therefore, if central banks remain dovish, as the markets expect, this could be another positive factor for precious metals prices.

Attractive Valuations

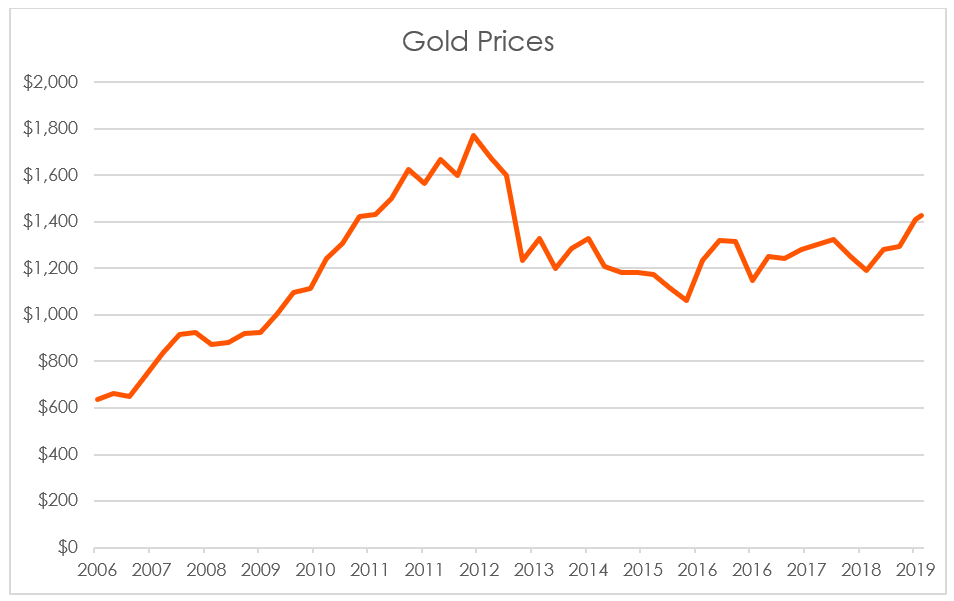

Ever since the commodity super cycle ended in 2011, precious metals prices reset lower as supplies remained high and demand waned. While there have been periodic upward spouts, precious metals prices have been depressed for a prolonged period.

Source: Bloomberg. Data from 12/31/2006 to 7/30/2019.

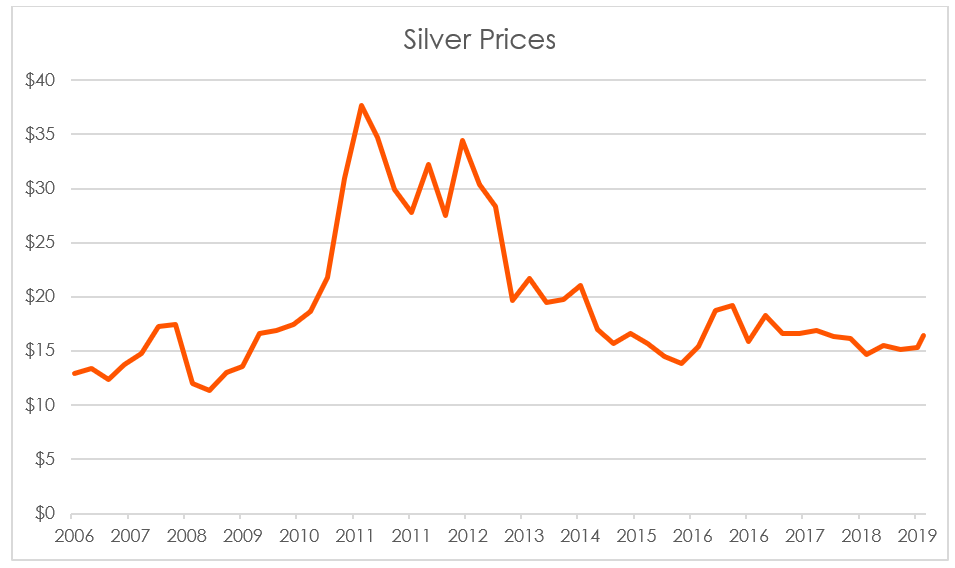

Silver, in particular, bore the brunt of this pressure, stemming from weak emerging market demand. While silver is considered a precious metal, roughly half of its demand comes from industrial activity, making it more sensitive than gold to economic expansion.

Source: Bloomberg. Data from 12/31/2006 to 7/30/2019.

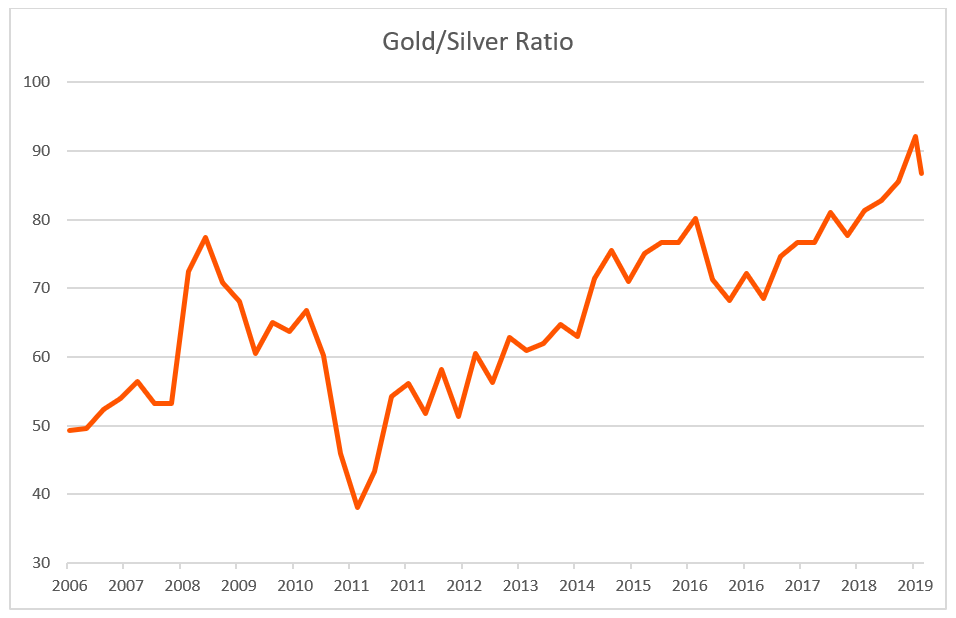

A common valuation metric to assess whether silver is undervalued relative to gold is the gold/silver ratio. A high ratio indicates silver could be undervalued. Historically, since 1998, the gold/silver ratio has averaged a level of around 64. As shown in the chart below, although silver has rallied recently, the ratio remains well above historical levels at just below 90. This could be an indication that within the precious metals complex, silver may be more of a relative value play than gold.

Source: Bloomberg. Data from 12/31/2006 to 7/30/2019.

How to Gain Exposure to Gold and Silver

As gold and silver have become more popular alternative investments for investors, there are now myriad options for investors to gain exposure.

One option is to purchase the physical commodity. This comes with direct ownership, but costs related to storage, insurance, and transportation costs may be higher, along with potential tax complications. This includes a 60/40 long term and short term capitals gains blend similar to options investing taxation, or if organized as a collectibles investment, then the collectibles tax rate of up to 28%.

Another option is to gain exposure through derivatives, like a futures contract. This offers potentially better liquidity than direct ownership, but trading derivatives may be suitable only for more sophisticated investors and can suffer from contango where the spot price falls below the futures price.

A further option to buy ETFs that hold a basket of gold mining stocks or silver mining stocks. Mining stocks and ETFs that hold them are traded as stocks, but miners are often leveraged to the price of the underlying commodity which can make them more volatile than the physical commodity itself. However, for those with a bullish outlook, mining stocks linked to the underlying commodity could be a high risk/reward option. These are taxed as traditional stocks are, with applicable capital gains taxes assessed. Assuming the stock is held for more than a year, the maximum capital gains rate is 20%.