Uranium, Explained

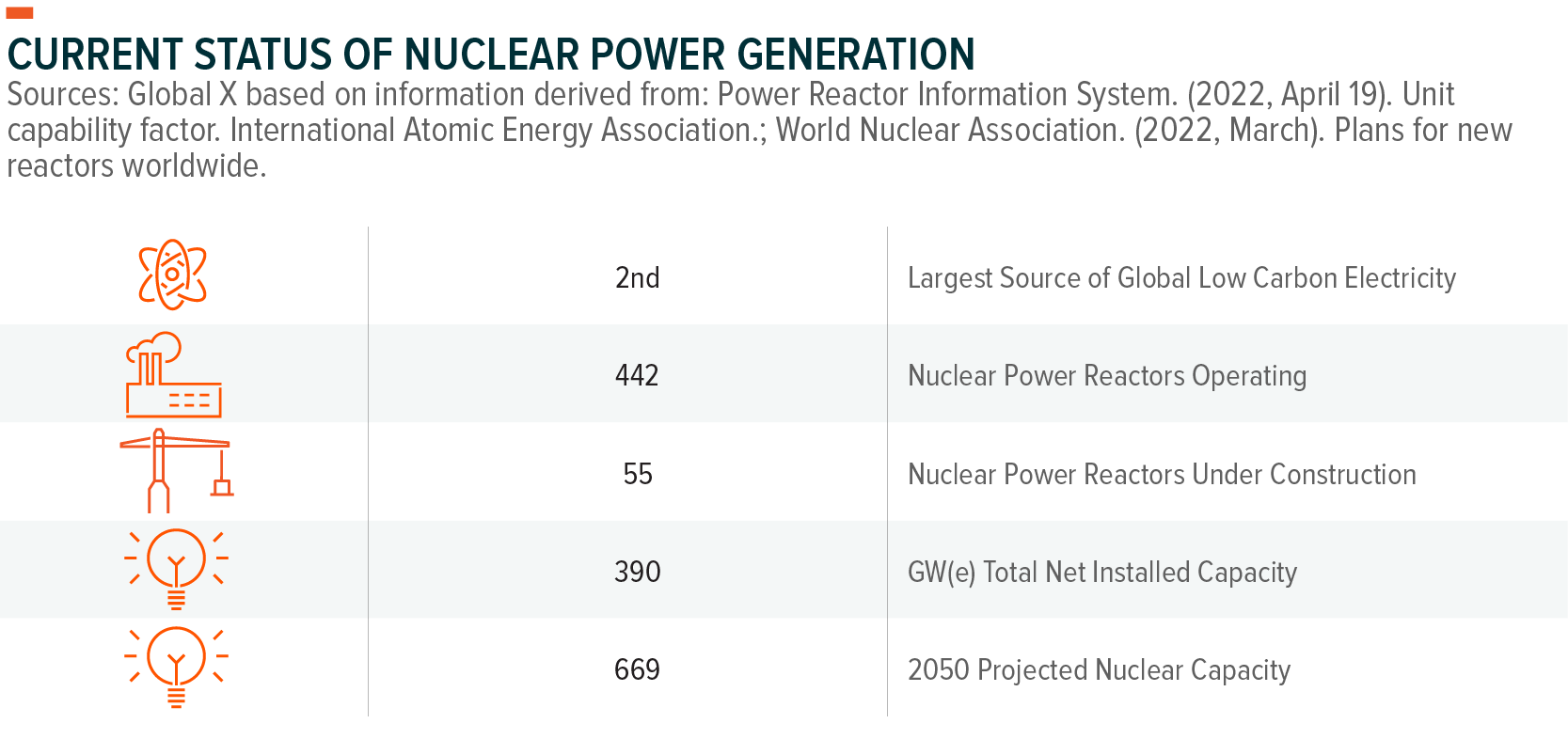

Nuclear power is a clean, efficient, and essential source of electricity used to meet the world’s growing energy demands. Nuclear power can produce electricity at a greater scale while minimizing greenhouse gas emissions. This helps countries expand their electricity grid and usage, while limiting air pollution. Roughly 10.4% of the world’s electricity was generated from nuclear power in 2020, accounting for approximately one-third of the world’s low-carbon electricity.1There was a 0.5 GW(e) increase in net installed capacity since the end of 2019 with projections anticipating increases by 17% over current levels to 456 GW(e) by 2035, and by 71.5% to 669 GW(e) by 2050.2

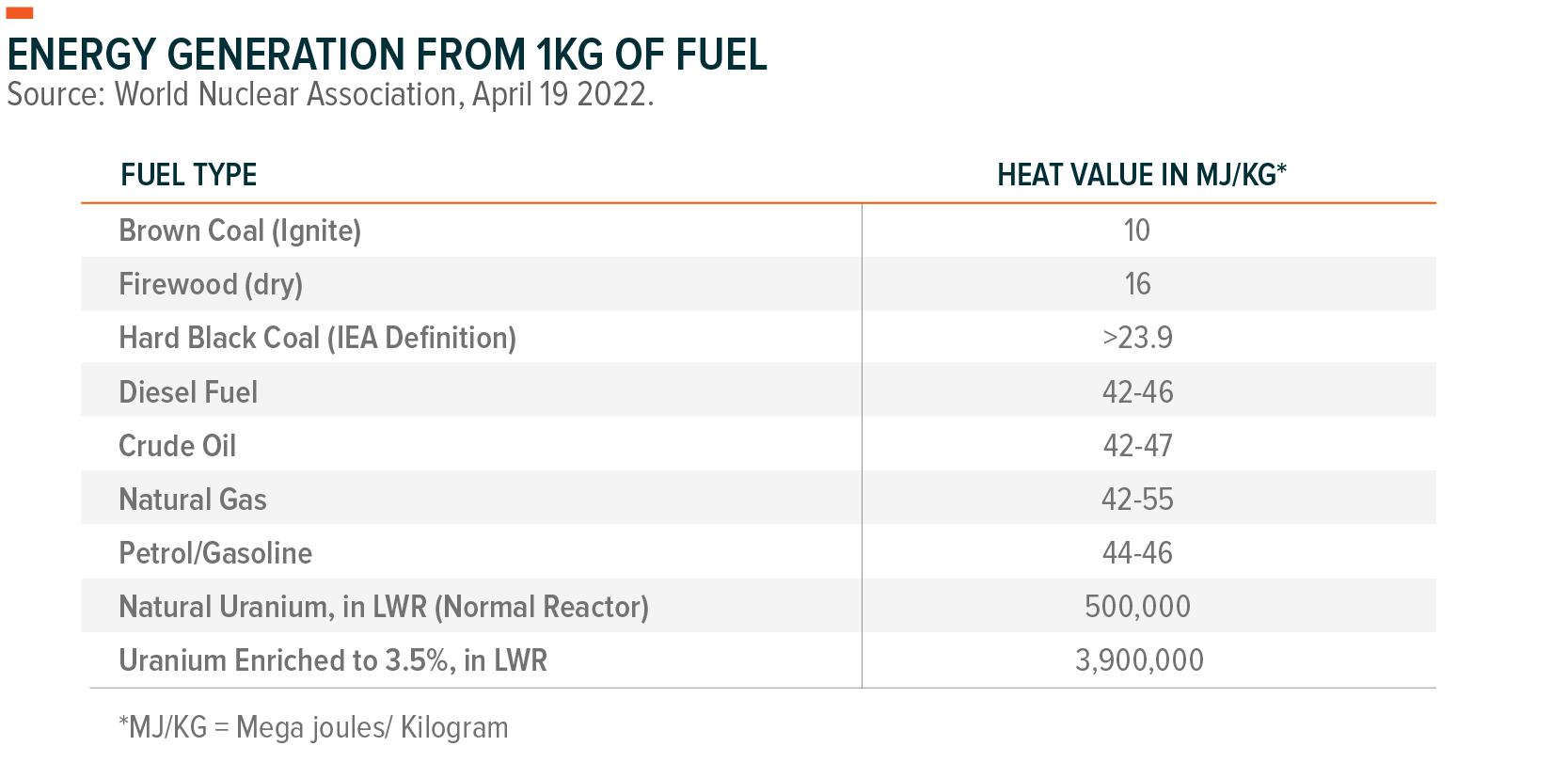

Uranium fuel enables nuclear power plants to generate electricity. A single uranium pellet, slightly larger than a pencil eraser, contains the energy equivalent of a ton of coal, three barrels of oil, or 17,000 cubic feet of natural gas.3 Global nuclear power output primarily drives the demand for this commodity. Despite expected growth in nuclear power, and a correlative increase in uranium demand, gaining exposure to this commodity sometimes proves difficult. Uranium trades with thin liquidity on futures exchanges and there are ownership restrictions related to its usage in weapons production.

Key Questions Answered Here

- What is uranium?

- How is uranium extracted?

- How is uranium used to generate electricity?

- What are the advantages of uranium compared to other fuel sources?

- What is the outlook for uranium demand?

- What is the status of the uranium supply?

- Are uranium prices expected to recover?

- How do you invest in uranium?

Explaining Uranium and Its Extraction

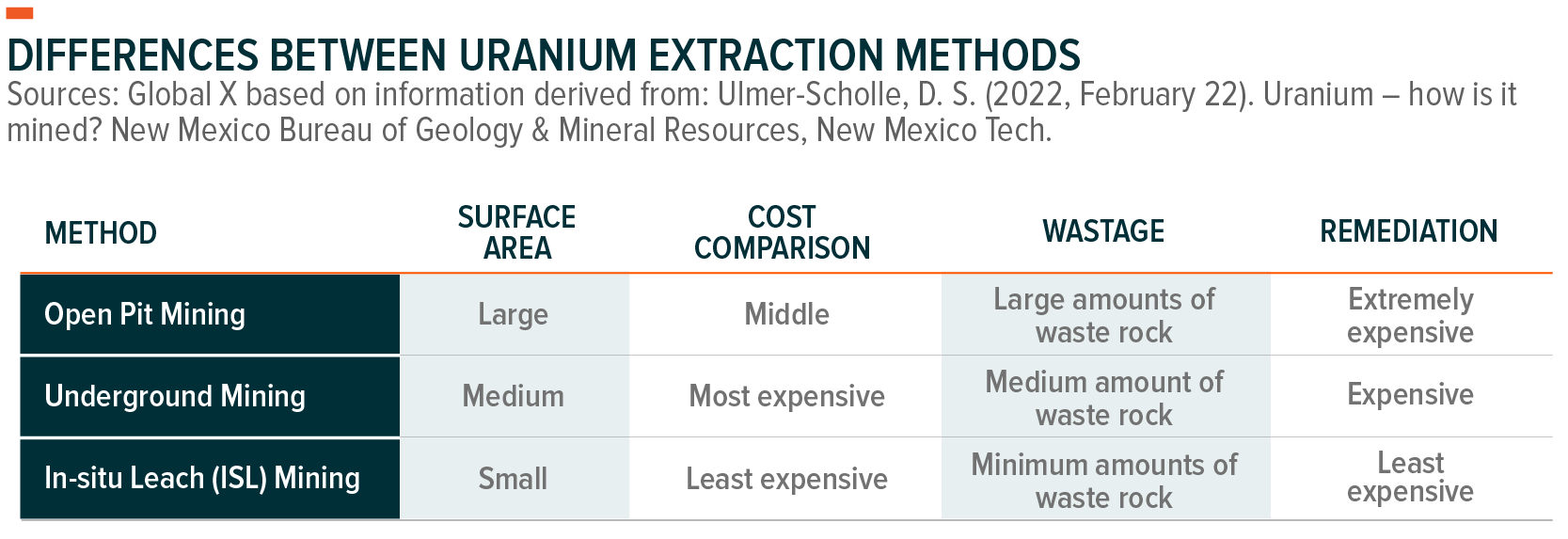

Uranium is a heavy, dense, and radioactive metal, making it a potent source of energy. Found in most rocks in concentrations of two to four parts per million, it appears as commonly in the Earth’s crust as several other metals, such as tin and tungsten.4 Uranium extraction generally involves recovery from the ground using open-pit mining, underground mining, or in-situ leach (ISL) methods.5

Open-pit and underground mining methods collect rocks that contain very low concentrations of uranium. A milling process crushes the rocks to grind them into fine fragments, while added water helps create a slurry – a semi-liquid mixture. Sulfuric acid or an alkaline solution mixed with the slurry allows 95-98% of the uranium to be recovered. Uranium oxide, also known as yellowcake, is precipitated from this solution. Yellowcake must undergo yet another enrichment process to make it viable as nuclear fuel.6

The preferred method for extracting uranium, ISL mining proves more cost-effective and environmentally friendly than open-pit or underground mining.7 It involves pumping a solution called a lixiviant into the ground to dissolve the uranium and separate it from the rest of the rock formation. Miners then recover the purified and concentrated uranium extract from the ore and dry it to produce yellowcake.8

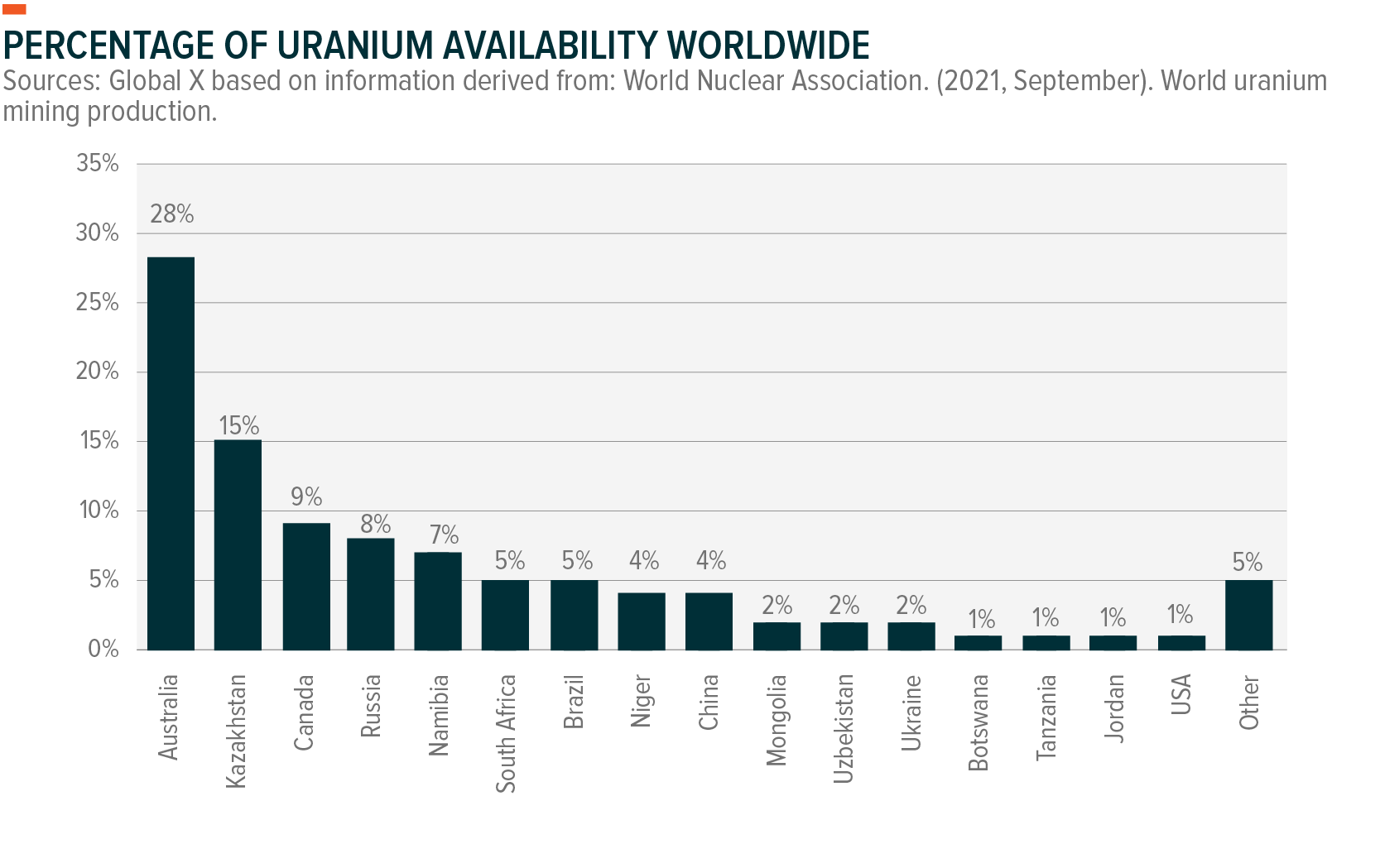

Uranium can be found in many parts of the world, but is fairly top heavy in where the reserves can be found. Countries such as Australia, Kazakhstan, and Canada often lead the uranium production charge, but uranium is present across many nations globally.

Uranium Electricity Generation and Its Advantages Over Other Fuel Sources

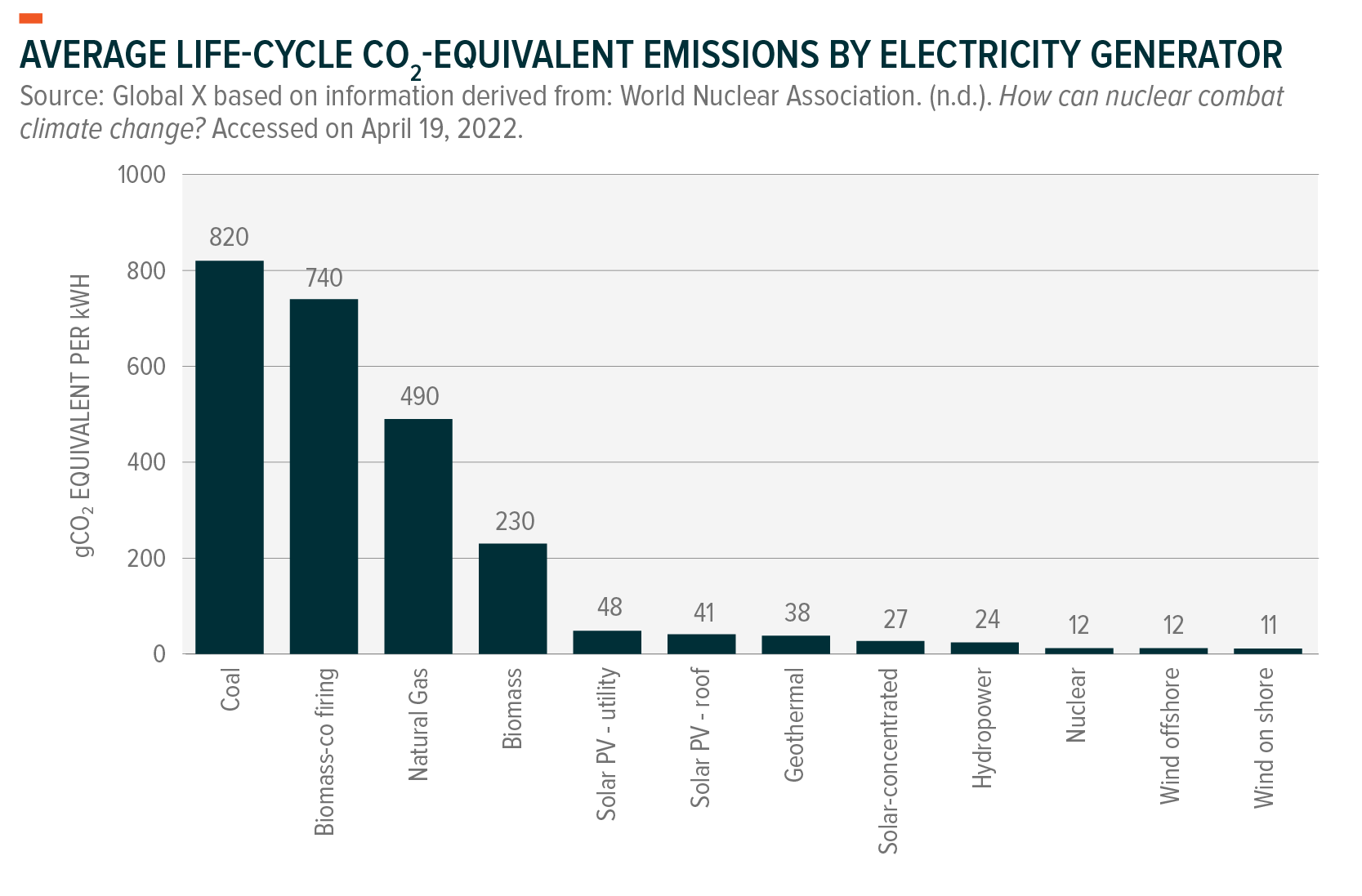

Nuclear power remains one of the few sources of electricity that combines large-scale power output and low greenhouse gas emissions, with costs comparable to those of traditional fossil fuel power stations.9

Similar to coal or natural gas power plants, nuclear reactors generate electricity by producing immense heat. This heat produces steam, which propels a turbine connected to an electric motor. As the turbine rotates, the electric motor produces electricity. In nuclear power stations, however, the heat generated derives from splitting uranium-235 atoms in the process of nuclear fission, as opposed to burning fossil fuels.10

Nuclear fission produces thousands of times more energy than that released through the process of burning similar amounts of fossil fuels, making nuclear power a very efficient method of generating utility-scale power.11 Additionally, the ongoing fuel costs for nuclear power plants tend to remain quite low, due to the minimal amount of material needed to power the plant.

In addition to the power density advantage of uranium, nuclear power also ranks among the cleanest methods of producing electricity, as measured by greenhouse gas emissions. The U.S. Environmental Production Agency estimates that 35% of global greenhouse gas emissions derive from electricity and heating (25%), as well as other energy sources (10%).12 Giving nuclear adequate room to lower global emissions, while increase total share of electricity generation along with wind, solar, hydropower.

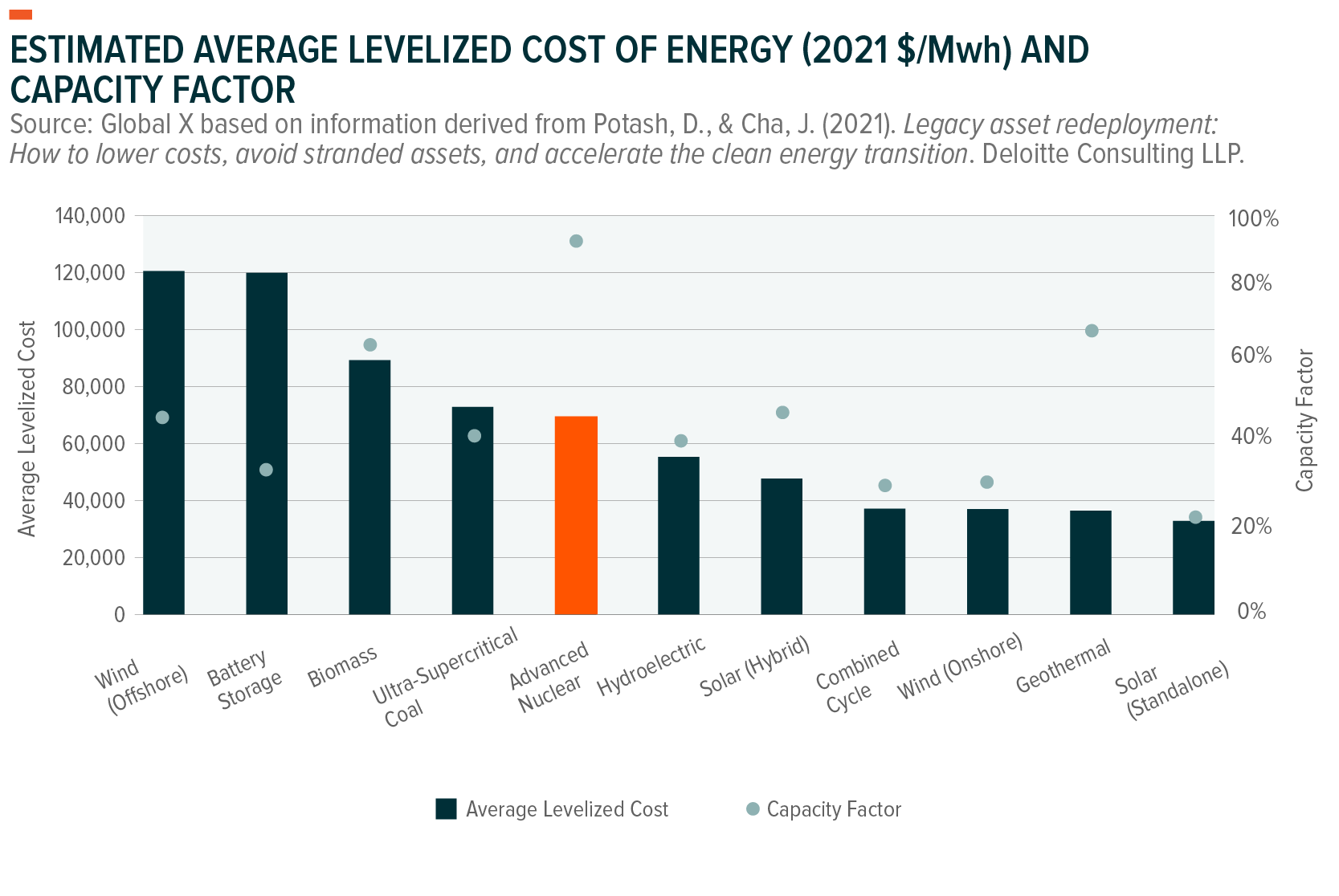

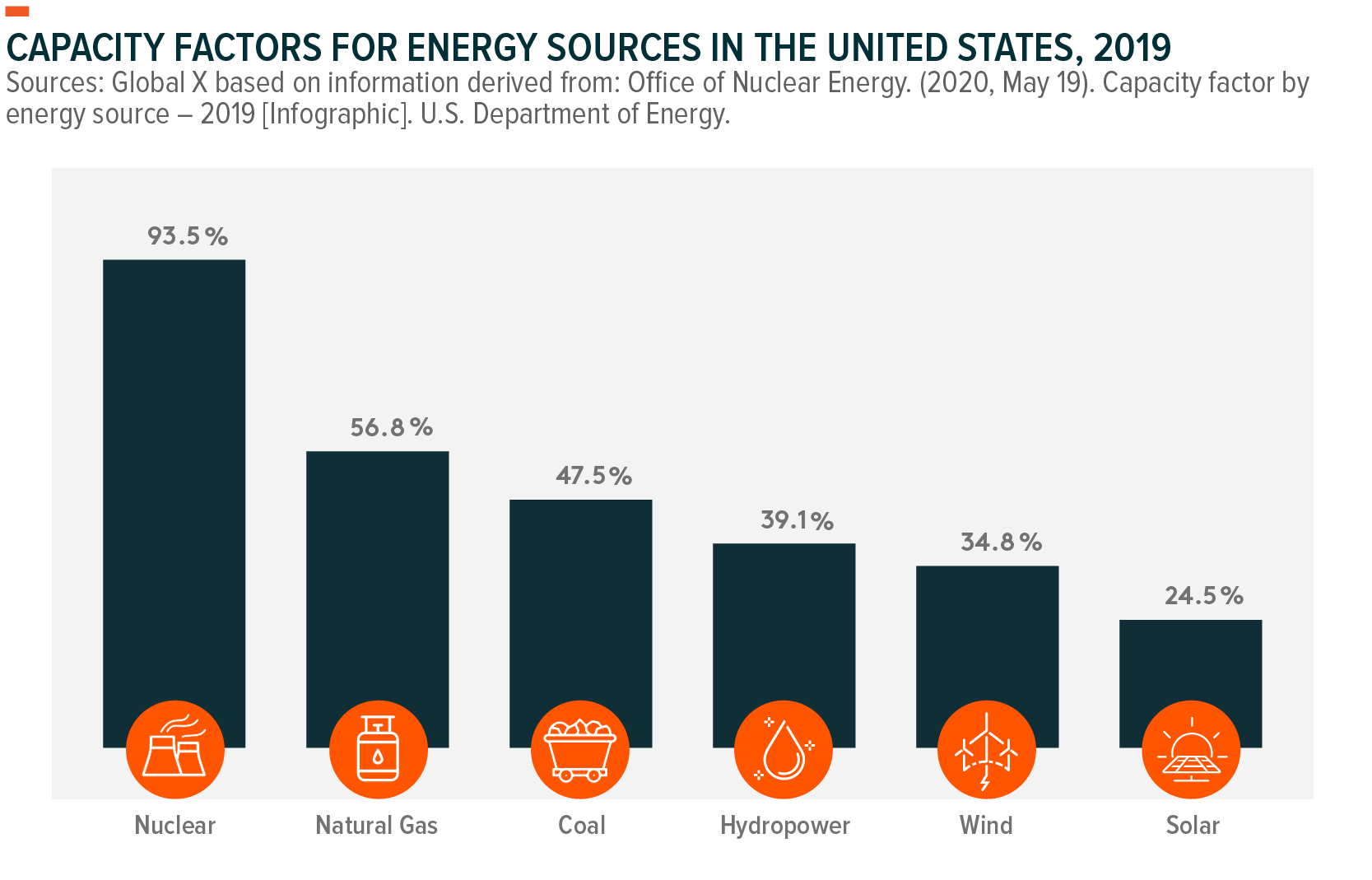

In terms of levelized costs, nuclear power provides a cheaper alternative to coal and biomass, while remaining significantly more cost competitive than offshore wind.13 As a note, while onshore wind and solar are considerably less capital intensive than nuclear, these are less reliable energy sources and qualify as variable renewable energies (VREs). This means they produce energy intermittently, rather than on a demand basis, creating variability in availability when the wind neglects to blow or the sun doesn’t shine. The lower dependency associated with VREs is highlighted when analysing the capacity factor for nuclear against solar and wind.

In terms of levelized costs, nuclear power provides a cheaper alternative to coal and biomass, while remaining significantly more cost competitive than offshore wind.13 As a note, while onshore wind and solar are considerably less capital intensive than nuclear, these are less reliable energy sources and qualify as variable renewable energies (VREs). This means they produce energy intermittently, rather than on a demand basis, creating variability in availability when the wind neglects to blow or the sun doesn’t shine. The lower dependency associated with VREs is highlighted when analysing the capacity factor for nuclear against solar and wind.

When comparing power sources with unequal capacity factors, the calculation of the final cost of energy production must include storage costs, since demand spikes and periods of low energy production availability require storage reserves to mitigate blackouts for lower capacity factor sources. The average levelized cost of battery storage is 72.7% more expensive than nuclear, particularly notable given that nuclear plants achieve almost 3 times greater reliability than wind and solar plants.14 Contrary to popular belief, capacity and electricity generation for various fuel sources do not always align. For example, U.S. nuclear generation capacity exceeded 98 gigawatts in 2019, to account for 9% of the country’s total capacity, but generated over 20% of electricity that year, demonstrating the importance of the energy source’s capacity factor.15 For this reason, we see nuclear working in tandem with wind, hydroelectricity, and solar, rather than in competition, by safeguarding energy stability.

Section 111(b) of the Clean Air Act requires conventional coal plants to be built with carbon capture and sequestration (CCS) to meet specific CO2 emission standards. Coal with 30% CCS meets the New Source Performance Standard (NSPS).

The Outlook for Uranium Demand

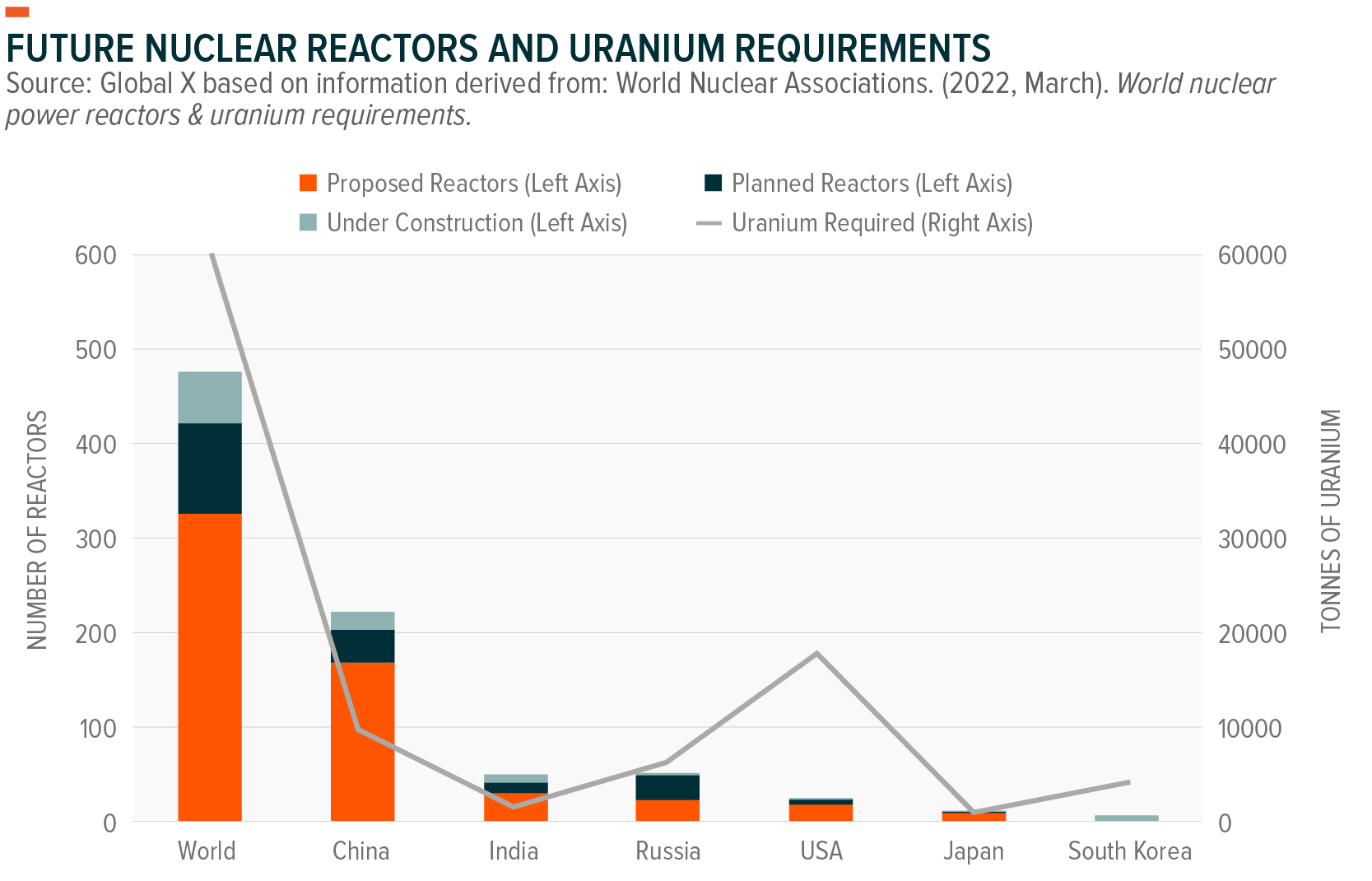

Nuclear power contributes approximately 10.4% of the world’s total energy supply and serves as a major source of energy in developed markets, such as the European Union (25%) and the United States (19%).16,17,18 Globally, 55 reactors currently under construction represent a 12.5% increase in nuclear capacity, with an additional 54 reactors planned.19Reactors in the planning stage represent the second phase after design, while construction marks the final stage prior to being fully operable. The early stage developments highlight the expanding appetite for nuclear over past few years. The planning stage represents a 30% potential rise in current nuclear capacity, largely led by emerging economies such as China, South Korea, and India.20 Increased demand primarily derives from countries with large populations contending with the dual issues of substantial electricity requirements and escalating air pollution problems, such as India and China. The latter represents the world’s largest market for uranium and China plans to expand its nuclear power capacity significantly. As of February 2022, China maintained 53 operational reactors, producing an estimated 51 gigawatts, 19 reactors under construction, and an additional 34 planned.21

The Chinese government intends to invest $440 billion in nuclear reactors over the next 15 years, targeting the production of 200 gigawatts of nuclear energy by 2035.22 The monumental project entails building over 150 reactors across mainland China, part of President Xi Jinping’s goal of carbon neutrality by 2060 and peak emissions by 2030.23 China’s plan projects lowering carbon emissions by 1.5 billion tons, more than what the United Kingdom, Spain, France, and Germany currently produce, combined. The International Energy Agency predicts China will triple its nuclear energy capacity in the next 20 years, forecasting China to outpace the European Union and the United States to become the largest nuclear power producer by as early as 2030.24

With larger emerging countries, such as China and India, continuing their extensive nuclear expansion plans, smaller nations such as South Korea, Bangladesh, and Turkey also continue to gain government support for new reactors, with active planning of multiple reactors underway in each country.25 In the developed world, in February 2022, France announced their plan to build six new nuclear power reactors, with an additional eight reactors under consideration.26 The pro-nuclear initiative is part of Macron’s plan to lower the country’s energy consumption while increasing its carbon free production capacity. France also delayed its initial policy goal of reducing nuclear power’s share of electricity generation, allowing extensions to the original 40-year operating life of some reactors, similar to the lifetime extensions used in the United States.27 Europe in general is echoing France’s shift in its stance on nuclear power. In February 2022, the European Commission ruled to label nuclear as sustainable source of energy, with the announcement aimed to help raise private capital to meet the E.U. climate change targets.28

These global initiatives delineate the vital role that nuclear energy plays in decarbonization efforts. The omnipresent shift away from fixed fossil fuels demonstrates the need for an on-demand clean source of energy essential to achieve net zero goals. Nuclear is a crucial energy source in filling energy production gaps associated with the energy transition. We can see in the United States, for example, nuclear power’s outsized reliability relative to other energy sources.

Building Small on a Grand Scale

Utilizing a technology with deployment capabilities to potentially power a small town or mining operation, the concept of small modular reactors (SMRs) is gaining greater traction. SMRs are small and flexible, have a power capacity of up to 300 MW(e), juxtaposed to the average traditional reactor at 1000 MW(e) and can fluctuate their outputs according to demand. Argentina, Canada, China, Russia, South Korea, and the United States have SMRs under construction or undergoing the licensing process, while globally approximately 70 SMR designs have reached various stages of development.29 While generally still in the early stages of widespread adoption, Russia developed the first commercially operating floating SMR in Akademik Lomonsov.30 Potential uses for SMRs include deployment in hard-to-reach areas and availability as an export, demonstrating the particular benefits of SMRs to rural communities. Prefabrication lowers the construction time of SMRs to 2-3 years, a fraction of the 7-9 years required for a traditional reactor.31

Uranium Market Status: Still in a Supply Deficit

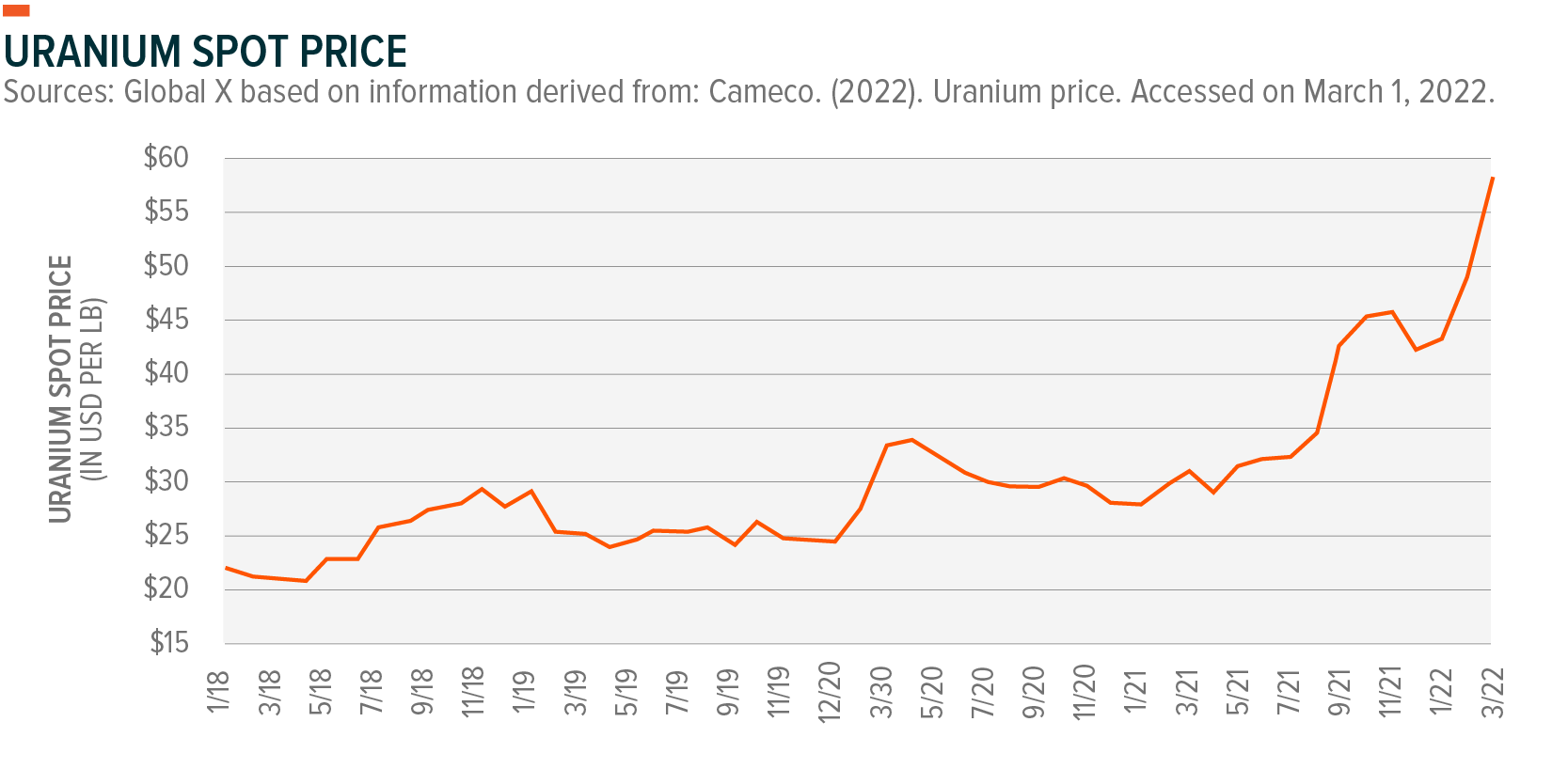

Uranium supply consists of new production from mining activity and existing inventories, largely from decommissioned nuclear weapons stockpiles. Since 1980, weapons-grade uranium in the United States and the former Soviet Union has been blended down to be repurposed as reactor fuel as part of nuclear disarmament agreements. This steady flow of supply kept uranium prices, as well as mining production, artificially low.

Supply from mining production met approximately 67% of 2021 uranium demand, with the remainder being met with commercial stockpiles, nuclear weapons stockpiles, recycled plutonium, uranium from reprocessing used fuel, and some from the re-enrichment of depleted uranium tails.32 However, the depletion of these secondary supplies involve a projected drop to 35 million pounds, or 19% of U3O8 total supply, by 2025 and further reduction to only 11% of total supply in 2030.33 Although this supply stream will contribute towards meeting uranium demand in the near-term, it is estimated there will be a deficit of 8 million pounds within the uranium market in 2023. In the medium-term (2024-2027), supply deficits should consolidate in the 3-to-14-million-pound range per year, with supply gaps estimated to tighten post-2027, as higher-cost mines and greenfield projects come online.34

The demand side of the equation also looks very promising. UxC, one of the world’s leading sources for data on uranium, projects that the demand for this commodity will grow 21.7%, to over 213 million pounds of U3O8 by 2035, from 175 million pounds U3O8 in 2021.35

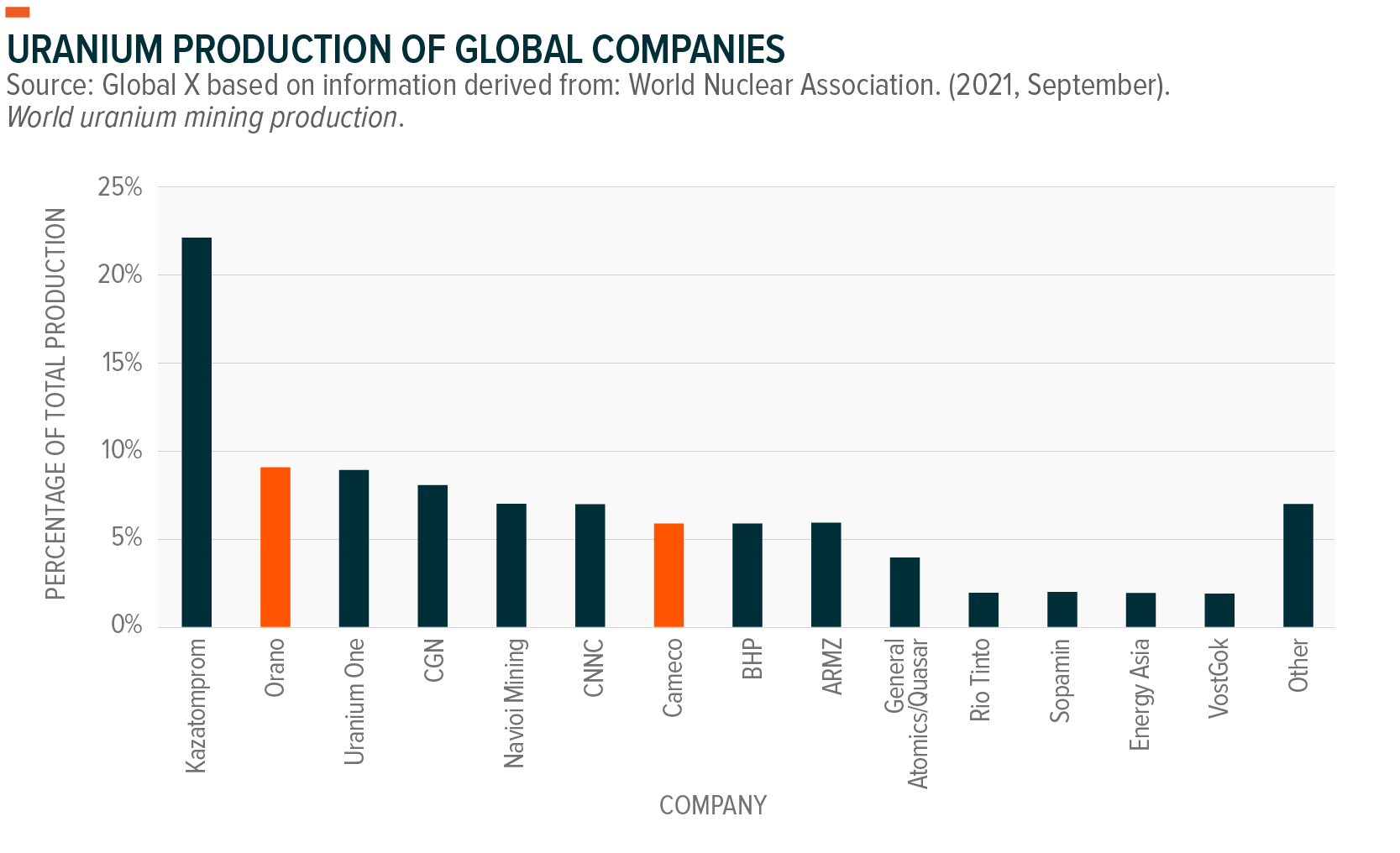

Canada: A Resurgence of Uranium Production

Canada ranked as the world’s largest uranium producer for over a decade, accounting for 22% of world output, but was overtaken by Kazakhstan in 2009.36 With geopolitical tensions affecting Central Asian producers, Canada may fill the void and potentially become the largest producer of uranium. Canada is rich in uranium resources and has a long history of exploring, mining, and generating nuclear power. Leading uranium miners are Cameco and Orano Canada, formerly known as Areva Resources Canada. These two companies produce over 15% of total uranium production and Cameco’s current plans for expanded operations could increase this total in the near future.37

Cameco: Leading the Charge

In 2017, Cameco, one of the largest publicly traded uranium companies, produced 15% of the world’s uranium production, prior to widespread production cuts back in mid-2018.38 The Canadian mining company recently publicized plans to restart their McArthur River mine and Key Lake mill in Saskatchewan later this year, the same mines previously closed down for over three and a half years. By 2024, the company aims to reach 60% capacity, representing 15 million pounds of uranium production annually, which in 2020 was 16% of total production.39 During the last uranium boom in 2007, McArthur River alone generated 17.5% of global production, but suspended operations in July 2018, citing low price levels.40

For reference, Cameco currently functions at 25% of its capacity, giving the company ample room to grow production.41As uranium prices continue to hover around decade level highs, Cameco also announced a 50% increase in its dividend pay-out per share, reflecting an improvement in the uranium market, while also achieving an additional 70 million pounds in long-term contracts since the beginning of 2021.42

Sprott: A New Way to Play the Uranium Market

Sprott Physical Uranium Trust, the largest physical uranium fund globally, has a primary goal of buying physical uranium in a liquid and convenient way. Unlike more widely known commodities, such as gold, copper, crude oil, etc., the uranium futures market is exceedingly thin. The advent of Sprott’s physical trust, which incepted in July 2021, provides investors a liquid way to invest in the uranium market, while also offering price discovery for spot uranium prices. Since inception, Sprott has grown in both size and volume. On September 14, 2021, the Trust filed to increase the amount available from $300 million to $1.3 billion, or 20% of total annual production. Since the first major buying spree from Sprott, the fund has almost tripled in size, with over $3.5 billion in assets and ownership of 54,667,000 tons of uranium, as of April 11, 2022.43,44

Outlook for the Uranium Industry

Uranium prices took a hit following the 2011 Fukushima nuclear disaster, which led to the multi-year shutdown of all nuclear power plants in Japan. Over the past eight years, the global nuclear industry has recovered production of nuclear power beyond pre-Fukushima levels. Japan especially put a concerted effort into restoring its nuclear capabilities, operating a total of 33 nuclear reactors to date.45

Production cuts in early 2019 supported uranium prices, but the investment case has turned even more positive on the demand side since the pre-pandemic environment. Initiatives, including the recent passage of the $6 billion civil nuclear credit program outlined in the nuclear energy provision of the U.S. infrastructure bill and the European Commission’s classification of nuclear as sustainable, are helping establish nuclear power as a key solution in the shift away from fossil fuels and thus influencing uranium demand.46 The recent steps taken by policymakers towards validating nuclear energy demonstrate backing for uranium prices and are anticipated to pique investor interest further. We believe the policy changes, as well as the supply deficit causing the new sources of demand, support a strong growth outlook for uranium.

The brisk stances taken by governments around the world are also advancing the broader uranium industry. Large uranium producers, such as Cameco and Kazatomprom, as well as small cap miners, such as Denison Mines, are benefiting from the shift to uranium. Thus far in 2022, the majority of uranium mining companies are performing well, but the bulk of uranium miners still trade at discounted levels compared to the pre-Fukushima period.47 The focus on keeping operating margins high and costs lean should mitigate large spikes in supply, as miners slowly increase production based on contracted utility demand.

Investing in Uranium

The nuances of gaining exposure to uranium increase in comparison to dealing in other more commonly traded commodities, such as oil or gold. Common solutions involve purchasing uranium mining stocks or exchange traded funds (ETFs) that own a basket of uranium mining stocks. Another entails gaining access to uranium futures, which trade with relatively light liquidity. Individual uranium miners potentially hold high idiosyncratic risks though, but accessing the industry through a broad basket of uranium mining stocks globally could help mitigate some of these risks. While uranium futures offer exposure to the spot price of uranium, they can be subject to negative returns associated with contango, which occurs when the spot price of a commodity trades below its future price, along with the thin liquidity.

Individual stocks also potentially offer somewhat of a levered play on the underlying commodity price, given the high fixed costs associated with mining. Uranium mining stocks maintain a relatively high unsystematic risk, due to the esoteric nature of the industry. For this reason, we believe investing in uranium ETFs may provide an efficient and cost-effective method for accessing a diverse basket of companies involved in uranium mining activities around the world.